Quickbooks Online Accounting

3rd Edition

ISBN: 9780357391693

Author: Owen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Getwell hospital provides you with the following information:

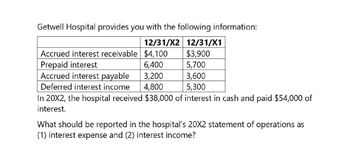

Transcribed Image Text:Getwell Hospital provides you with the following information:

12/31/X2 12/31/X1

Accrued interest receivable $4,100

$3,900

Prepaid interest

6,400

5,700

Accrued interest payable

3,200

3,600

Deferred interest income

4,800

5,300

In 20X2, the hospital received $38,000 of interest in cash and paid $54,000 of

interest.

What should be reported in the hospital's 20X2 statement of operations as

(1) interest expense and (2) interest income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assuming a 360-day year, proceeds of $47,444 were received from discounting a $48,147, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was a. 7.59% Ob. 7.08% Oc. 5.84% Od. 3.84%arrow_forwardPlease see attached infoarrow_forwardAssuming a 360-day year, proceeds of $47,044 were received from discounting a $47,639, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was Select the correct answer. 6% 3% 5% 7%arrow_forward

- Federal Bank of America has loaned $9,000 to Southgate Animal Hospital, using a 90-day non-interest-bearing note. The bank discounted the note at 8%. The debit to Discount on Notes Payable in the general journal will be in the amount of a.$9,000.00. b.$9,180.00. c.$8,820.00. d.$180.00arrow_forwardOn October 1, Eli's Carpet Service borrows $300,000 from First National Bank on a 5-month, $120,000, 8% note. The entry by Eli's Carpet Service to record payment of the note and accrued interest on January 1 is uc Select one: a. Notes Payable. 127,500 127,500 Cash.... b. The answer does not exist С. Notes Payable. Interest Expense.. 125,000 2,500 Cash. 127,500 d. Notes Payable. Interest Payable.. 125,000 2,500 Cash. 127,500 e. Notes Payable.. Interest Payable.. 125,000 10,000 Cash 135,000 IBAarrow_forwardTake me to the text Fill in the blanks for each of the following independent scenarios (A-D). Do not enter dollar signs or commas in the input boxes. Round all answers to the nearest whole number. Scenario Annual Net Cash Flow Discount Rate Number of Payments Present Value of Annuity Factor Present Value of Annuity $ A $20,000.00 $ 10% 4.3553 B % 2 1.6901 $82,814.90 $ C $21,000.00 6% 7.3601 D $8,000.00 9% 4.4859 $35,887.20arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,