FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

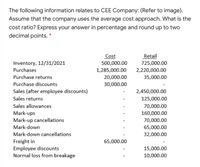

Transcribed Image Text:The following information relates to CEE Company: (Refer to image).

Assume that the company uses the average cost approach. What is the

cost ratio? Express your answer in percentage and round up to two

decimal points. *

Retail

Cost

500,000.00

Inventory, 12/31/2021

725,000.00

Purchases

1,285,000.00

2,220,000.00

Purchase returns

20,000.00

35,000.00

Purchase discounts

30,000.00

Sales (after employee discounts)

2,450,000.00

Sales returns

125,000.00

Sales allowances

70,000.00

Mark-ups

Mark-up cancellations

160,000.00

70,000.00

Mark-down

65,000.00

Mark-down cancellations

32,000.00

Freight in

Employee discounts

Normal loss from breakage

65,000.00

15,000.00

10,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- e. $106,000 Assume that sales are predicted to be $15,000, the expected contribution margin is $6,000, and a net loss of $1,000 is anticipated. The break-even point in sales ($) is: Select one: O a. 8,333 O b. 11,667 Oc. 12,500 O d. 16,000 O e. 17,500 Next pagearrow_forwardInput quantity 1,000 kg Normal loss 10% of input Process costs £14,300 Actual output 880 kg Losses are sold for £8 per kg The cost per unit is equal to A £10 B £15 C £20 D £25arrow_forwardYear Unit Sales 1 73,000 2 86,000 3 105,000 4 97,000 5 67,000 Production of the implants will require $1,500,000 in networking capital to start. It is expected that networking capital requirements are not changing over the life of the project. Total fixed costs are $3,300,000 per year,variable production costs are $225 per unit, and the units are priced at $375 each. The equipment needed to begin production has an installed cost of$16,500,000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as a seven-year MACRS property. In five years, this equipment can be sold for about 20 percent of the acquisition cost. The tax rate is 21 percent and the required returns is 18 percent. Based on these preliminary estimates, a) What is theNPV of the project? b) What is the IRR? USE EXCEL AND SHOW WORKINGarrow_forward

- Clarita Contracting builds roads, tunnels, bridges, and other transportation infrastructure. The following are the budgeted costs and time (months) to a given stage of completion for a project to upgrade a bridge to current standards. The project was originally estimated to take 25 months to complete. Also presented are the actual results through the first 11 months of the project. Percentage Complete 0% 4% 8% 12% 16% 20% 24% 28% 32% 36% 40% 44% 48% 52% 56% 60% 64% 68% 72% 76% 80% 84% 88% 92% 96% 100% Cost ($000) Budget 0 213 471 775 1,125 1,520 1,961 2,447 2,979 3,557 4,180 4,849 5,563 6,323 7,129 7,980 8,877 9,819 10,807 11,841 12,920 14,045 15,215 16,431 17,693 19,000 Actual 0 112 266 464 706 990 1,317 1,688 2,102 2,559 3,059 3,063 4,189 4,819 Months to Reach Budget Actual 0 5 7 8 9 10 11 12 13 14 14 15 16 17 18 18 19 20 20 21 22 22 23 24 24 25 0 1 1 2 3 4 4 5 6 7 8 9 10 11arrow_forwardSubject: Logistic management calculate EVA and suggest favorable or not ? Investment 1 mioSales 500,000All Expenses 400,000Market opportunity cost 15%arrow_forwardPV Versus Internal Rate of Return Nguyen Hospital is considering two different low-field MRI systems: the Clearlook System and the Goodview System. The projected annual revenues, annual costs, capital outlays, and project life for each system (in after-tax cash flows) are as follows: Clearlook Goodview Annual revenues $720,000 $900,000 Annual operating costs 445,000 655,000 System investment 900,000 800,000 Project life 5 years 5 years Assume that the cost of capital for the company is 8 percent. The present value tables provided in Exhibit 19B.1 and Exhibit 19B.2 must be used to solve the following problems. Required: 1. Calculate the NPV for the Clearlook System - $198075 2. Calculate the NPV for the Goodview System - $178285 Which MRI system would be chosen -Clearlook System 3. What if Nguyen Hospital wants to know why IRR is not being used for the investment analysis? Calculate the IRR for each project. Round the discount factor to three decimal places. Round…arrow_forward

- Determine feasibility of the project using FW Method. Use MARR = 10%. Alternatives А B C D Capital investment -$150,000 -$85,000 -$75,000 -$120,000 Annual revenues $28,000 $16,000 $15,000 $22,000 Annual expenses -$1,000 -$550 -$500 -S700 Market Value (EOL) $20,000 $10,000 $6,000 $11,000 Life (years) 10 10 10 10 Round off your answer to the NEAREST WHOLE NUMBER Ex. 12345 FW of Alt. A is Blank 1 FW of Alt. B is Blank 2 FW of Alt. C is Blank 3 FW of Alt. D is Blank 4arrow_forwardB. Consider the following: Total variable costs $200,000 Total fixed costs $150,000 Annual volume of units 500 Average invested capital $400,000 Target Return on investment 20.0% To the nearest tenth, what is the markup percentage required to earn the target return on investments using the cost-plus formula based on total costs?arrow_forwardCalculate the Contribution Margin Ratio: Sales 2,000,000 Rent 500,000. Depreciation 200,000. Variable COGS 60,000 Fixed COGS 35,000.arrow_forward

- Using discount rate 20% the project should be rejected or acceptedarrow_forwardIf Cape Cod Railway’s costs total $50,000 per month, the variable passengers is $10 , and tickets sell for $50 , what is the contribution margin per unit and contribution margin ratio? A. $40 per passenger; 20%B. $10 per passenger; 80% C. $10 per passenger; 20% D. $40 per passenger; 80%arrow_forward3. The Clearwater Company has a budget of $500000 which can be spent on the five independents projects. If MARR = 20%, how should the budget be allocated? Total Project Project Number i* Cost 1 29.1% $150000 2 10.5% 50000 21.5% 200000 4 19.5% 75000 23.2% 25 000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education