Income Tax Fundamentals 2020

38th Edition

ISBN: 9780357391129

Author: WHITTENBURG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Hi Expert Answer me Details given in below section

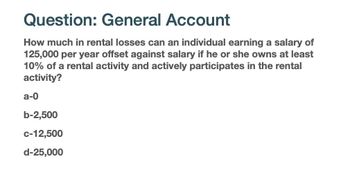

Transcribed Image Text:Question: General Account

How much in rental losses can an individual earning a salary of

125,000 per year offset against salary if he or she owns at least

10% of a rental activity and actively participates in the rental

activity?

a-0

b-2,500

C-12,500

d-25,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A. What effect does the rental activity have on her AGI for the year? Plz don't copy answer B. Assuming that Alexa's AGI from other sources is $90,000, what effect does the rental activity have on Alexa's AGI? Alexa makes all decisions with respect to the property. C. Assuming that Alexa's AGI from other sources is $120,000, what effect does the rental activity have on Alexa's AGI? Alexa makes all decisions with respect to the property. D. Assume that Alexa's AGI from other sources is $200,000. This consists of $150,000 salary, $10,000 of dividends, $25,000 of long-term capital gain, and net rental income from another rental property in the amount of $15,000. What effect does the Cocoa Beach condo rental activity have on Alexa's AGI?arrow_forwardpurchase property that has an annual net income of 587000 and want to ear 8.25% on investment what do I pay for propertyarrow_forwardOwearrow_forward

- The Allowable Business Investment Loss is __________ of the realized Business Investment Loss in a given year. Question 2 options: a) Same amount b) One-third c) One-half d) One-fiftharrow_forwardmgarrow_forwardQUESTION 8 Given the following information, calculate the total annual tax liability of the homeowner: market value of property: $350,000; assessed value of property: 40% of the market value; exemptions: $2,000; millage rate: 33.95 mills. O $11, 882.50 O $4,753.00 O $4,685.10 O $46,851.00arrow_forward

- H1. profile-image Carlos owns a property which he has rented. During 2021, the property generated $24,000 in rental income. Carlos incurred the following expenses related to rental operations: • Depreciation $5,000 • Real estate tax 2,000 Utilities (water and electricity) Maintenance 3,000 • Boat expenses which Carlos uses to 1,500 meet clients and sign contracts 5,500 Determine the net income from rental operations that Carlos will include in his individual income tax return. Submit your computations.arrow_forwardPlease do not give image formatarrow_forwardpter 15, 16, and 17 Saved p%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q Help Save & E payments. Isaac Incorporated began operations in January 2024. For some property sales, Isaac recognizes income in the period of sale for financial reporting purposes. However, for income tax purposes, Isaac recognizes income when it collects cash from the buyer's installment In 2024, Isaac had $621 million in sales of this type. Scheduled collections for these sales are as follows: 2024 $ 61 million 2025 121 million 2026 131 million 2027 152 million 2028 156 million $ 621 million Assume that Isaac has a 25% income tax rate and that there were no other differences in income for financial statement and tax purposes. Note: Round your answer to the nearest whole million. Ignoring operating expenses and additional sales in 2025, what deferred tax liability would Isaac report in its year-end 2025 balance sheet? here to search Multiple Choice # $ 3 4 5 E R W 27 DOLL 9:29 PM Construction on…arrow_forward

- PROBLEM 6: MULTIPLE CHOICE – COMPUTATIONAL 1. The actuarial valuation report of an entity shows the following information: Present value of defined benefit obligation, Jan. 1 340,000 Current service cost 30,000 Discount rate 10% Benefits paid to retirees Actuarial gain 100,000 60,000 How much is the year-end balance of the present value of defined benefit obligation? a. 210,000 b. 244,000 c. 304,000 d. 364,000arrow_forward14. Leslie Inc. has correctly determined the following information related to operations for 2018: Revenue from sales Expenses Income before income taxes P7,000,000 4,000,000 P3,000,000 In reviewing the records, you discovered the following items: During 2018, the company discovered an error in depreciation in 2017. The correction of this error, which has not been recorded, will result in an increase in depreciation for 2017 of P200,000. During 2018, the company sustained a loss of P400,000 because of flood, which destroyed its inventory. The company charged retained earnings and credited inventory for P400,000.arrow_forwardRental Cost: yearly rent 8000; insurance 250; security deposit 500 Buying Cost: yearly mortgage 14000 (7000 is interest); property taxes 3000; insurance and maintenance 1500; down payment and closing cost 4000; growth in equity 450; appreciation 1200 3% on savings 27% tax bracket What is the rental cost?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT