ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

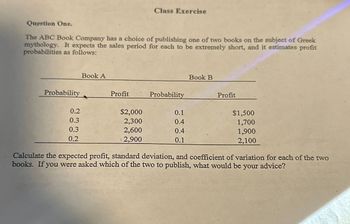

Transcribed Image Text:Question One.

The ABC Book Company has a choice of publishing one of two books on the subject of Greek

mythology. It expects the sales period for each to be extremely short, and it estimates profit

probabilities as follows:

Probability

0.2

0.3

0.3

0.2

Book A

Profit

Class Exercise

$2,000

2,300

2,600

: 2,900

Probability

0.1

0.4

0.4

0.1

Book B

Profit

$1,500

1,700

1,900

2,100

Calculate the expected profit, standard deviation, and coefficient of variation for each of the two

books. If you were asked which of the two to publish, what would be your advice?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A large number of MBA applicants are given an aptitude test. Scores are normally distributed with a mean of 460 and standard deviation of 80. What is the probability a randomly chosen applicant scores 600 or above in this test? a. 0.5401 b. 0.0401 c. 0.4599 d. 0.0852arrow_forwardFirst Cost, S Probability $60,000 $80,000 $100,000 $120,000 0.25 0.35 0.30 0.10 Reference: Table 10 Determine the associated risk measure in this equipment investment in terms of standard deviation. A. $4,923 OB. $6,123 C. $8,523 D. $4437.8arrow_forwardIf the economy booms, Meyer&Co. stock will have a return of 20.8 percent. If the economy goes into a recession, the stock will have a loss of 13.1 percent. The probability of a boom is 63 percent while the probability of a recession is 37 percent. What is the standard deviation of the returns on the stock? 9.29% 12.43% 13.56% 14.61% 14.61%arrow_forward

- You're the manager of global opportunities for a U.S. manufacturer that is considering expanding sales into Asia. Your ma the market potential in Malaysia, the Philippines, and Singapore as described in the following table: Success Level Big Mediocre Failure Malaysia Probability 0.5 0.3 0.2 Units 500,000 300,000 0 Philippines Probability 0.2 0.7 0.1 Units 1,400,000 700,000 0 Singapore Probability Units 0.3 0.3 0.4 1,200,000 384,000 0 The product sells for $10, and each unit has a constant marginal cost of $8. Assume that the (fixed) cost of entering the market (regardless of which market you select) is $250,000. In the following table, enter the expected number of units sold, and the expected profit, from entering each market. Market Malaysia Expected Number of Units Sold Expected Profit Philippines Singapore $ If you were to enter one of the previously described markets, which one would you enter in order to earn the highest expected profit?arrow_forward‘Lottery A’ refers to a lottery ticket that pays $2,000 with a probability of 0.3, $8,000 with a probability of 0.4, $12,000 with a probability of 0.2, and $18,000 with a probability of 0.1. Lottery B pays $3,000 with a probability of 0.3, $8,000 with a probability of 0.4, $12,000 with a probability of 0.2, and $15,000 with a probability of 0.1. Which of the following is true? A) A risk-averse person would definitely prefer lottery A to lottery B.B) A risk-averse person would definitely prefer lottery B to lottery A.C) Whether a risk-averse person prefers lottery A to lottery B depends on his degree of risk-aversion.D) A risk-averse person would prefer to pay $50 to switch from lottery B to lottery A.E) We do not have enough information to judge whether any of the statements listed in A-D, above, are correct.arrow_forwardYou invest in a new project whose profit is distributed as follows: Probability Profit 10% 1,000,000 50% 500,000 15% 10,000,000 20% 5% -1,000,000 What are the expected profits from this project?arrow_forward

- If the farmer uses pesticides he expects a crop of 60,000 bushels; if he does not use pesticides he expects a crop of 50,000 bushels. The cost of pesticides is $30,000 and the other costs associated with planting and harvesting the crop total $450,000. The price of corn at harvest time will either be $9.00 with probability of 0.50 or it will be $11.00 with probability 0.50, so if the farmer decides to sell the crop at harvest, the expected price per bushel that he will receive is $10.00. If the farmer does not use pesticides and decides to sell the crop at harvest, what is his expected profit? a. $180,000.00 b. $100,000.00 c. $50,000.00 d. $20,000.00 If the farmer uses pesticides he expects a crop of 60,000 bushels; if he does not use pesticides he expects a crop of 50,000 bushels. The cost of pesticides is $30,000 and the other costs associated with planting and harvesting the crop total $450,000. The price of corn at harvest time will either…arrow_forwardThere are two types of projects in the market: A (safer) and B (riskier). At time 1, the payoff of A will be either $500 (probability 0.75) or $300 (probability 0.25). The appropriate discount rate for project A is 12%. The minimum price A can accept is $350. The payoff of B will be either $800 (probability 0.2) or $100 (probability 0.8). The appropriate discount rate for project B is 20%. In this simple economy, there are 90% chance that the project will be A. Evaluate the funding situation, i.e., which type of project will be funded and the price, based on the following scenarios: When there is no information asymmetry and everyone knows everything. When there is information asymmetry and investors cannot tell if the project is A or B.arrow_forwardRisk difference may sometimes be referred to as excess risk. True Falsearrow_forward

- suppose you pay 25 dollars to enter into a raffle with a 400 dollar prize. if you have a 5% chance of winning, the expected value of winning is?arrow_forwardA real estate developer must decide on a plan for developing a certain piece of property. After careful consideration, the developer has two acceptable alternatives: residential proposal or commercial proposal. The main factor or state of nature that will influence the profitability of the development is whether or not a shopping center is built close by and the size of the shopping center. There is a 20% chance of no center being built, a 50% chance of a medium shopping center built, and a 30% chance of a large shopping center. If the developer selects the residential proposal and no center is built, he has a further set of options: do nothing $400,000 payoff; build a small shopping center himself $700,000 payoff; or put in a park resulting in $800,000 payoff. Should a medium shopping center be built nearby, his payoff for residential would be $1,600,000 and large shopping center results in a $1,200,000 payoff. If the developer selects the commercial proposal and no center is…arrow_forwardYou have been given the following risk assessment by your team. >=0.45. Calculate the Total Risk Exposure for your project. You have decided to track only risk Risk Probability Response Time too slow 0.25 Requirements Mismatch 0.33 Web Server Failure 0.45 Late delivery 0.6 Personnel Shortfall 0.55 Loss $14,000.00 $6,000.00 $0 $150,000.00 $12,000.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education