Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

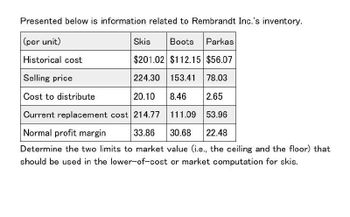

Presented below is information related to Rembrandt Inc.'s inventory. Please provide correct answer the general accounting question

Transcribed Image Text:Presented below is information related to Rembrandt Inc.'s inventory.

(per unit)

Historical cost

Selling price

Cost to distribute

Skis

Boots Parkas

$201.02 $112.15 $56.07

224.30 153.41 78.03

20.10

8.46

2.65

Current replacement cost 214.77 111.09 53.96

Normal profit margin

33.86 30.68 22.48

Determine the two limits to market value (i.e., the ceiling and the floor) that

should be used in the lower-of-cost or market computation for skis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Presented below is information related to Sheffield Inc's inventory, assuming Sheffield uses lower-of-LIFO cost-or-market. Historical cost Selling price Cost to distribute Current replacement cost Normal profit margin (per unit) Floor $ Skis $254.60 $ $ 284.08 25.46 272.02 42.88 Boots $142.04 194.30 10.72 140.70 Parkas $71.02 98.83 Determine the following: (a) The two limits to market value (i.e., the ceiling and the floor) that should be used in the lower-of-cost-or-market computation for skis. (Round answers to 2 decimal places, e.g. 52.75.) Ceiling $ 3.35 68.34 38.86 28.48 (b) The cost amount that should be used in the lower-of-cost-or-market comparison of boots. (Round answer to 2 decimal places, e.g. 52.75.) (c) The market amount that should be used to value parkas on the basis of the lower-of-cost-or-market. (Round answer to 2 decimal places, e.g. 52.75.)arrow_forwardCalculate the Lower-of-Cost-or-Market using the table below for Samson Goods, Inc. springs inventory. (1) Complete the table. Part # Cost Replacement Cost Net Realizable Value Normal Profit NRV less Normal Profit LCM SP17G $181,000 $ 152,000 $151,000 $15,000 SP23X 254,000 249,800 262,500 25,800 SP78A 205,400 214,000 206,000 10,200 Total (2) Prepare the journal entry to record the Allowance to Reduce Inventory to Market using the "Loss Method". $ $ (Record the adjustment to inventory due to decline in value)arrow_forwardPlease Provide Explanation And Don`t Give Image Formatarrow_forward

- The following information relates to CEE Company: (Refer to image). Assume that the company uses the average cost approach. What is the cost ratio? Express your answer in percentage and round up to two decimal points. * Retail Cost 500,000.00 Inventory, 12/31/2021 725,000.00 Purchases 1,285,000.00 2,220,000.00 Purchase returns 20,000.00 35,000.00 Purchase discounts 30,000.00 Sales (after employee discounts) 2,450,000.00 Sales returns 125,000.00 Sales allowances 70,000.00 Mark-ups Mark-up cancellations 160,000.00 70,000.00 Mark-down 65,000.00 Mark-down cancellations 32,000.00 Freight in Employee discounts Normal loss from breakage 65,000.00 15,000.00 10,000.00arrow_forwardThe following information is taken from a company's records. Cost Market value per Unit per Unit Inventory Item 1 (8 units) $38 $37 Inventory Item 2 (20 units) 19 19 Inventory Item 3 (13 units) 7 Applying the lower-of-cost-or-market approach, what is the correct value that should be reported on the balance sheet for the inventory? $ %24arrow_forwardPresented below is information related to Waterway Inc's inventory, assuming Waterway uses lower-of-LIFO cost-or-market. (per unit) Skis Boots Parkas Historical cost $262.20 $146.28 $73.14 Selling price 292.56 200.10 101.78 Cost to distribute 26.22 11.04 3.45 Current replacement cost 280.14 144.90 70.38 Normal profit margin 44.16 40.02 29.33 Determine the following: (a) The two limits to market value (i.e., the ceiling and the floor) that should be used in the lower-of-cost-or-market computation for skis. (Round answers to 2 decimal places, e.g. 52.75.) Ceiling $ Floor $arrow_forward

- The following information is taken from a company’s records. Costper Unit Market valueper Unit Inventory Item 1 (10 units) $40 $39 Inventory Item 2 (23 units) 20 20 Inventory Item 3 (12 units) 8 10 Applying the lower-of-cost-or-market approach, what is the correct value that should be reported on the balance sheet for the inventory?arrow_forwardThe following information is taken from a company’s records. Costper Unit Market valueper Unit Inventory Item 1 (10 units) $39 $38 Inventory Item 2 (22 units) 19 19 Inventory Item 3 (12 units) 9 11 Applying the lower-of-cost-or-market approach, what is the correct value that should be reported on the balance sheet for the inventory? $fill in the blank 1arrow_forwardOn the basis of the data shown below: Item InventoryQuantity Cost perUnit Market Value per Unit(Net Realizable Value) Raven 10 1,700 $163 $159 Dove 23 9,200 24 30 Determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item, as shown in Exhibit 9.$______arrow_forward

- Smmons. Inc. uses the lower-of-cont-ormarket method to value s inventory that is accounted for using the FIFO method. Data regarding an tam in its inventory ls as follows Cost $26 Replacement cost 20 Selling price 30 Cost of completion and disposal 2 Normal profit margin 7. What is the lower-of-cost-or-mariket for this item?arrow_forwardLower-of-Cost-or-Market InventoryOn the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 9. ProductInventoryQuantityUnitCost PriceUnitMarket Value per Unit(Net Realizable Value)Model A300$140$125Model B50090112Model C1506059Model D800120115Model E400140145 Inventory at the Lower of Cost or MarketProductTotal CostTotal MarketLower of Total Cost or Total MarketA$$$B C D E Total$$$arrow_forwardThe following information is available for the Century Trading: Product A B C D Cost $102 $45 $24 $9 Estimated sales price 120 60 30 15 Estimated disposal costs 15 18 8 5 Number of units 4,000 6,000 5,500 7,200 REQUIRED: Using the lower of cost and net realizable value, determine the total inventory value to be presented in Centurys Trading's statement of financial position.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College