Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Question: General Accounting

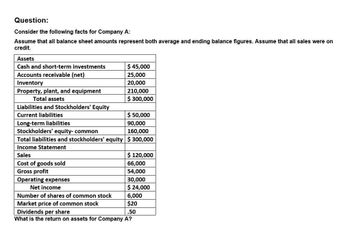

Transcribed Image Text:Question:

Consider the following facts for Company A:

Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on

credit.

Assets

Cash and short-term investments

$ 45,000

Inventory

Accounts receivable (net)

Property, plant, and equipment

Total assets

Liabilities and Stockholders' Equity

25,000

20,000

210,000

$ 300,000

Current liabilities

Long-term liabilities

$ 50,000

90,000

Stockholders' equity- common

Total liabilities and stockholders' equity $300,000

160,000

Income Statement

Sales

Cost of goods sold

Gross profit

Operating expenses

$ 120,000

66,000

54,000

30,000

$ 24,000

6,000

$20

.50

Net income

Number of shares of common stock

Market price of common stock

Dividends per share

What is the return on assets for Company A?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8 Instructions Ratio of fixed assets to long-term liabilitiesarrow_forwardThe following is selected financial data from Block Industries: How much does Block Industries have in current liabilities? A. $19,800 B. $18,300 C. $12,300 D. $25,800arrow_forwardReturn on Assetsarrow_forward

- A comparative balance sheet for Gena Company appears below:GENA COMPANYComparative Balance SheetDec. 31, 2021 Dec. 31, 2020AssetsCash $ 34,000 $11,000Accounts receivable 21,000 13,000Inventory 35,000 17,000Prepaid expenses 6,000 9,000Long-term investments -0- 17,000Equipment 60,000 33,000Accumulated depreciation—equipment (20,000) (15,000)Total assets $136,000 $85,000Liabilities and Stockholders' EquityAccounts payable $ 17,000 $ 7,000Bonds payable 36,000 45,000Common stock 53,000 23,000Retained earnings 30,000 10,000Total liabilities and stockholders' equity $136,000 $85,000Additional information:1. Net income for the year ending December 31, 2021 was $35,000.2. Cash dividends of $15,000 were declared and paid during the year.3. Long-term investments that had a cost of $17,000 were sold for $14,000.4. Depreciation expense for the year was $5,000.InstructionsPrepare a full statement of cash flows for the year ended December 31, 2021, using the indirectmethod.arrow_forwardThe following summary financial statement information is provided for Denbury Industries: Cash and cash equivalents Short-term investments Accounts receivable Inventory Property, plant, and equipment Long-term investments Total assets Net income Interest expense Investment income Multiple Choice O 2024 2023 $ 239,850 $ 368,740 Calculate the return on investments ratio for 2024. 2.5% 25,640 18,740 658,930 690,760 345,920 415,380 859,710 735,480 83,670 65,300 2,213,720 2,294,400 $ 279,630 $ 199,850 39,540 25,670 5,750 3,170arrow_forwardUse the following information to complete the Financial Statements a. Average collection period of 55 days Total equity is $2,250,000 C. Return on Equity of 12% d. Total assets turnover of 1.248 е. Gross profit margin of 40% f. Curren ratio of 3.5 g. Long term liabilities are $1,514,422.5 h. Initial inventory was $1,000,000 and the inventory turnover is 3 times i. The debt ratio (liabilities to assets) is 48% Income Statement Sales Cost of goods sold Gross profit Expenses and taxes Net profit b.arrow_forward

- Need help ASAP :(arrow_forwardCalculate the following for Co. XYZ: c. Average collection period (365 days) d. Times interest earned Assets: Cash and marketable securities $400,000Accounts receivable 1,415,000Inventories 1,847,500Prepaid expenses 24,000Total current assets $3,686,500Fixed assets 2,800,000Less: accumulated depreciation 1,087,500Net fixed assets $1,712,500Total assets $5,399,000Liabilities: Accounts payable $600,000Notes payable 875,000Accrued taxes Total current liabilities $1,567,000Long-term debt 900,000Owner's equity Total liabilities and owner's equity Co. XYZ Income Statement: Net sales (all credit) $6,375,000Less: Cost of goods sold 4,375,000Selling and administrative expense 1,000,500Depreciation expense 135,000Interest expense Earnings before taxes $765,000Income taxes Net income Common stock dividends $230,000Change in retained earningsarrow_forwardwhat is the answer of a?arrow_forward

- gopu.9arrow_forwardSeminole Corporation reported the following items at December 31, 2021, and 2020: (Click the icon to view the comparative financial information.) Read the requirements. Requirement 1. Compute the company's (a) quick (acid-test) ratio and (b) days' sales outstanding for 2021. Evaluate each ratio value as strong or weak. All sales are on account with terms of net 30 days. (a) Enter the formula and calculate the quick (acid-test) ratio for 2021. (Abbreviation used: Cash* = Cash and cash equivalents. Round your final answer to two decimal places.) Cash* + Short-term investments + Net current receivables + Total current liabilities = Quick (acid-test) ratio $ Seminole's quick (acid-test) ratio is considered fairly weak. (b) Select the formula and calculate Seminole's days' sales outstanding for 2021. (Round interim calculations to two decimal places, XX.XX. Round the days' sales outstanding up to the next whole day.) Accounts receivable turnover = + Days' sales outstanding Seminole's days'…arrow_forwardAssets Current assets: Cash Marketable securities Accounts receivable (net) Inventory Total current assets Investments Plant and equipment Less: Accumulated depreciation Net plant and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term liabilities: Bonds payable Total liabilities Stockholders' equity Preferred stock, $ 50 par value Common stock, $ 1 par value Capital paid in excess of par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 611,000 272,000 $ 52,500 22,500 178,000 290,000 $ 543,000 66,200 339,000 $948,200 $ 95,100 78,700 12,000 $ 185,800 159,400 $ 345,200 $ 100,000 80,000 190,000 233,000 $ 603,000 $948,200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,