Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Pls General Accounting Question Solution

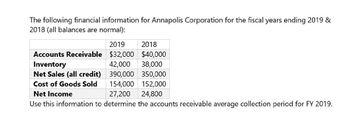

Transcribed Image Text:The following financial information for Annapolis Corporation for the fiscal years ending 2019 &

2018 (all balances are normal):

Accounts Receivable

Inventory

Net Sales (all credit)

Cost of Goods Sold

Net Income

2019

2018

$32,000 $40,000

42,000 38,000

390,000 350,000

154,000 152,000

27,200

24,800

Use this information to determine the accounts receivable average collection period for FY 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Starlight Enterprises has net credit sales for 2019 in the amount of $2,600,325, beginning accounts receivable balance of $844,260, and an ending accounts receivable balance of $604,930. Compute the accounts receivable turnover ratio and the number of days sales in receivables ratio for 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Starlight Enterprises if the industry average is 1.5 times and the number of days sales ratio is 175 days?arrow_forwardPrior to adjustments, Barrett Companys account balances at December 31, 2019, for Accounts Receivable and the related Allowance for Doubtful Accounts were 1,200,000 and 60,000, respectively. An aging of accounts receivable indicated that 106,000 of the December 31, 2019, receivables may be uncollectible. The net realizable value of accounts receivable at December 31, 2019, was: a. 1,034,000 b. 1,094,000 c. 1,140,000 d. 1,154,000arrow_forwardBerry Farms has an accounts receivable balance at the end of 2018 of $425,650. The net credit sales for the year are $924,123. The balance at the end of 2017 was $378,550. What is the number of days sales in receivables ratio for 2018 (round all answers to two decimal places)?arrow_forward

- The following information (in millions) was taken from the December 31 financial statements Accounts receivable, gross Allowance for expected credit losses Accounts receivable, net Revenues Total current assets Total current liabilities 13) Calculate the current ratio for 2020 13) 2021 $ 1.102 28 1,074 14,477 3,426 3,120 2020 $ 1.080 26 1,054 13,819 3,102 3,274 2019 $ 1.241 28 1,213 14,917 2,830 4,287arrow_forwardThe following financial information is for Annapolis Corporation for the fiscal years ending 2018 and 2019 (all balances are normal): Cost of Accounts Net Sales Net Item/Account Inventory Goods Receivable (all credit) Income Sold 2019 2018 $44,000 $42,000 $410,000 $154,000 $27,200 $34,000 $38,000 $350,000 $152,000 $24,800 Use this information to determine the accounts receivable average collection period for FY 2019. (Use 365 days a year. Round your answers to one decimal place.)arrow_forwardThe following is select financial statement information from Vortex Computing: Year Net Credit Sales Ending Accounts Receivable 2018 $1,557,200 $398,000 2019 $1,755,310 $444,400 2020 $1,865,170 $500,780 Compute the accounts receivable turnover ratios and the number of days’ sales in receivables ratios for 2019 and 2020 (round answers to two decimal places): 2019 Accounts Receivable Turnover = ["", "", "", ""] times. 2019 Days' Sales in Receivables = ["", "", "", ""] days. 2020 Accounts Receivable Turnover = ["", "", "", ""] times. 2020 Days' Sales in Receivables = ["", "", "", ""] days.arrow_forward

- The following is select financial statement information from Vortex Computing: Year Net Credit Sales Ending Accounts Receivable 2018 $1,557,200 $398,000 2019 $1,755,310 $444,400 2020 $1,865,170 $500,780 Compute the accounts receivable turnover ratios and the number of days’ sales in receivables ratios for 2019 and 2020 (round answers to two decimal places): 2019 Accounts Receivable Turnover = ["", "", "", ""] times. 2019 Days' Sales in Receivables = ["", "", "", ""] days. 2020 Accounts Receivable Turnover = ["", "", "", ""] times. 2020 Days' Sales in Receivables = ["", "", "", ""] days. What do the outcomes tell a potential investor about Vortex Computing, if 2020 industry average for accounts receivable turnover ratio is 4.00 times and days’ sales in receivables ratio is 91.25 days? It takes Vortex Computing ["", "", ""] its competitors in the industry to collect on accounts receivable. If a lender were deciding between companies,…arrow_forwardNeed Tutor Helparrow_forwardThe following information was taken from the accounts receivable records of Sarasota Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $160,000 0.5% 31 – 60 days outstanding 66,000 2.5% 61 – 90 days outstanding 40,200 4.0% 91 – 120 days outstanding 20,600 6.5% Over 120 days outstanding 5,600 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,200 prior to the adjustment (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $3,880 prior to the adjustment.arrow_forward

- Please answer the following requirements on these general accounting questionarrow_forwardVon Company had the following data relating to its Accounts Receivable: Accounts Receivable, December 31, 2019- P1,300,000 Allowance for uncollectible accounts, December 31, 2019- P25,400 2020 credit sales- P5,400,000 Collections from customers in 2020, including recoveries- P4,610,000 Accounts written-off on August 24, 2020- P125,000 Recoveries of accounts previously written off in prior years- P25,000 Estimated uncollectible receivables per aging, Dec. 31, 2020- P165,000 Von’s net accounts receivable at December 31, 2020 was A. P1,900,000 B. P1,800,000 C. P1,825,000 D. P1,850,000arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College