Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

General Accounting

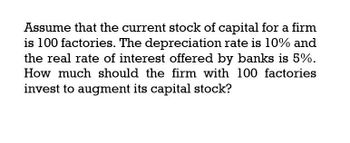

Transcribed Image Text:Assume that the current stock of capital for a firm

is 100 factories. The depreciation rate is 10% and

the real rate of interest offered by banks is 5%.

How much should the firm with 100 factories

invest to augment its capital stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forwardWhat is answer ?arrow_forwardSuppose the growth rate of a firm's profits is 5%, the interest rate is 6%, and the current profits of the firm are $100 million dollars. What is the value of the firm?arrow_forward

- As the general manager of a firm, you are presented with an investment proposal from one of your divisions. Its net present value, if discounted at the cost of capital for your firm (which is 15 percent), is $ 1 00,000, and its internal rate of return is 20 percent. (a) What are the economic interpretations of the net present value and internal rate of return figures? In other words, what do they mean? (b) What, if any, additional information would you like to have before approving the project?arrow_forwardA firm requires an investment of $18,000 and will return $25,000 after one year. If the firmborrows $10,000 at 6%, what is the return on levered equity?arrow_forwardA firm will earn a taxable net return of $500 million next year. If it took on debt today, it would have to pay creditors\varepsilon(rDebt) = 5% + 10% x wDebt2. Thus, if the firm has 100% debt, the financial markets would demand 15% expected rate of return. Further, assume that the financial markets will lend the firm capital at this overall net cost of 15%, regardless of how the firm is financed. The firm is in the 25% marginal tax bracket. 1. If the firmis fully equity-financed, what is its value? 2. Using APV, if the firm is financed with equal amounts of debt and equity today, what is its value? 3. Using WACC, if the firm is financed with equal amounts of debt and equity today, what is its value? 4. Does this firm have an optimal capital structure? If so, what is its APV and WACC?arrow_forward

- Sefton Villa will be worth either €60 million, €80 million or €100 million in one year with equal probabilities. The firm has bonds outstanding with a promised payment of €75 million in one year at an expected rate of 6% and the required rate of return on the assets is 12%. What is the company's equity cost of capital? What is the expected payoff of the debt? What is the debt’s promised rate of return?arrow_forwardA firm has $600,00 in current assets and $150,000 in current liabilities. If it uses cash to pay $50,000 in accounts recievalbes will the current ratio increase or decraese? Will the net working capital increase or decrease or stay the same? Why?arrow_forwardWhat is the cash cow value and the value of its growth opportunities (NPVGO) if a corporation has current earnings of $5 per share and expects to be able to make an investment of 20% of its earnings next year in a new one-time project with an expected return on invested capital of 24%? The discount rate for the firm is 8%. Cash cow value is $62.50 and NPVGO is $1.85 Cash cow value is $20.83 and NPVGO is $2 Cash cow value is $62.50 and NPVGO is $14 Cash cow value is $25.00 and NPVGO is $3 Cash cow value is $25.00 and NPVGO is $3arrow_forward

- Suppose a company’s most recent free cash flow (i.e., FCF0)was $100 million and is expected to grow at a constant rate of 5percent. If the company’s weighted average cost of capital is 15percent, what is the current value from operations?arrow_forwardThe DEF Company is planning a $64 million expansion. The expansion is to be financed by selling $25.6 million in new debt and $38.4 million in new common stock. The before-tax required rate of return on debt is 0.086 and the required rate of return on equity is 0.125. If the company has a marginal tax rate of 0.26, what is the firm's cost of capital? Instruction: Type your answer as a decimal, and round to three decimal placesarrow_forwardSuppose you have a market value of equity equal to $ 500 million and a market value of debt equal to $475 million. What are the capital structure weights?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College