EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please Solve this One

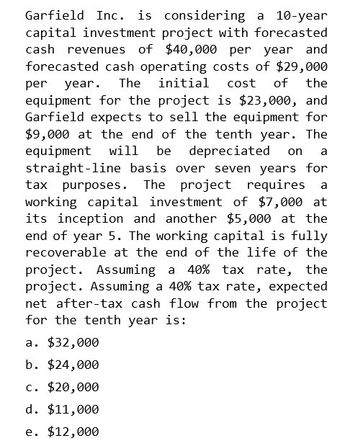

Transcribed Image Text:Garfield Inc. is considering a 10-year

capital investment project with forecasted

cash revenues of $40,000 per year and

forecasted cash operating costs of $29,000

per year. The initial cost of the

equipment for the project is $23,000, and

Garfield expects to sell the equipment for

$9,000 at the end of the tenth year. The

equipment will be depreciated on a

straight-line basis over seven years for

tax purposes. The project requires a

working capital investment of $7,000 at

its inception and another $5,000 at the

end of year 5. The working capital is fully

recoverable at the end of the life of the

project. Assuming a 40% tax rate, the

project. Assuming a 40% tax rate, expected

net after-tax cash flow from the project

for the tenth year is:

a. $32,000

b. $24,000

c. $20,000

d. $11,000

e. $12,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Markoff Products is considering two competing projects, but only one will be selected. Project A requires an initial investment of $42,000 and is expected to generate future cash flows of $6,000 for each of the next 50 years. Project B requires an initial investment of $210,000 and will generate $30,000 for each of the next 10 years. If Markoff requires a payback of 8 years or less, which project should it select based on payback periods?arrow_forwardJasmine Manufacturing is considering a project that will require an initial investment of $52,000 and is expected to generate future cash flows of $10,000 for years 1 through 3, $8,000 for years 4 and 5, and $2,000 for years 6 through 10. What is the payback period for this project?arrow_forwardRedbird Company is considering a project with an initial investment of $265,000 in new equipment that will yield annual net cash flows of $45,800 each year over its seven-year life. The companys minimum required rate of return is 8%. What is the internal rate of return? Should Redbird accept the project based on IRR?arrow_forward

- Gardner Denver Company is considering the purchase of a new piece of factory equipment that will cost $420,000 and will generate $95,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further Instructions on internal rate of return in Excel, see Appendix C.arrow_forwardConsolidated Aluminum is considering the purchase of a new machine that will cost $308,000 and provide the following cash flows over the next five years: $88,000, 92,000, $91,000, $72,000, and $71,000. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forwardManzer Enterprises is considering two independent investments: A new automated materials handling system that costs 900,000 and will produce net cash inflows of 300,000 at the end of each year for the next four years. A computer-aided manufacturing system that costs 775,000 and will produce labor savings of 400,000 and 500,000 at the end of the first year and second year, respectively. Manzer has a cost of capital of 8 percent. Required: 1. Calculate the IRR for the first investment and determine if it is acceptable or not. 2. Calculate the IRR of the second investment and comment on its acceptability. Use 12 percent as the first guess. 3. What if the cash flows for the first investment are 250,000 instead of 300,000?arrow_forward

- The Rodriguez Company is considering an average-risk investment in a mineral water spring project that has an initial after-tax cost of 170,000. The project will produce 1,000 cases of mineral water per year indefinitely, starting at Year 1. The Year-1 sales price will be 138 per case, and the Year-1 cost per case will be 105. The firm is taxed at a rate of 25%. Both prices and costs are expected to rise after Year 1 at a rate of 6% per year due to inflation. The firm uses only equity, and it has a cost of capital of 15%. Assume that cash flows consist only of after-tax profits because the spring has an indefinite life and will not be depreciated. a. What is the present value of future cash flows? (Hint: The project is a growing perpetuity, so you must use the constant growth formula to find its NPV.) What is the NPV? b. Suppose that the company had forgotten to include future inflation. What would they have incorrectly calculated as the projects NPV?arrow_forwardCaduceus Company is considering the purchase of a new piece of factory equipment that will cost $565,000 and will generate $135,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return In Excel, see Appendix C.arrow_forwardGarnette Corp is considering the purchase of a new machine that will cost $342,000 and provide the following cash flows over the next five years: $99,000, $88,000, $92,000. $87,000, and $72,000. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return in Excel. see Appendix C.arrow_forward

- Garfield Inc. is considering a 10-year capital investment project with forecasted revenues of $40,000 per year and forecasted cash operating expenses of $29,000 per year. The initial cost of the equipment for the project is $23,000, and Garfield expects to sell the equipment for $9,000 at the end of the tenth year. The equipment will be depreciated over 7 years. The project requires a working capital investment of $7,000 at its inception and another $5,000 at the end of year 5. Assuming a 40% marginal tax rate, the expected net cash flow from the project in the tenth year is (D) * A. $32,000 B. $24,000 C. $20,000 D. $11,000arrow_forwardWater's Edge Resorts is evaluating a project that would require an initial investment in equipment of $498,000.00 and that is expected to last for 4 years. MACRS depreciation would be used where the depreciation rates in years 1, 2, 3, 4, and 5 are 25%, 45%, 15%, 10, and 5%, respectively. For each year of the project, Water's Edge Resorts expects relevant annual revenue associated with the project to be $644000.00 and relevant annual costs associated with the project to be $479000.00. The tax rate is 44.00 percent. What is (X plus Y) if X is the relevant operating cash flow (OCF) associated with the project expected in year 1 of the project and Y is the relevant OCF associated with the project expected in year 4 of the project? $191,004.00 (plus or minus $10) O $261,492.00 (plus or minus $10) $294,360.00 (plus or minus $10) $103,356.00 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forwardMonroe Printing is evaluating the pamphlet project. The project would require an initial investment of $73,300.00 that would be depreciated to $12,300.00 over 4 years using straight-line depreciation. The first annual operating cash flow of $18,000.00 is expected in 1 year, and annual operating cash flows of $18,000.00 are expected each year forever. Monroe Printing expects the project to have an after-tax terminal value of $108,700.00 in 3 years. The tax rate is 22.80%. What is X, the project's relevant expected cash flow for NPV analysis in year 3? $83,916.40 (plus or minus $10) $108,700.00 (plus or minus $10) $101,916.40 (plus or minus $10) $126,700.00 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,