EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

What is the project's discounted payback?

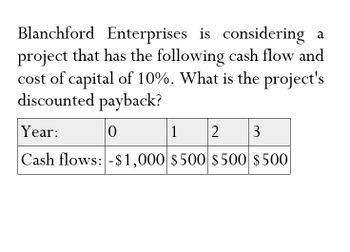

Transcribed Image Text:Blanchford Enterprises is considering a

project that has the following cash flow and

cost of capital of 10%. What is the project's

discounted payback?

Year:

0

1

2

3

Cash flows: -$1,000 $500 $500 $500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Foster Manufacturing is analyzing a capital investment project that is forecast to produce the following cash flows and net income: The payback period of this project will be: a. 2.5 years. b. 2.6 years. c. 3.0 years. d. 3.3 years.arrow_forwardRedbird Company is considering a project with an initial investment of $265,000 in new equipment that will yield annual net cash flows of $45,800 each year over its seven-year life. The companys minimum required rate of return is 8%. What is the internal rate of return? Should Redbird accept the project based on IRR?arrow_forwardPlease give exact answer and excel steps Jeans LLC has a project with the following cash flows . Its required rate of return is 5 % , Year 012345 Cash Flow Project A -52,000.00 25,000.00 17,000.00 14,000.00 12,000.00 -3,000.00 What is the internal rate of retum ( IRR ) for this project ? options: a. 11.73859230479%b. 11.73962884992%c. 11.738592037872%d. 11.738591574995%e. 11.738592402818%f. 11.738672984783% Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Redesign Inc. is considering a project that has the following cash flow data. What is the project's payback period and discounted payback period? Assume the cost of capital is 12%. Year 0 1 2 3 Cash flows -$500 $200 $200 $200arrow_forwardNeed helparrow_forwardThe future cash flows of a stand-alone capital project follow: If the cost of capital is 14%, what is the NPV of the project? (your financial calculator with cash flow journal helps here!) year 0 1 2 3 cash flow ($5000) $2500 $2500 $ 2500 $5804 $804 $6217 $1217arrow_forward

- Need helparrow_forwardRubash Company is considering a project that has the following cash flow and WACC data. What is the project's MIRR? WACC = 9% Year: 0 1 2 3 Cash flows: - $1,500 $400 $525 $940 a. 8.00% b 8.45% c. 8.75% d. 9.33% e. 9.83%arrow_forwardDarius Inc. is considering a project that has the following cash flow data. Given WACC = 10%, what is the project's NPV? Year 0 = $-100,000 Year 1 = $45,000 Year 2 = $10,000 Year 3 = $0 Year 4 = $50,000 Year 5 = $15,000 Question 2Answer a. $0 b. $2,321.10 c. $1.20 d. $-7,361.95 e. $-1,230.18 f. $-524.23arrow_forward

- Barry Inc. is considering a project that has the following cash flow and WACC data. What is the project's MIRR? WACC = 9.75% Year 1 3 5 CFs -$53,600 8,010 16,020 24,030 32,040 40,050 2.arrow_forwardSolve this general accounting questionarrow_forwardThe cash flows associated with an investment project are as follows: Project Y (200 000) 100 000 Year 100 000 120 000 110 000 The discount rate is 8 percent. What's the discount payback period of the projects? (compile a spreadsheet) Calculate NPV, PI of a projects Calculate IRR of a projects Should the firm accept the project? a) b) c) d) 01234arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning