Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Calculate the net income for the firm. General accounting

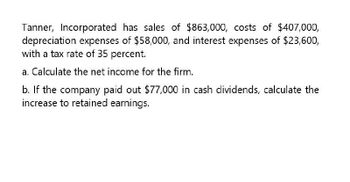

Transcribed Image Text:Tanner, Incorporated has sales of $863,000, costs of $407,000,

depreciation expenses of $58,000, and interest expenses of $23,600,

with a tax rate of 35 percent.

a. Calculate the net income for the firm.

b. If the company paid out $77,000 in cash dividends, calculate the

increase to retained earnings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardChasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital expenditures of $112,900, cash dividends of $35,800, and average maturities of long-term debt over the next 5 years of $122,300. What is Chasses free cash flow and cash flow adequacy ratio? a. $94,300 and 0.77, respectively c. $130,100 and 1.06, respectively b. $94,300 and 0.82, respectively d. $165,900 and 1.36, respectivelyarrow_forwardBurner, Incorporated has sales of 1,250,000, costs of 620,000, depreciation expenses of 85,000, and interest expenses of 34,000, with a tax rate of 30 percent. a. Calculate the net income for the firm. b. If the company paid out $90,000 in cash dividends, calculate the increase to retained earnings.need answerarrow_forward

- Burner, Incorporated has sales of 1,250,000, costs of 620,000, depreciation expenses of 85,000, and interest expenses of 34,000, with a tax rate of 30 percent. a. Calculate the net income for the firm. b. If the company paid out $90,000 in cash dividends, calculate the increase to retained earnings.arrow_forwardA firm has the following accounts.: Sales = $10,346,000; Cost of goods sold = $6,005,000; Addition to retained earnings = $225,000; Dividends paid to stockholders = $225,000; Interest expense = $1,500,000. The firm's tax rate is 21%. What is the firm's annual depreciation expense? O $2,271,380 $2,469,099 O $4,341,000 $2,069,620arrow_forwardCalculate the increase to retained earningsarrow_forward

- Lifeline, Inc., has sales of $830,362, costs of $376,820, depreciation expense of $39,240, interest expense of $35,120, and a tax rate of 30 percent. What is the net income for this firm? (Hint: Build the Income Statement)arrow_forwardVinubhaiarrow_forwardPlease answer general accountingarrow_forward

- Ansarrow_forwardYou are given the following information for Company A.: sales = $73,900; costs = $54,100; addition to retained earnings = $5,700; dividends paid = $2,780; interest expense = $2,490; tax rate = 21 percent. What is Depreciation Expense for company Calculate the depreciation expense for the company.arrow_forwardGreen Grass, Inc., has sales of $573,000, costs of $284,000, depreciation expense of $32,000, interest expense of $13,000, and a tax rate of 32 percent. (Do not include the dollar sign ($).) If the firm paid out $55,000 in cash dividends, the addition to retained earnings is $ _____ .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning