ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

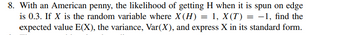

Transcribed Image Text:8. With an American penny, the likelihood of getting H when it is spun on edge

is 0.3. If X is the random variable where X (H) = 1, X(T) = −1, find the

expected value E(X), the variance, Var(X), and express X in its standard form.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose that Bloomsburg University graduate starting salaries are normally distributed with a mean of $40,712 and a standard deviation of $12,570. What is the probability that a randomly selected graduate's starting salary is below $48,000? 0.848 0.000 0.719 0.281arrow_forwardA pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 8%. The probability distribution of the risky funds is as follows: Stock fund (S) Bond fund (B) Proportion in Stock Fund The correlation between the fund returns is 0.10. Tabulate the investment opportunity set of the two risky funds. (Round your answers to 2 decimal places.) 0.00 % Expected Return 20% 12 20.00 40.00 60.00 80.00 100.00 Proportion in Bond Fund Standard Deviation 30% 15 100.00 % 80.00 60.00 40.00 20.00 0.00 Expected Return % Standard Deviation %arrow_forward1. A sales man, figure that a contract results in a sale with 2. During a given day, he contacted two prospective clients. Calculate the probability distribution for X, the number of clients who signed the sales contract, so that the variance and standard deviation is found.arrow_forward

- 2. Let X and Y be continuous random variables with joint pdf fx.y (x, y) = 3x, 0syarrow_forwardNonearrow_forwardThe probability distribution for the number of automobiles sold during a day (x) at Bob Iron Motors is as follows. x f(x) 0 0.001 1 0.007 2 0.034 3 0.099 4 0.188 5 6 0.220 7 0.136 8 0.055 9 0.015 10 0.001 21 The expected value of the number of automobiles sold is, a 5.20 b 5.31 c 5.42 d 5.53arrow_forwardProspect Z = ($1, 0.30 ; $18, 0.40 ; $25, 0.30) What is the standard deviation of prospect Z? (Note: The answer may not be a whole number; please round to the nearest hundredth) (Note: The numbers may change between questions, so read carefully)arrow_forward1. Suppose the prices of used cars in the market are normally distributed with a mean of $15,000 and a standard deviation of $7,5000. What is the probability of selecting a car from this market and its priced above $20,000.arrow_forwardAt races, your horse, White Rum, has a probability of 1/20 of coming 1st, 1/10 of coming 2nd and a probability of 1⁄4 in coming 3rd. First place pays $5,000 to the winner, second place $4,000 and third place $1,350.Hence, is it worth entering the race if it costs $1050? Your company plans to invest in a particular project. There is a 40% chance you will lose $3,000, a 45% chance you will break even, and a 15% chance you will make $5,500. Based solely on this information, what should you do? On 1st Jan 2006, a business had inventory of $19,000. During the month, sales totalled $32,500 and purchases $24,000. On 31st Jan 2006 a fire destroyed some of the inventory. The undamaged goods in inventory were valued at $11,000. The business operates with a standard gross profit margin of 30%. Based on this information, what is the cost of the inventory destroyed in the fire?arrow_forwardPlease help me with both the question. Thank youarrow_forwardIs this example also an example of economically rational decision making? “In 2019, I started my small business by selling prints of my photographs. Now it’s temporarily closed. During this time I had the option of shipping my prints through USPS or UPS. I decided to ship my prints through USPS instead of UPS since it was a bit expensive at the time. My prints that were shipped out from USPS arrived in time and came in good condition. The opportunity cost is the cost of UPS shipping.”arrow_forward3arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education