Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Hi expart Provide answer of this accounting question

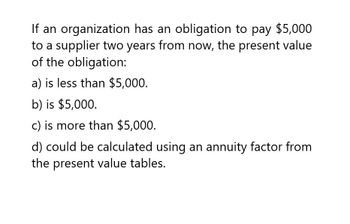

Transcribed Image Text:If an organization has an obligation to pay $5,000

to a supplier two years from now, the present value

of the obligation:

a) is less than $5,000.

b) is $5,000.

c) is more than $5,000.

d) could be calculated using an annuity factor from

the present value tables.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- For each of the following situations involving annuities, solve for the unknown. Assume that interest is compounded annually and that all annuity amounts are received at the end of each period. (i=interest rate, and n=number of years)(FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of 1$ and PVAD of $1) (Use appropriate factor (s) from the tables provided. Round your final answers to nearest whole dollar amount.) Present Value Annuity Amount i= n= ______________ $ 2,600 8% 5 507,866 135,000 _____ 4 661,241 170,000 9% ____ 540,000 78,557 _____ 8 230,000 _____________ 10% 4arrow_forwardCalculate the present value of the following annulties, assuming each annuity payment is made at the end of each compounding period. (FV of $1, PV of $1, FVA of $1, and PVA of S1) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.) \table[[, \table[[Annuity], [Payment]], \table [[ Annual], [Rate]], \table[[Interest], [Compounded]], \table [[Period], [Invested]], \table [[Present Value of], [ Annuity]]], [1., $5,000, 7.0%, Semiannually,3 years,], [2., 10, 000, 8.0%, Quarterly,2 years, ], [3., 4,000, 10.0 %, Annually,5 years,]]arrow_forwardFor each of the following situations involving annuities, solve for the unknown. Assume that interest is compounded annually and that all annuity amounts are received at the end of each period. (i = interest rate, and n = number of years) (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answers to nearest whole dollar amount.)arrow_forward

- For each of the following situations involving annuities, solve for the unknown. Assume that interest is compounded annually and that all annuity amounts are received at the end of each period. (i = interest rate, and n = number of years) (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your final answers to nearest whole dollar amount.) Present Value Annuity Amount i = n = 1. ? $2,400 8% 5 2. 533,082 140,000 ? 4 3. 583,150 180,000 9% ? 4. 530,000 75,502 ? 8 5. 235,000 ? 10% 4arrow_forwardPlease help with question, thank you much.arrow_forwardFor each of the following cases, calculate the present value of the annuity, assuming the annuity cash flows occur at the end of each year. SEE DETAILS IN PICarrow_forward

- A company wants to have $50,000 at the beginning of each 6-month period for the next 4 1/2 years. If an annuity is set up for this purpose, how much must be invested now if the annuity earns 6.29%, compounded semiannually? (a) Decide whether the problem relates to an ordinary annuity or an annuity due. ordinary annuityannuity due (b) Solve the problem. (Round your answer to the nearest cent.) $arrow_forwardPlease use a physical TIMELINE to solve.arrow_forwardWhat's the answer?arrow_forward

- A company wants to have $20,000 at the beginning of each 6-month period for the next 4years. If an annuity is set up for this purpose, how much must be invested now if the annuity earns 6.31%, compounded semiannually? (a) Decide whether the problem relates to an ordinary annuity or an annuity due. ordinary annuityannuity due (b) Solve the problem. (Round your answer to the nearest cent.)arrow_forwardWhat is the monthly payment for a home costing $475,000 with a 20% down payment and the balance financed for 30 years at 6.5%? (a) State the type. A. present valueB. future value C.ordinary annuityD.amortizationEsinking fund (b) Answer the question. (Round your answer to the nearest cent.)arrow_forwardFor each of the following situations involving annuities, solve for the unknown. Assume that interest is compounded annually and that all annuity amounts are received at the end of each period. (i = interest rate, and n = number of years) (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Present Value Annuity Amount i = n = $3,000 75,000 20,000 80,518 1 2 3 4 5 242,980 161,214 500,000 250,000 8% 9% 10% 5 4 8 4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning