ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

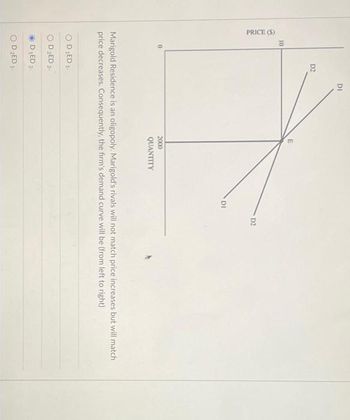

Transcribed Image Text:PRICE (S)

10

0

D2

DI

OD LED 1.

D₂ED 2-

D₁ED 2.

OD ₂ED 1¹

2000

QUANTITY

DI

D2

Marigold Residence is an oligopoly. Marigold's rivals will not match price increases but will match

price decreases. Consequently, the firm's demand curve will be (from left to right)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Refer to the table below to answer the following questions. Table 14.2.10 Fim A Comply A: Sim Cheat A $1 Sm Comply B Sim B-S05m Firm B A:-50.5m A0 Cheat B $15m B:0 Refer to Table 14.2.10. Firm A and Firm B are the only producers of soap powder. They collude and agree to share the market equally. The equilibrium a dominant strategy equilibrium because the strategy in this game is for a firm Select one O A is to comply regardless of the other firm's choice O B.is to comply when the other firm cheats and to cheat when the other firm complies O Cis not to comply when the other firm complies and to cheat when the other firm cheats OD. is to cheat regardless of the other firm's choice OEis not to comply when the other firm cheats and to cheat when the other firm complies 219 PMarrow_forward1. Write a sentence or two defining the following terms in your own words. Give examples of each. s. Oligopoly t. Induced u. Inelastic Demandarrow_forwardThe graph shows the demand curve for cars in 2017. Suppose that the least-possible cost of producing a car is $10,000 and that the efficient scale is 10,000 cars a month. Draw the average total cost curve for a car manufacturer in 2017. Label it. The graph shows that the market for cars is a natural oligopoly with O A. 1 firm OB. 2 firms OC. 3 firms OD. 4 firms 50,000- 40,000- 30,000- 20,000- 10,000- 0- Price (dollars per car) 0 D 30 Quantity (thousands of cars per month) >>> Draw only the objects specified in the question. 50 Qarrow_forward

- 4arrow_forwardRainbow Wer-Odeon Bargaining Game Rainbow Reeder Rep S O St O O PH M Rainbow Writer (RW) is a small online company selling a highly rated software package for printing color labels directly onto CDs. The firm currently earns a profit of $2 million per year selling its package exclusively on its Web site. Odeon, the producer of the most popular software package for editing and burning CDs and DVDs has expressed interest in bundling Rainbow Writer's product into its own package. Odeon expects that bundling would further boost its sales and allow it to sell the new bundled product at a higher price, thus raising its profits beyond its current profit of $12 million. Figure 5 shows the decision tree for the Rainbow Writer-Odeon bargaining game. Refer to Figure 5. How will Rainbow Writer respond to Odeon's two possible offers? O Rainbow Writer will only accept an offer of $40 per copy of the software package. O Rainbow Writer will only accept an offer of $30 per copy of the software package.…arrow_forward45arrow_forward

- Suppose that in the market for cell phone service the number of competitors has dwindled until D & C Romer Net and Spa T. Wireless have become the only providers left in the nation. Seeking to boost their profits, the two companies secretly agree to a coordinated increase in their prices for cell phone minutes. This practice is known as a Nash equilibrium. O tying. collusion. antitrust. predatory pricing.arrow_forwardOnly typed answerarrow_forwardConsider two Cournot oligopolists, firm 1 and firm 2, in a homogenous product market. The market demand is P = 100 - 3Q and each firm has a constant marginal cost MC=10. The market price of equilibrium and total quantity in the market is: Select one: O a. P* 30 and Q* = 20 O b. P* 40 and Q* = 20 ○ C. P* 40 and Q* = 30 d. P20 and Q* = 30arrow_forward

- 5. Duopolist firms 1 and 2 compete on price with some market differentiation. Demand for firm ie{1, 2} is q, = 2 – 2p, + p, Neither firm has costs. a. Find the best response functions for each firm in the static game. b. Find the unique Nash equilibrium prices in the static game. c. Are prices strategic complements or strategic substitutes? Briefly explain. d. Does Firm 1 want Firm 2 to increase or decrease p,?arrow_forwardFirm x is and oligopoly market. Market demand is inelastic, so this firm can increase profit by rasing prices. However, if it does so, it might lose sales to its competitors. How can this frim use price signaling to increase its profits?arrow_forward3. Demand for a good produced by a duopoly is given by P = 100 - Q. Both firms have constant marginal costs, MC = 20 and zero fixed costs. Firms can choose to maximize profit or revenue. Suppose firm 1 choose to maximise profit and firm 2 choose to maximise revenue. Determine the equilibrium price and quantity of each firm.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education