[The following information applies to the questions displayed below.]

While completing undergraduate schoolwork in information systems, Dallin Bourne and Michael Banks decided to start a technology support company called eSys Answers. During year 1, they bought the following assets and incurred the following start-up fees:

| Year 1 Assets | Purchase Date | Basis |

|---|---|---|

| Computers (5-year) | October 30, Year 1 | $ 16,000 |

| Office equipment (7-year) | October 30, Year 1 | 10,000 |

| Furniture (7-year) | October 30, Year 1 | 5,000 |

| Start-up costs | October 30, Year 1 | 18,800 |

In April of year 2, they decided to purchase a customer list from a company providing virtually the same services, started by fellow information systems students preparing to graduate. The customer list cost $11,800, and the sale was completed on April 30. During their summer break, Dallin and Michael passed on internship opportunities in an attempt to really grow their business into something they could do full time after graduation. In the summer, they purchased a small van (for transportation, not considered a luxury auto) and a pinball machine (to help attract new employees). They bought the van on June 15, Year 2, for $25,000 and spent $4,000 getting it ready to put into service. The pinball machine cost $5,000 and was placed in service on July 1, Year 2.

| Year 2 Assets | Purchase Date | Basis |

|---|---|---|

| Van | June 15, Year 2 | $ 29,000 |

| Pinball machine (7-year) | July 1, Year 2 | 5,000 |

| Customer list | April 30, Year 2 | 11,800 |

Assume that eSys Answers does not claim any §179 expense or bonus

Note: Round your intermediate calculations and final answers to the nearest whole dollar amount.

Required:

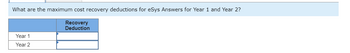

a. What are the maximum cost recovery deductions for eSys Answers for Year 1 and Year 2?

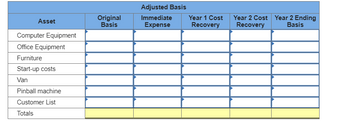

c. What is eSys Answers' basis in each of its assets at the end of Year 2?

Step by stepSolved in 2 steps

- Data table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table Year 1 2 3 4 5 6 7 8 9 10 11 3-Year 33.33% 44.45% 14.81% 7.41% 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% - 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% Xarrow_forwardAt the beginning of Year 1, Cactus Company has three employees: A, B, and C. Employee A has 3 expected years of future service. Employee B has 4 expected years of future service, and Employee C has 5 expected years of future service. Using the year-of-future-service method, compute the amortization fraction for Years 1 through 5 that Cactus would use to amortize its prior service cost.arrow_forwardhow did you get the Amortization Expense of 25,000arrow_forward

- Describe the cost formula for a strictly fixed cost such as depreciation of 15,000 per year.arrow_forwardBurnham Industries incurs these costs for the month: A. What Is the prime cost? B. What is the conversion cost?arrow_forwardMODIFIED ACCELERATED COST RECOVERY SYSTEM Using the information given in Exercise 5Apx-1B and the rates shown in Figure 5A-4, prepare a depreciation schedule showing the depreciation expense, accumulated depreciation, and book value for each year under the Modified Accelerated Cost Recovery System. For tax purposes, assume that the computer has a useful life of five years. (The IRS schedule will spread depreciation over six years.)arrow_forward

- Frequency of Payments Number of Number of Annual Rate Years Involved Payments Involved Case A 10% 17 17 Annually Case B 10% 8 Annually Case C 7% 8 16 Semiannuallyarrow_forwardFrom the following list indicate which of the liabilities that would be classified as current. O a. Deferred revenue on a project that will be completed in 6 months O b. Bank loan payable in 2 years O c. Deferred income taxes O d. Pension liability Oe. The portion of a 10-year bank loan that is due this year O f. Payroll deductions owing to the government Og. A provision for warranty repairs related to a product with a 1-year warranty ype here to search eTextbook and Media 8:arrow_forwardProblem1: A sum of ₱ 35,000 is invested from March 8,2019 to December 5,2019, at 18 ½ % Simple Interest. Find the interest earned using the four methodsarrow_forward

- Kingbird Leasing Company agrees to lease equipment to Oriole Corporation on January 1, 2020. The following information relates to the lease agreement. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. The cost of the machinery is $514,000, and the fair value of the asset on January 1, 2020, is $677,000. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $55,000. Oriole estimates that the expected residual value at the end of the lease term will be 55,000. Oriole amortizes all of its leased 1. 2. 3. equipment on a straight-line basis. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. The collectibility of the lease payments is probable. 4. 5. 6. Kingbird desires a 10% rate of return on its investments. Oriole's incremental borrowing rate is 11%, and the lessor's implicit rate is unknown. (Assume the accounting period ends on…arrow_forwardTotal interest expended will be: a. OMR 50,400,000 b. OMR 45,000,000 c. OMR 55,000,000 d. OMR 45,400,000 Total of non-interest expenses during the year was: a. OMR 9,660,000 b. OMR 8,680,000 c. OMR 16,860,000 d. OMR 16,680,000arrow_forwardAjax Corporation has hired Brad O'Brien as its new president. Terms included the company's agreeing to pay retirement benefits of $18,600 at the end of each semiannual period for 10 years. This will begin in 3,285 days. If the money can be invested at 8% compounded semiannually, what must the company deposit today to fulfill its obligation to Brad? (Please use the following provided Table and Table 12.3.) (Use 365 days a year. Do not round intermediate calculations. Round your answer to the nearest cent.) Deposit amount 124,779.35arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT