Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer general accounting

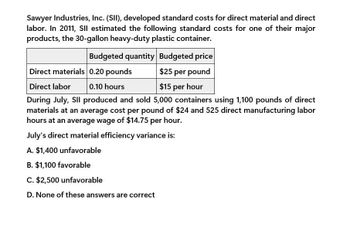

Transcribed Image Text:Sawyer Industries, Inc. (SII), developed standard costs for direct material and direct

labor. In 2011, SII estimated the following standard costs for one of their major

products, the 30-gallon heavy-duty plastic container.

Budgeted quantity Budgeted price

Direct materials 0.20 pounds

Direct labor

0.10 hours

$25 per pound

$15 per hour

During July, Sll produced and sold 5,000 containers using 1,100 pounds of direct

materials at an average cost per pound of $24 and 525 direct manufacturing labor

hours at an average wage of $14.75 per hour.

July's direct material efficiency variance is:

A. $1,400 unfavorable

B. $1,100 favorable

C. $2,500 unfavorable

D. None of these answers are correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Krouse Company produces two products, forged putter heads and laminated putter heads, which are sold through specialty golf shops. The company is in the process of developing itsoperating budget for the coming year. Selected data regarding the companys two products areas follows: Manufacturing overhead is applied to units using direct labor hours. Variable manufacturing overhead Ls projected to be 25,000, and fixed manufacturing overhead is expected to be15,000. The estimated cost to produce one unit of the laminated putter head is: a. 42. b. 46. c. 52. d. 62.arrow_forwardJameson Company produces paper towels. The company has established the following direct materials and direct labor standards for one case of paper towels: During the first quarter of the year, Jameson produced 45,000 cases of paper towels. The company purchased and used 135,700 pounds of paper pulp at 0.38 per pound. Actual direct labor used was 91,000 hours at 12.10 per hour. Required: 1. Calculate the direct materials price and usage variances. 2. Calculate the direct labor rate and efficiency variances. 3. Prepare the journal entries for the direct materials and direct labor variances. 4. Describe how flexible budgeting variances relate to the direct materials and direct labor variances computed in Requirements 1 and 2.arrow_forwardJoyT Company manufactures Maxi Dolls for sale in toy stores. In planning for this year, JoyT estimated variable factory overhead of 600,000 and fixed factory overhead of 400,000. JoyT uses a standard costing system, and factory overhead is allocated to units produced using standard direct labor hours. The level of activity budgeted for this year was 10,000 direct labor hours, and JoyT used 10,300 actual direct labor hours. Based on the output accomplished during this year, 9,900 standard direct labor hours should have been used. Actual variable factory overhead was 596,000, and actual fixed factory overhead was 410,000 for the year. Based on this information, the variable factory overhead controllable variance for JoyT for this year was: a. 24,000 unfavorable. b. 2,000 unfavorable. c. 4,000 favorable. d. 22,000 favorable.arrow_forward

- Lean accounting Dashboard Inc. manufactures and assembles automobile instrument panels for both eCar Motors and Greenville Motors. The process consists of a lean product cell for each customers instrument assembly. The data that follow concern only the eCar lean cell. For the year, Dashboard Inc. budgeted the following costs for the eCar production cell: Dashboard Inc. plans 2,000 hours of production for the eCar cell for the year. The materials cost is 240 per instrument assembly. Each assembly requires 24 minutes of cell assembly time. There was no April 1 inventory for either Raw and In Process Inventory or Finished Goods Inventory. The following summary events took place in the eCar cell during April: A. Electronic parts and wiring were purchased to produce 450 instrument assemblies in April. B. Conversion costs were applied for the production of 400 units in April. C. 380 units were started, completed, and transferred to finished goods in April. D. 350 units were shipped to customers at a price of 800 per unit. Instructions 1. Determine the budgeted cell conversion cost per hour. 2. Determine the budgeted cell conversion cost per unit. 3. Journalize the summary transactions (a) through (d). 4. Determine the ending balance in Raw and In Process Inventory and Finished Goods Inventory. 5. How does the accounting in a lean environment differ from traditional accounting?arrow_forwardBusiness Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per pound of direct materials is 1.60. The standard rate for labor is 8.00. Overhead is applied on the basis of direct labor hours. A plantwide rate is used. Budgeted overhead for the year is as follows: The company expects to work 12,000 direct labor hours during the year; standard overhead rates are computed using this activity level. For every small stapler produced, the company produces two regular staplers. Actual operating data for the year are as follows: a. Units produced: small staplers, 35,000; regular staplers, 70,000. b. Direct materials purchased and used: 56,000 pounds at 1.5513,000 for the small stapler and 43,000 for the regular stapler. There were no beginning or ending direct materials inventories. c. Direct labor: 14,800 hours3,600 hours for the small stapler and 11,200 hours for the regular stapler. Total cost of direct labor: 114,700. d. Variable overhead: 607,500. e. Fixed overhead: 350,000. Required: 1. Prepare a standard cost sheet showing the unit cost for each product. 2. Compute the direct materials price and usage variances for each product. Prepare journal entries to record direct materials activity. 3. Compute the direct labor rate and efficiency variances for each product. Prepare journal entries to record direct labor activity. 4. Compute the variances for fixed and variable overhead. Prepare journal entries to record overhead activity. All variances are closed to Cost of Goods Sold. 5. Assume that you know only the total direct materials used for both products and the total direct labor hours used for both products. Can you compute the total direct materials and direct labor usage variances? Explain.arrow_forwardAdam Corporation manufactures computer tables and has the following budgeted indirect manufacturing cost information for the next year: If Adam uses the step-down (sequential) method, beginning with the Maintenance Department, to allocate support department costs to production departments, the total overhead (rounded to the nearest dollar) for the Machining Department to allocate to its products would be: a. 407,500. b. 422,750. c. 442,053. d. 445,000.arrow_forward

- Douglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred: Marston applies overhead using rates based on direct labor hours, machine hours, number of moves, and number of batches. The second level of activity (the right column in the preceding table) is the practical level of activity (the available activity for resources acquired in advance of usage) and is used to compute predetermined overhead pool rates. Required: 1. Prepare a performance report for Marstons manufacturing costs in the current year. 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost. 3. One of Marstons managers said the following: Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at 10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of 30,000 per year. Also, I know that fuel costs about 0.25 per move. Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)arrow_forwardLean accounting Modern Lighting Inc. manufactures lighting fixtures, using lean manufacturing methods. Style Omega has a materials cost per unit of 16. The budgeted conversion cost for the year is 308,000 for 2,200 production hours. A unit of Style Omega requires 18 minutes of cell production time. The following transactions took place during June: 1. Materials were acquired to assemble 620 Style Omega units for June. 2. Conversion costs were applied to 620 Style Omega units of production. 3. 600 units of Style Omega were completed in June. 4. 580 units of Style Omega were sold in June for 100 per unit. A. Determine the budgeted cell conversion cost per hour. B. Determine the budgeted cell conversion cost per unit. C. Journalize the summary transactions (1)(4) for June.arrow_forwardGenent Industries, Inc. (GII), developed standard costs for direct material and direct labor. In 2015, GII estimated the following standard costs for one of their major products, the 30-gallon heavy-duty plastic container. Budgeted quantity Budgeted price Direct materials 0.30 pounds $20 per pound Direct labor 0.20 hours $12 per hour During July, GII produced and sold 3,000 containers using 1,000 pounds of direct materials at an average cost per pound of $19 and 625 direct manufacturing labor hours at an average wage of $11.75 per hour. The direct material price variance during July is ________. The direct material usage (quantity) variance during July is ________.arrow_forward

- Genent Industries, Inc. (GII), developed standard costs for direct material and direct labor. In 2015, GII estimated the following standard costs for one of their major products, the 30-gallon heavy-duty plastic container. Budgeted quantity Budgeted price Direct materials 0.30 pounds $20 per pound Direct labor 0.20 hours $12 per hour During July, GII produced and sold 3,000 containers using 1,000 pounds of direct materials at an average cost per pound of $19 and 625 direct manufacturing labor hours at an average wage of $11.75 per hour. The direct manufacturing labor flexible-budget variance during July is ________.arrow_forwardCenent Industries, Inc. (GII), developed standard costs for direct material and direct labor, In 2017, GII estimated the following standard costs for one of their major products, the 30- gallon heavy -duty plastic container. Budgeted quantity Budgeted price $20 per pound Direct materials 0.40 pounds Direct labor 0.80 hours $15 per hour During July, Gl produced and sold 4,000 containers using 1,700 pounds of direct materials at an average cost per pound of $15 and 3,225 direct manufacturing labor hours at an average wage of $15.25 per hour. The direct material price variance during July is OA $2,000 unfavorable OB. $20,000 unfavorable OC. $8,500 unfavorable O D. S8,500 favorable Calculator Next MacBook Pro esc ) %23 4. 7. 8 delete Y U D F H K %#3arrow_forwardGenent Industries, Inc. (GII), developed standard costs for direct material and direct labor. In 2017, GII estimated the following standard costs for one of their major products, the 30−gallon heavy−duty plastic container. Budgeted quantity Budgeted price Direct materials 0.40 pounds $50 per pound Direct labor 0.50 hours $11 per hour During July, GII produced and sold 4,000 containers using 1,750 pounds of direct materials at an average cost per pound of $48 and 2,090 direct manufacturing labor hours at an average wage of $11.30 per hour. The direct manufacturing labor efficiency variance during July is ________.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning