EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Hi expart Provide solution

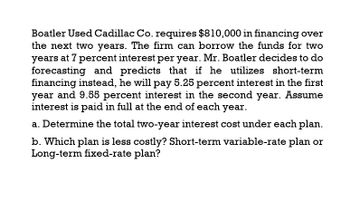

Transcribed Image Text:Boatler Used Cadillac Co. requires $810,000 in financing over

the next two years. The firm can borrow the funds for two

years at 7 percent interest per year. Mr. Boatler decides to do

forecasting and predicts that if he utilizes short-term

financing instead, he will pay 5.25 percent interest in the first

year and 9.55 percent interest in the second year. Assume

interest is paid in full at the end of each year.

a. Determine the total two-year interest cost under each plan.

b. Which plan is less costly? Short-term variable-rate plan or

Long-term fixed-rate plan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Boatler Used Cadillac Co. requires $870,000 in financing over the next two years. The firm can borrow the funds for two years at 9 percent interest per year. Ms. Boatler decides to do forecasting and predicts that if she utilizes short-term financing instead, she will pay 5.75 percent interest in the first year and 10.55 percent interest in the second year. Assume interest is paid in full at the end of each year. a. Determine the total two-year interest cost under each plan. Long-term fixed-rate Short-term variable-rate b. Which plan is less costly? Interest Cost O Short-term variable-rate plan O Long-term fixed-rate planarrow_forwardBoatler Used Cadillac Company requires $980,000 in financing over the next two years. The firm can borrow the funds for two years at 10 percent interest per year. Ms. Boatler decides to do forecasting and predicts that if she utilizes short-term financing instead, she will pay 6.75 percent interest in the first year and 11.55 percent interest in the second year. Assume interest is paid in full at the end of each year. Determine the total two-year interest cost under each plan. Which plan is less costly? multiple choice Short-term variable-rate plan Long-term fixed-rate planarrow_forwardBoatler Used Cadillac Co. requires $850,000 in financing over the next two years. The firm can borrow the funds for two years at 12 percent interest per year. Ms. Boatler decides to do forecasting and predicts that if she utilizes short-term financing instead, she will pay 7.75 percent interest in the first year and 13.55 percent interest in the second year. Assume interest is paid in full at the end of each year. What is the short term variable rate?arrow_forward

- Smith borrows 21,500 to purchase a new car. The car dealer finances the purchase with a loan that will require level monthly payments at the end of each month for 4 years, starting at the end of the month in which the car is purchased (assume the car is purchased on the 1st of the month). The loan has 0% interst rate for the first year followed by 7% annual nominal interest rate, compounded monthly, for the following three years. Find the outstanding balance on the loan at the end of the first year.arrow_forwardThe Clarke family is buying a home and will select a mortgage with a 25-year amortization period, at a rate of 6% compounded semiannually for a 5-year term. The monthly mortgage payment will be their only debt payment. The family’s gross monthly income is $8,400. Property taxes are estimated at $500 per month, and heating costs at $375 per month. The bank has upper limits of 39% for GDS and 44% for TDS. What is the maximum mortgage for which the Clarkes qualify?arrow_forwardYour cousin has asked you to help him analyze the cash flows for a $40,000, 3- year loan he is considering taking out. He has two choices for structuring his payments: level principal or level payments. He has asked you to prepare an amortization schedule for each loan structure. Both loans have an APR of 7% and monthly payments. Which loan has the smaller payment in month 15?arrow_forward

- George Green wishes to invest $8000.00 that he saved from his summer job. His bank offers 3.75% for a one-year term investment or 3.5% for a six-month term. a)How much will George receive (capital plus interest) after one year if he invests at the one-year rate? Round to nearest one. b)How much will he receive (capital plus interest) after one-year if he invests for six months at a time at 3.5% each time? This means George took the interest from the first investment transaction and included it in the principal for the second transaction. Round to nearest 100th. c)What would the one-year rate have to be to yield the same amount of interest when investing for six months at a time at 3.5% each time? Give your answer as a percentage round to nearest 100th .arrow_forwardDonovan took a $46,000 loan at 3.78% compounded monthly and decided to make end of month payments of $1,413. 1) How many payments will Donovan have to make to amortize this loan? (rounded to the next higher whole number) 2) What will the size of his final payment be? (enter a positive value)arrow_forward4. Suppose Dr.Campbell has a home purchase of $145,000 at the APR of 6% for 30 years, and he have made 8 years of payments. If he decide to refinance that loan for 4%for 15 years. ) How much is his original monthly payment? -- Create an amortization schedule for the first three months for the beginning 30 years loan.arrow_forward

- Jesse borrowed $30,000. The company plans to set up a sinking fund that will repay the loan at the end of 8 years. Assume 12% interest rate compounded semiannually. What must his company pay into the fund each period of time?arrow_forwardGisella borrows $120, 000 from Capital Mortgage Co. at 9% per annum interest, monthly payments for 30 years. At the end of 6 years, she sells the house and will pay off the loan at the closing of sale (assume that the sale takes place at the end of the sixth year). What will her loan payoff be? Using excel functions only and an amortization schedule.arrow_forwardScott takes out a college loan today of $5,000 at 4.5% per year. Scott is expected to make 20 annual payments of $X at the end of each year to repay the loan, starting a year from today. But starting with the sixth payment, Scott can only pay one - quarter of $X at the end of each year. This goes on for 10 payments. The bank agrees to accumulate the unpaid balance at 4.5%. After making the 10 reduced payments, the loan is renegotiated with the bank. Calculate the revised level payment $P that will yield the bank 1% per year over the remaining 5 years of the term of the original loan.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT