EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please give me correct answer

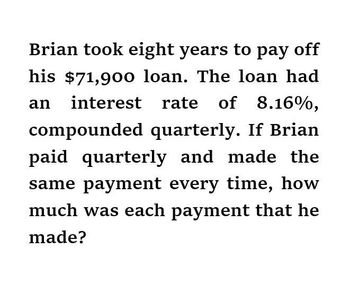

Transcribed Image Text:Brian took eight years to pay off

his $71,900 loan. The loan had

an interest rate of 8.16%,

compounded quarterly. If Brian

paid quarterly and made the

same payment every time, how

much was each payment that he

made?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please Need helparrow_forwardPrisha received a loan of $8,100 at 5.25% compounded monthly. He settled the loan by making periodic payments at the end of every three months for 6 years, with the first payment made 3 years and 3 months from now. What was the size of the periodic payments? $ 0.00 Round to the nearest centarrow_forwardJohn received a loan of $40,500, 6 years ago. The interest rate charged on the loan was 4.68% compounded quarterly for the first 6 months, 5.46% compounded semi-annually for the next 2 years, and 5.88% compounded monthly thereafter. a. Calculate the accumulated value of the loan at the end of the first 6 months. Round to the nearest cent b. Calculate the accumulated value of the loan at the end of the next 2 year period. Round to the nearest cent c. Calculate the accumulated value of the loan today. Round to the nearest cent d. Calculate the amount of interest charged on this loan over the past 6 years. jamie wants to double his money in 9 years in an investment fund. What quarterly compounding interest rate do you suggest that he looks for?arrow_forward

- Josiah took out a 25-year loanfor $215,000 at 9.6% interest,compounded monthly. If hismonthly payment on the loan is$1893.41, how much of his firstpayment went toward notereduction?arrow_forwardTom Bond borrowed $6,200 at 6,% for three years compounded annually. What is the compound amount of the loan and how much interest will he pay on the loan? Compound amount = S (Round to the nearest cent as needed.)arrow_forwardJimmy paid off a mortgage by paying $700 per month for 12 years. What was the original amount of the mortgage if the interest rate charged was 4.30% compounded semi-annually? Round to the nearest centarrow_forward

- 1) Alisha invests 5,000 into an account. The effective monthly interest rate is .25% for the first six months, .5% for the next year, and .75% for the next six months. Find the amount Alisha has in the account after two years, and find the average compound monthly interest rate (i.e. the equivalent effective monthly interest rate) for the two year period. Finally, find the average yearly interest rate (i.e. the equivalent effective annual interest rate) for the two year period.arrow_forward6 Keane just borrowed $38,700 for 5 years at an interest rate of 5.9 percent, compounded monthly. What is the amount of each monthly loan payment?arrow_forwardTom Bond borrowed $6,600 at 6-% for three years compounded annually. What is the compound amount of the loan and how much interest will he pay on the loan? Compound amount = $ (Round to the nearest cent as needed.) Compound interest = $ (Round to the nearest cent as needed.)arrow_forward

- Three years ago, ZYX deposited $2,590 in an account that has earned and will earn 8.60 percent per year in compound interest. If CAB deposits $3,690 in an account in 2 years from today that earns simple interest, then how much simple interest per year must CAB earn to have the same amount of money in 6 years from today as ZYX will have in 6 years from today? Answer as an annual rate. 19.32% (plus or minus .05 percentage points) 11.87% (plus or minus .05 percentage points) 3.79% (plus or minus .05 percentage points) 2.52% (plus or minus .05 percentage points) None of the above is within .05 percentage points of the correct answerarrow_forwardBrody borrowed from a bank at 5.06% compounded monthly; he settled the loan by repaying $4,460 at the end of every month for 2 years. a) What was the amount of loan received? $ b) What was the amount of interest charged?arrow_forwardCorey received a $36,750 loan from a bank that was charging interest at 3.50% compounded semi-annually. a. How much does he need to pay at the end of every 6 months to settle the loan in 3 years? b. What was the amount of interest charged on the loan over the 3-year period?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you