Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Check my work

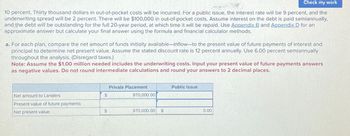

10 percent. Thirty thousand dollars in out-of-pocket costs will be incurred. For a public issue, the interest rate will be 9 percent, and the

underwriting spread will be 2 percent. There will be $100,000 in out-of-pocket costs. Assume interest on the debt is paid semiannually,

and the debt will be outstanding for the full 20-year period, at which time it will be repaid. Use Appendix B and Appendix D for an

approximate answer but calculate your final answer using the formula and financial calculator methods.

a. For each plan, compare the net amount of funds initially available-inflow-to the present value of future payments of interest and

principal to determine net present value. Assume the stated discount rate is 12 percent annually. Use 6.00 percent semiannually

throughout the analysis. (Disregard taxes.)

Note: Assume the $1.00 million needed includes the underwriting costs. Input your present value of future payments answers

as negative values. Do not round intermediate calculations and round your answers to 2 decimal places.

Private Placement

Public Issue

Net amount to Landers

$

970,000.00

Present value of future payments

Net present value

$

970,000.00

$

0.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I need this question completed in 10 minutes with full handwritten working outarrow_forward16. You borrow $27,000 to purchase a plane. The loan will be paid in monthly installments over one year at 30% interest annually. The first payment is due one month from today. What is the amount of each monthly payment? (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)arrow_forwardPrepare an amortization schedule for a three-year loan of $111,000. The interest rate is 10 percent per year, and the loan calls for equal annual payments. How much total interest is paid over the life of the loan?arrow_forward

- Suppose we need to make 10 end-of-year payments of $5, 000 to pay off aloan. Assuming the rate of interest is 5% compounded annually and using the prospective method, what is the outstanding loan balance immediately after the 5th payment? Please show all work.arrow_forwardConsider a loan of 1,000,000 which is to be amortized by 60 monthly payments. The interest rate is 10% converted monthly. Construct the first 5 rows (t=0 to t=4) of the amortization schedulearrow_forwardPlease show all formulas and the process in Excel for each question. You borrow a GPM of $450,000 with annual payments and 15-year term. The interest rate is 4.5% and the payment factors from year 1 to year 15 are: 50%, 50%, 50%, 50%, 50%, 75%, 75%, 75%, 75%, 75%, 100%, …, 100%. Questions: What are the annual payments for years 1 to 15? What is remaining balance at the end of each year? What are the interest payment and principal payment for years 1 to 15? Answer the questions (1) to (3) above if annual payment is changed to monthly payment.arrow_forward

- An ARM for $100,000 is made at a time when the expected start rate is 5 percent. The loan will be made with a teaser rate of 2 percent for the first year, after which the rate will be reset. The loan is fully amortizing, has a maturity of 25 years, and payments will be made monthly. Required:a. What will be the payments during the first year?b. Assuming that the reset rate is 6 percent at the beginning of year (BOY) 2, what will the payments be?c. By what percentage will the monthly payments increase?d. If the reset date is three years after loan origination and the reset rate is 6 percent, what will the loan payments be beginning in year 4 through year 25arrow_forwardCZ Enterprises borrows $202,775 at an interest rate of 10% today and will repay this amount by making 10 semiannual payments. Payments begin in six months. What is the amount of the payments that CZ will need to make? (Use the present value and future value tables, a financial calculator, a spreadsheet or the formula method for your calculations. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round your final answer to the nearest cent, $X.XX.) CZ will need to make payments of $ 26,260.31.arrow_forwardSuppose a borrower makes a $100,000 loan with annual payments at a 10 percent rate and a 10-year term. The loan is fully amortizing; however, payments are made on an annual basis to simplify the initial illustration. How the annual loan payment is calculated?arrow_forward

- Pasadena Healthcare has borrowed $1,000,000 on a five-year, annual payment term load at a 15 percent rate. The first payment is due one year from now. Construct the amortization schedule for this loan.arrow_forwardYou plan to make a lump-sum deposit of $5000 now into an investment account that pays 6% per year, and you plan to withdraw an equal end-of-year amount of $1000 for 5 years, starting next year. At the end of the sixth year, you plan to close your account by withdrawing the re- maining money. Define the engineering economy symbols involved.arrow_forwardLorkay Seidens Inc. just borrowed $25,000. The loan is to be repaid in equal installments at the 22 end of each of the next five years, and the interest rate is 10 percent. a. Set up an amortization schedule for the loan. b. How large must each annual payment be if the loan is for $50,000? Assume that the interest rate remains at 10 percent and that the loan is paid off over five years. c. How large must each payment be if the loan is for $50,000, the interest rate is 10 percent, and the loan is paid off in equal installments at the end of each of the next 10 years? This loan is for the same amount as the loan in part (b), but the payments are spread out over twice as many periods. Why are these payments not half as large as the payments on the loan in part (b)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education