Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

is my response accurate

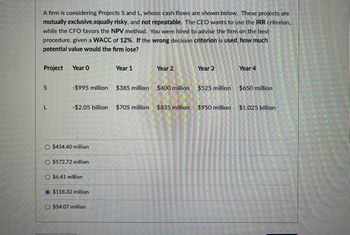

Transcribed Image Text:A firm is considering Projects S and L, whose cash flows are shown below. These projects are

mutually exclusive,equally risky, and not repeatable. The CEO wants to use the IRR criterion,

while the CFO favors the NPV method. You were hired to advise the firm on the best

procedure, given a WACC of 12%. If the wrong decision criterion is used, how much

potential value would the firm lose?

Project Year O

Year 1

Year 2

Year 3

Year 4

S

-$995 million

$385 million

$400 million

$525 million

$650 million

L

-$2.05 billion

$705 million

$835 million

$950 million

$1.025 billion

O $454.40 million

O $572.72 million

O $6.41 million

$118.32 million

O $54.07 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A firm is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR criterion, while the CFO favors the NPV method. You were hired to advise the firm on the best procedure, given a WACC of 15%. If the wrong decision criterion is used, how much potential value would the firm lose? Project Year 0 Year 1 Year 2 Year 3 Year 4 S -$995 million $385 million $400 million $525 million $650 million L -$2.05 billion $705 million $835 million $950 million $1.025 billion $6.04 million O $359.08 million $46.04 million $451.15 million O $405.11 millionarrow_forwardA firm is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR criterion, while the CFO favors the NPV method. You were hired to advise the firm on the best procedure. If the wrong decision criterion is used, how much potential value would the firm lose? (compare NPVs for projects)WACC: 6.75%Year 0 1 2 3 4 CFS -$1,025 $380 $380 $380 $380CFL -$2,150 $765 $765 $765 $765arrow_forwardA firm is considering two investment projects, Y and Z. These projects are NOT mutually exclusive. Assume the firm is not capital constrained. The initial costs and cashflows for these projects are: 0 1 2 3 Y -40,000 17,000 17,000 15,000 Z -28,000 12,000 12,000 20,000 Using a discount rate of 9% calculate the net present value for each project. What decision would you make based on your calculations? How would your decision change if the discount rate used for calculating the net present value is 15%? Calculate an approximate IRR for each project. Assume the hurdle rate is 9%. What decision would you make based on your calculations? Calculate the payback period for each project. The company looks to select investment projects paying back in 2 years. What decision would you make based on your calculations? Critically discuss Net Present Value (NPV), Internal Rate of Return (IRR) and payback period as criteria for investment appraisal.arrow_forward

- 1. Basic NPV methods tell us that the value of a project today is NPV0. Time value of money issues also lead us to believe that if we choose not to do the project that it will be worth NPV1 one period from now, such that NPV0 > NPV1. Why then do we see some firms choosing to defer taking on a project. Be complete and thorough in your answer. 2. Briefly describe the agency relationship that exists between the shareholders and the managers of the firm and how it can result in what is referred to as the agency conflict?arrow_forwardThe payback method helps firms establish and identify a maximum acceptable payback period that helps in their capital budgeting decisions. Consider the case of Cold Goose Metal Works Inc.: Cold Goose Metal Works Inc. is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Beta’s expected future cash flows. To answer this question, Cold Goose’s CFO has asked that you compute the project’s payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table and compute the project’s conventional payback period. For full credit, complete the entire table. (Note: Round the conventional payback period to the nearest two decimal places. If your answer is negative use a minus sign.) Year 0 Year 1 Year 2 Year 3 Expected cash flow -$4,500,000 $1,800,000 $3,825,000 $1,575,000 Cumulative…arrow_forwardThe payback method helps firms establish and identify a maximum acceptable payback period that helps in their capital budgeting decisions. Consider the case of Cold Goose Metal Works Inc.: Cold Goose Metal Works Inc. is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Beta’s expected future cash flows. To answer this question, Cold Goose’s CFO has asked that you compute the project’s payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table and compute the project’s conventional payback period. For full credit, complete the entire table. (Note: Round the conventional payback period to two decimal places. If your answer is negative, be sure to use a minus sign in your answer.) Year 0 Year 1 Year 2 Year 3 Expected cash flow -$4,500,000 $1,800,000 $3,825,000 $1,575,000…arrow_forward

- The firm is facing capital rationing challenges. Given the current economic situation, the minimum required rate of return for both projects is 4.37%. Based on the given information, which project should you accept and why? Please show all the calculations by which you came up with the final answer.arrow_forwardPlss show complete steps thanks. All parts it is one question only or I'll dislike. I will like for complete ans. With formulaarrow_forward. The payback period The payback method helps firms establish and identify a maximum acceptable payback period that helps in their capital budgeting decisions. Consider the case of Cold Goose Metal Works Inc.: Cold Goose Metal Works Inc. is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Delta’s expected future cash flows. To answer this question, Cold Goose’s CFO has asked that you compute the project’s payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table and compute the project’s conventional payback period. For full credit, complete the entire table. (Note: Round the conventional payback period to two decimal places. If your answer is negative, be sure to use a minus sign in your answer.) Year 0 Year 1 Year 2 Year 3 Expected cash flow -$6,000,000…arrow_forward

- The Weiland Computer Corporation is trying to choose between the following mutually exclusive design projects, P1 and P2: Year 0 1 2 3 Cash flows (P1) -$53,000 27,000 27,000 27,000 Cash flow (P2) -$16,000 9,100 9,100 9,100 If the discount rate is 10 percent and the company applies the profitability index (PI) decision rule, which project should the firm accept? If the firm applies the Net Present Value (NPV) decision rule, which project should it take? Are your answers in (a) and (b) different? Explain why?arrow_forwardJefferson International is trying to choose between the following two mutually exclusive design projects: Cash Flow (B) -$38,000 Year Cash Flow (A -$75,000 32.400 17,800 30,200 14,200 3 36.600 19.800 The required return is 12 percent. If the company applies the profitability index (PI) decision rule, which project should the firm accept? If the company applies the NPV decision rule, which project should it take? Given your first two answers, which project should the firm actually accept? Project A; Project B; Project A O Project A; Project B; Project B O Project B; Project A; Project A O Project B; Project A; Project B O Project B; Project B, Project Barrow_forwardSuppose you are considering a project with an initial investment of $500,000. This project has an estimated net present value (NPV) of $750,000. How would you explain the meaning of the $750,000 net present value (NPV) to a nonfinancial manager? O The positive NPV indicates this project is expected to increase the value of the firm by $250,000. The positive NPV indicates this project is expected to increase the value of the firm by $750,000. The project benefits outweigh the costs by $250,000 on a present value basis. O The project benefits outweigh the costs by $500,000 on a present value basis.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education