Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Assignment question 3.6 financial accounting

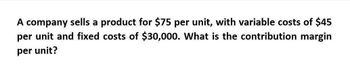

Transcribed Image Text:A company sells a product for $75 per unit, with variable costs of $45

per unit and fixed costs of $30,000. What is the contribution margin

per unit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate the per-unit contribution margin of a product that has a sale price of $200 if the variable costs per unit are $65.arrow_forwardSuppose that a company has fixed costs of $11 per unit and variable costs $6 per unit when 11,000 units are produced. What are the fixed costs per unit when 20,000 units are produced?arrow_forwardA company sells its products for $80 per unit and has per-unit variable costs of $30. What is the contribution margin per unit? A. $30 B. $50 C. $80 D. $110arrow_forward

- A product has a sales price of $230 and a per-unit contribution margin of $115. What is the contribution margin ratio? Contribution margin ratio fill in the blank 1%arrow_forwardWhat isbthe overall contribution margin ratio ?arrow_forwardWhat is the unit contribution margin of this general accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College