ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

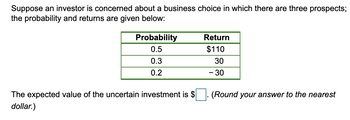

Transcribed Image Text:Suppose an investor is concerned about a business choice in which there are three prospects;

the probability and returns are given below:

Probability

0.5

0.3

0.2

The expected value of the uncertain investment is $

dollar.)

Return

$110

30

- 30

(Round your answer to the nearest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Question is in attached image, Thank you!arrow_forward19. An individual has initial wealth Wo = 3 and has the opportunity to invest some quantity of money x in an extremely risky corporate bond. With probability p= 1/4, the bond will be worth 10x at maturity. With probability 1 – p, it will be worth zero. The individual's utility function over final wealth is u(W) = W0.5. What is the level of investment x that maximizes expected utility? (а) 0 (b) 1 (c) 4/3 (d) V3 (e) 2arrow_forwardIn the table below x denotes the X-Tract Company’s projected annual profit (in $1,000). The table also shows the probability of earning that profit. The negative value indicates a loss. x f(x) x = profit -100 0.01 f(x) = probability -200 0.04 0 100 0.26 200 0.54 300 0.05 400 0.02 8 What is the expected value of profit? a $136 b $142 c $148 d $154arrow_forward

- Your company must decide whether to introduce a new product. The sales of the product will be either at a high (success) or low (failure) level. The conditional value for this decision is as follows Decision High Low Introduce $4,000,000 -$2,000,000 Do Not Introduce 0 0 Probability 0.3 0.7 You have the option to conduct a market survey to sharpen you market demand estimate. The survey costs $200,000. The survey provides incomplete information about the sales, with three possible outcomes: (1) predicts high sales, (2) predicts low sales, or (3) inconclusive. Such surveys have in the past provided these results Result High Low Predicts High 0.4 0.1 Inconclusive 0.4 0.5 Predicts Low 0.2 0.4 a) Using expected monetary value, what is your decision? b) What is the expected value of perfect information before taking the survey? c) Draw the complete decision tree, including the survey option. d) What is the…arrow_forwardIn a large casino, the house wins on its blackjack tables with a probability of 50.9%. All bets at blackjack are 1 to 1, which means that if you win, you gain the amount you bet, and if you lose, you lose the amount you bet. a. If you bet $1 on each hand, what is the expected value to you of a single game? What is the house edge? b. If you played 150 games of blackjack in an evening, betting $1 on each hand, how much should you expect to win or lose? c. If you played 150 games of blackjack in an evening, betting $3 on each hand, how much should you expect to win or lose? d. If patrons bet $7,000,000 on blackjack in one evening, how much should the casino expect to earn? a. The expected value to you of a single game is $ (Type an integer or a decimal.)arrow_forwardsolve d pleasearrow_forward

- c and d please!!arrow_forwardQ1) An expected utility maximiser owns a car worth £60000£60000 and has a bank account with £20000£20000. The money in the bank is safe, but there is a 50%50% probability that the car will be stolen. The utility of wealth for the agent is u(y)=ln(y)u(y)=ln(y) and they have no other assets.arrow_forward‘Lottery A’ refers to a lottery ticket that pays $2,000 with a probability of 0.3, $8,000 with a probability of 0.4, $12,000 with a probability of 0.2, and $18,000 with a probability of 0.1.What is the expected value of Lottery A?A) $7200B) $8000C) $9000D) $7900E) None of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education