SWFT Individual Income Taxes

43rd Edition

ISBN: 9780357391365

Author: YOUNG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Subject: Accounting

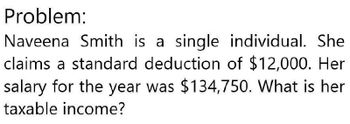

Transcribed Image Text:Problem:

Naveena Smith is a single individual. She

claims a standard deduction of $12,000. Her

salary for the year was $134,750. What is her

taxable income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Melodie's taxable income is $39,000 and she pays income tax of $4,489. If Melodie's taxable income increases to $41,000, she would pay income taxes of $4,884. What is Melodie's marginal tax rate? 19.75 22.00 18.50 12.00 Some other amountarrow_forwardLisa records nonrefundable Federal income tax credits of 65,000 for the year. Her regular income tax liability before credits is 190,000, and her TMT is 150,000. a. What is Lisas AMT? b. What is Lisas regular income tax liability after credits?arrow_forwardWhat is taxable income?arrow_forward

- Answer wantarrow_forwardProblemarrow_forwardCompute the gross income, adjusted gross income, and taxable income in the following situation. Use the exemptions and deductions in the table to the right. Explain how it was decided whether to itemize deductions or use the standard deduction. A man is single and earned wages of $63,600. He received $390 in interest from a savings account. He contributed $510 to a tax-deferred retirement plan. He had $1650 in itemized deductions from charitable contributions. Solve His gross income is $ Tax Rate Single 10% up to $9325 15% up to $37,950 25% up to $91,900 28% up to $191,650 33% up to $416,700 35% up to $418,400 39.6% above $418,400 Standard deduction $6350 Exemption (per person) $4050arrow_forward

- Sally McKrachen is a single young professional with a gross income of $51,000. Sally has no adjustments to gross income, but she does have itemized deductions totaling $4,275. If personal exemptions for the year are $3,700 each and the standard deduction is $5,800, what is Sally's taxable income? a. $ 37,225 b. $43,028 c. $47,300 d. $ 41,500arrow_forward( explain all option with proper Correct answer. )arrow_forwardIn 2022, Miranda records net earnings from self-employment of $102,000. She has no other income. Determine the amount of Miranda's self-employment tax. $15,825.10 $15,606.00 $14,412.14 $11,680.43 $12,325.54 $15,300arrow_forward

- Jan, a single taxpayer, has adjusted gross income of $250,000, medical expenses of $10,000, home mortgage interest of $3,000, and property taxes of $2,000. View the standard deduction amounts. Requirement Should she itemize or claim the standard deduction? ... Select the labels and enter the amounts to calculate total itemized deductions. Then enter the standard deduction allowed. (Complete all input fields. Enter a "0" for amounts with a zero balance. Assume the tax year is 2023.) Itemized deductions Total itemized deductionsarrow_forwardKaren is single. Last year she earned $36,300 in wages. Additional tax information for the year is as follows:interest earned: $125; capital gains from sale of stock: $1,650; penalty on early withdrawal of savings: $300;contributions to Keogh retirement fund: $1,900; real estate taxes paid: $3,000; mortgage interest paid: $3,100.Find the taxable income for the year. Group of answer choices $26,075 $35,275 $29,175 $37,475arrow_forwardKamryn Brown is single and earns $50,000 in taxable income and will use the following tax rate schedule to calculate the taxes he owes. 0-10,275 10% 10,276-41,775 12% 41,776-89,075 22% 89,076-170,050 24% Calculate the dollar amount of taxes that Kamryn owes. Select one: O a. $2,737.66 O b. $6,616.66 O c. $10,000.00 O d. $17,587.66 O e. $11,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT