On January 1, 2023, Gomez Company acquired 90 percent of Martin Company’s outstanding stock for $756,720. The 10 percent noncontrolling interest had an assessed fair value of $84,080 on that date. Martin's acquisition-date book value consisted of $306,000 common stock and $446,000

Also on January 1, 2023, Martin acquired an 80 percent interest in Short Company for $351,800. At the acquisition date, the 20 percent noncontrolling interest fair value was $87,950. Short's acquisition-date book value consisted of $203,000 common stock and $183,000 retained earnings. Any excess fair value was attributed to a fully amortized copyright that had a remaining life of 5 years. Martin uses the equity method to account for its investment in Short. Reported separate net income (before inclusion of equity method income) totals for 2023 follow:

| Martin Company | $ 178,600 |

|---|---|

| Short Company | 124,800 |

The following are the 2024 financial statements for these three companies (credit balances indicated by parentheses). Short has transferred inventory to Martin since the takeover amounting to $76,000 (2023) and $86,000 (2024). These transactions include the same markup applicable to Short’s outside sales. In each year, Martin carried 20 percent of this inventory into the succeeding year before disposing of it. An effective tax rate of 21 percent is applicable to all companies. All dividend declarations are paid in the same period.

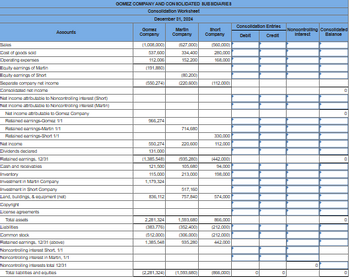

| Accounts | Gomez Company | Martin Company | Short Company |

|---|---|---|---|

| Sales | $ (1,008,000) | $ (627,000) | $ (560,000) |

| Cost of goods sold | 537,600 | 334,400 | 280,000 |

| Operating expenses | 112,006 | 152,200 | 168,000 |

| Equity income of Martin | (191,880) | 0 | 0 |

| Equity income of Short | 0 | (80,200) | 0 |

| Net income | $ (550,274) | $ (220,600) | $ (112,000) |

| Retained earnings, 1/1/24 | $ (966,274) | $ (714,680) | $ (330,000) |

| Net income (above) | (550,274) | (220,600) | (112,000) |

| Dividends declared | 131,000 | 0 | 0 |

| Retained earnings, 12/31/24 | $ (1,385,548) | $ (935,280) | $ (442,000) |

| Cash and receivables | $ 121,500 | $ 105,680 | $ 94,000 |

| Inventory | 115,000 | 213,000 | 198,000 |

| Investment in Martin Company | 1,179,324 | 0 | |

| Investment in Short Company | 0 | 517,160 | 0 |

| Land, buildings, and equipment (net) | 836,112 | 757,840 | 574,000 |

| Total assets | $ 2,281,324 | $ 1,593,680 | $ 866,000 |

| Liabilities | $ (383,776) | $ (352,400) | $ (212,000) |

| Common stock | (512,000) | (306,000) | (212,000) |

| Retained earnings, 12/31/24 | (1,385,548) | (935,280) | (442,000) |

| Total liabilities and equities | $ (2,281,324) | $ (1,593,680) | $ (866,000) |

-

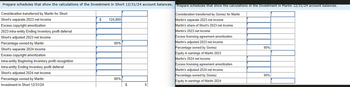

a1. Prepare schedules that show the calculations of the Investment in Short 12/31/24 account balances.

-

a2. Prepare schedules that show the calculations of the Investment in Martin 12/31/24 account balances.

-

b. Prepare the business combination’s 2024 consolidation worksheet; ignore income tax effects.

Step by stepSolved in 2 steps

- Prepare schedules that show the calculations of the Investment in Short 12/31/24 account balances. Consideration transferred by Martin for Short Short's separate 2023 net income Excess copyright amortization 2023 intra-entity Ending Inventory profit deferral Short's adjusted 2023 net income Percentage owned by Martin Short's separate 2024 income Excess copyright amortization Intra-entity Beginning Inventory profit recognition Intra-entity Ending Inventory profit deferral Short's adjusted 2024 net income Percentage owned by Martin Investment in Short 12/31/24 $ 124,800 80% 80% SA 0arrow_forwardJOURNAL ENTRIES FOR CULVER COMPANY (a) Adjusting entries for 2020 (in$) 31/12/2020 Revenue Account Dr. 9800 To Provision for depreciation Account 9800 (Being market value of Gordon inc. and Wallace corporat. depreciated ) 31/12/2020 Investment in Martin inc. a/c Dr. 1800 To Unrealised Appreciation Reserve a/c 1800 (Being market value of Martin inc.appreciated) (b) sale of Gordon stock journal entry 1/03/2021 Bank a/c Dr. 66300 Loss on disposal of investment alc Dr. 1400 To Investment in Gordon inc a/c…arrow_forwardPrepare the necessary joumal entries for the following fiscal year 2022 transactions made by Airflowing Corp. Additional Information: 1 Ai rflowing Corp. year-end is 12/31. 2 Assume straight-line amortization of discounts. 3 Ai rflowing Corp. records all purchases and payables at gross. Description Date February 2, 2022 Aiflowing Corp. purchased goods from Vents Inc for $ 250,00 ( 3/ 10, n 30 terms were February 26, 2022 Airfbwing Corp. paid Vents inc. for the 2/2/22 purchase. June 1, 2022 Arfbwing Corp. purchased a truck for $ 85,000 from Ford Mator Company Fleet Sales Division. The sales agreement call for Airfbwing Corp. to pay 10,000 on purchase date and to sign a 1-year, 10% note forthe remaning balance of the purchase price. July 1, 2022 Arfbwing Corp. borrowed from St. Paul Nat ibnalBank $ 3500,0 by signing a $ 3,700,000 zero-interest be aring note due one year from July 1 Airflowing Corp.s CFO has concerns re bted to cash the frst quarter of 2023.arrow_forward

- 1. The following information is from Direct to You Corp.’s (DYC) financial records for its year ended December 31, 2020: Select statement of financial position information: 2020 2019 Investments in financial assets (at fair value through profit or loss [FVPL]) 12,000 10,000 Inventory 575,000 498,000 Property, plant, and equipment (PPE) 1,984,000 1,396,000 Less: accumulated depreciation (650,400) (487,000) Copyright 126,000 135,000 Patents 564,000 417,000 Select statement of comprehensive income information: Depreciation of property, plant, and equipment (334,400) Amortization of patents (65,000) Interest expense (75,000) Impairment loss — copyright (9,000) Gain on sale of PPE 23,000 Additional information: PPE that originally cost $570,000 was sold during the year. 100,000 common shares were issued in 2020 to acquire $450,000 of property, plant, and equipment. DYC is subject to IFRS. What amount of net cash used…arrow_forwardPlease provide answer the following requirements a and b on these financial accounting questionarrow_forwardYou are required to calculate:1. Liquidity ratios 2. Solvency rations 3. Profitability ratios For the selected companies and shortly write your comments and findings.arrow_forward

- Compute RNOA with Disaggregation Refer to the balance sheet information below for Home Depot. Jan. 28, Feb. 3, 2019 2018 $14,357 $13,918 Operating assets Nonoperating assets Total assets Operating liabilities Nonoperating liabilities Total liabilities Net sales Operating expense before tax Net operating profit before tax (NOPBT) Other expense Income before tax Tax expense Net income $ millions NOPAT $ Numerator a. Compute return on net operating assets (RNOA). Assume a statutory tax rate of 22%. Note: 1. Select the appropriate numerator and denominator used to compute RNOA from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute 2018 RNOA. RNOA Numerator Average NOA $ Numerator Net income $ 605 1,222 $14,962 $15,140 $5,671 $5,456 9,929 9,190 $15,600 $14,646 $36,789 31,509 ◆ Average NOA x S ♦ OPAT x S 5,280 331 4,949 1,168 $3,781 b. Disaggregate RNOA into components of profitability (NOPM) and productivity (NOAT). Assume a statutory tax rate of 22%.…arrow_forwardLocate and download Gap Inc.’s 2020 Annual Report (for fiscal year 2/2/20-1/30/21) https://investors.gapinc.com/financial-information/default.aspx Current Assets What is the amount of Current Assets at 1/30/21? What is the amount of Inventories at 1/30/21? What valuation principle does Gap use to value these inventories? Which cost flow assumption does Gap use to determine the cost of inventories? Noncurrent Assets What is the amount of Noncurrent Assets at 1/30/21? What is the amount of Property and Equipment (net) held by Gap at 1/30/21? How much depreciation has been recorded on these assets at 1/30/21? What method does Gap use to calculate depreciation? 3. What is the amount of Furniture and Equipment held by Gap at 1/30/21?arrow_forwardsubject; accountingarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning