FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help with this accounting question not use chatgpt and

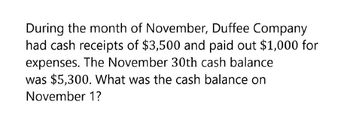

Transcribed Image Text:During the month of November, Duffee Company

had cash receipts of $3,500 and paid out $1,000 for

expenses. The November 30th cash balance

was $5,300. What was the cash balance on

November 1?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the year, Tempo Inc. has monthly cash expenses of $144,468. On December 31, its cash balance is $1,829,210. The ratio of cash to monthly cash expenses (rounded to one decimal place) is Oa. 13.7 months Ob. 12.7 months Oc. 6.4 months Od. 7.9 monthsarrow_forwardGregg Corp. reported revenue of $1,450,000 in its cash basis income statement for the year ended Dec. 31, Year 7. Additional information was as follows: Accounts receivable, Jan 1, Year 7 $400,000 Accounts receivable, Dec 31, Year 7 $530,000 Under the accrual basis, Gregg would report revenue of O $1,580,000 O $1,035,000 $1,335,000 O $1,505,000arrow_forwardBailey Co earns $27,792 of revenue on account and in $6,256 cash revenue transactions in Year 1. Cash collections of receivables amount to $7,152 in Year 1 with the remainder being collected in Year 2. Based on this information alone the company’s financial statements would show Total Revenue in Year 1 of $_arrow_forward

- Gibson Company engaged in the following transactions for Year 1. The beginning cash balance was $28,100 and the ending cash balance was $74,991. 1. Sales on account were $283,100. The beginning receivables balance was $94,700 and the ending balance was $77,000. 2. Salaries expense for the period was $55,460. The beginning salaries payable balance was $3,815 and the ending balance was $2,180. 3. Other operating expenses for the period were $120,170. The beginning other operating expenses payable balance was $4,860 and the ending balance was $9,181. 4. Recorded $19,330 of depreciation expense. The beginning and ending balances in the Accumulated Depreciation account were $14,340 and $33,670, respectively. 5. The Equipment account had beginning and ending balances of $211,970 and $238,570, respectively. There were no sales of equipment during the period. 6. The beginning and ending balances in the Notes Payable account were $48,500 and $150,500, respectively. There were no payoffs of…arrow_forwardThe financial statements of the Splish Brothers Inc. reports net sales of $360000 and accounts receivable of $48000 and $21600 at the beginning of the year and end of year, respectively. What is the average collection period for accounts receivable in days?arrow_forwardGarden Gate, Inc. reported the following data in its August 31 annual report. Cash and cash equivalents $ 485,625 Cash flow from operations (630,000) Required: a. What is the company's "cash burn" per month? per month b. What is the company's ratio of cash to monthly cash expenses? Round your answer to one decimal place. monthsarrow_forward

- Holloway Company earned $6,200 of service revenue on account during Year 1. The company collected $5,270 cash from accounts recievable during Year 1. a. the balance of the accounts recievable that would be reported on the Decmeber 31,Year1,balance sheet b. the amount of net income that would be reported on the Year 1 income statement. c. the amount of net cash flow from operating activites that would be reported on the Year 1 statement of cash flows d. the amount of retained earnings that would be reported on the Year 1 balance sheetarrow_forwardYork Company engaged in the following transactions for Year 1. The beginning cash balance was $86,000 and the ending cash balance was $59,100. 1. Sales on account were $548,000. The beginning receivables balance was $128,000 and the ending balance was $90,000. 2. Salaries expense for the period was $232,000. The beginning salaries payable balance was $16,000 and the ending balance was $8,000. 3. Other operating expenses for the period were $236,000. The beginning other operating expenses payable balance was $16,000 and the ending balance was $10,000. 4. Recorded $30,000 of depreciation expense. The beginning and ending balances in the Accumulated Depreciation account were $12,000 and $42,000, respectively. 5. The Equipment account had beginning and ending balances of $44,000 and $56,000, respectively. There were no sales of equipment during the period. 6. The beginning and ending balances in the Notes Payable account were $36,000 and $44,000, respectively. There were no payoffs of…arrow_forwardThe accounts receivable balance is?arrow_forward

- What are the gross sales for the month of December on these accounting question?arrow_forwardDuring the month of November, Luffee Company had cash receipts of $5,100 and paid out $1,300 for expenses. The November 30th cash balance was $7,200. What was the cash balance on November 1?arrow_forwardAt year-end, StickStick has cash of $ 22 comma 000$22,000, current accounts receivable of $ 80 comma 000$80,000, merchandise inventory of $ 24 comma 000$24,000, and prepaid expenses totaling $ 5 comma 900$5,900. Liabilities of $ 64 comma 000$64,000 must be paid next year. Assume accounts receivable had a beginning balance of $ 40 comma 000$40,000 and net credit sales for the current year totaled $ 480 comma 000$480,000. How many days did it take StickStick to collect its average level of receivables?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education