Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

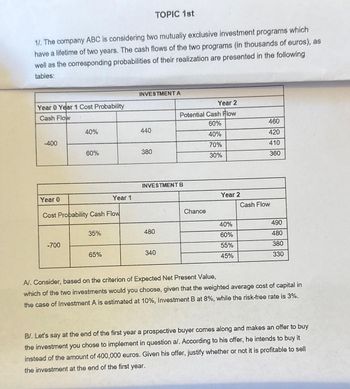

Transcribed Image Text:1/. The company ABC is considering two mutually exclusive investment programs which

have a lifetime of two years. The cash flows of the two programs (in thousands of euros), as

well as the corresponding probabilities of their realization are presented in the following

tables:

Year 0 Year 1 Cost Probability

Cash Flow

-400

Year 0

40%

-700

60%

Cost Probability Cash Flow

35%

Year 1

65%

TOPIC 1st

INVESTMENT A

440

380

INVESTMENT B

480

Year 2

Potential Cash Flow

60%

40%

70%

30%

340

Chance

Year 2

40%

60%

55%

45%

460

420

410

360

Cash Flow

490

480

380

330

AV. Consider, based on the criterion of Expected Net Present Value,

which of the two investments would you choose, given that the weighted average cost of capital in

the case of Investment A is estimated at 10%, Investment B at 8%, while the risk-free rate is 3%.

B/. Let's say at the end of the first year a prospective buyer comes along and makes an offer to buy

the investment you chose to implement in question a/. According to his offer, he intends to buy it

instead of the amount of 400,000 euros. Given his offer, justify whether or not it is profitable to sell

the investment at the end of the first year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following two mutually exclusive projects: Year Cash Flow (X) Cash Flow (Y)0-$19.100-$ 19,100 18,625 9,650 2 8,650 7,575 3 8,575 8,475 Calculate the IRR for each project. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) What is the crossover rate for these two projects? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g.. 32.16.) What is the NPV of Projects X and Y at discount rates of 0 percent, 15 percent, and 25 percent?arrow_forwardThe following information regarding an investment project is available. Initial investment is £125,000 Scrap Value £10,000 at the end of 5 years Year Inflow 1 £60,000 2 £50,000 3 £10,000 4 £10,000 5 £50,000 A). What is the ARR using the Average Investment formula? Choose one from the following: A. 15% B. 17% C. 19% D. 21%arrow_forwardA2arrow_forward

- A project is expected to produce cash inflows of $5,000 for seven years. What is the maximum amount that can be spent on costs to initiate this project and still consider the project as acceptable, given an 11% discount rate? Select one: Oa. $15,884.15 Ob. $23,340.13 Oc. $25,900.63 O d. $23,560.98 Oe. $26,984.02arrow_forwardKara, Incorporated, imposes a payback cutoff of three years for its international investment projects. Assume the company has the following two projects available. Year Cash Flow (A) 0 -$56,000 1 2 3 4 22,500 29,600 24,500 10,500 Cash Flow (B) -$ 101,000 a. Project A Project B b. Project acceptance 24,500 29,500 29,500 239,000 a. What is the payback period for each project? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. b. Which, if either, of the projects should the company accept? years yearsarrow_forwardA company is considering two projects. The discount rate is 10 percent, and the projects' cash flows would be: Years 1 2 3 Project A -S700 S500 S300 S100 Project B -S700 $100 $300 S600 a. Calculate the projects' NPVS. b. If the two projects are independent, which project(s) should be chosen? c. If the two projects are mutually exclusive, which project should be chosen?arrow_forward

- X will pay $80,000 for a project that will generate the following cash flows: YEAR 1 2 3 4 5 7 8 CASH FLOW $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $30,000 $30,000 The payback period for the investment is: O 7 years O 6.25 years O 7 years O 7.33 yearsarrow_forwardA company is considering two mutually exclusive investments with a discount rate of 10%.The cash flows of the projects over time follows: Time Project A Project B 0 - RM300,000 - RM405,000 1 - RM387,000 RM134,000 2 - RM193,000 RM134,000 3 - RM100,000 RM134,000 4 RM600,000 RM134,000 5 RM600,000 RM134,000 6 RM850,000 RM134,000 7 - RM180,000 RM0 Question: The company does not want to issue new share capital or debentures to financethis project. Recommend three (3) appropriate financing methods for this project.Provide support for your recommendations.arrow_forwardA company is considering two mutually exclusive investments with a discount rate of 10%.The cash flows of the projects over time follows: Time Project A Project B 0 - RM300,000 - RM405,000 1 - RM387,000 RM134,000 2 - RM193,000 RM134,000 3 - RM100,000 RM134,000 4 RM600,000 RM134,000 5 RM600,000 RM134,000 6 RM850,000 RM134,000 7 - RM180,000 RM0 A. What is the Net Present Value (NPV) for each project? B. Since the projects are mutually exclusive, which project would you recommend?Justify your recommendation. C. Suppose that the projects are independent projects, which project (s) would yourecommend? Justify your recommendation.arrow_forward

- An investment project provides cash inflows of $740 per year for 9 years. What is the project payback period if the initial cost is $1,480? A. 2.00 years B. 2.02 years C. 1.90 years D. 1.94 years E. 2.04 years What is the project payback period if the initial cost is $4,958? A. 6.70 years B. 6.77 years C. 6.37 years D. 6.83 years E. 6.50 years What is the project payback period if the initial cost is $7,400? A. 3.01 years B. Never C. 4.95 years D. 5.25 years E. 1.35 yearsarrow_forwardProject X has an initial cost of $46,919, and its expected net cash inflows are $11,500 per year for 6 years. The firm has a WACC of 8 percent, and Project X's risk would be similar to that of the firm's existing assets. Calculate the discounted payback period of Project X. 5.14 years |arrow_forwardAnnual cash inflows that will arise from two competing investment projects are given below: Year Investment A Investment B 1 $7,000 $ 10,000 2 8,000 3 9,000 4 10,000 $ 34,000 9,000 8,000 7,000 $ 34,000 The discount rate is 7%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: Compute the present value of the cash inflows for each investment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education