FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

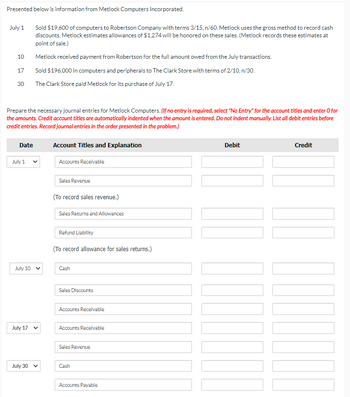

Transcribed Image Text:Presented below is information from Metlock Computers Incorporated.

July 1

10

Sold $19,600 of computers to Robertson Company with terms 3/15, n/60. Metlock uses the gross method to record cash

discounts. Metlock estimates allowances of $1,274 will be honored on these sales. (Metlock records these estimates at

point of sale.)

Metlock received payment from Robertson for the full amount owed from the July transactions.

17

Sold $196,000 in computers and peripherals to The Clark Store with terms of 2/10, n/30.

30

The Clark Store paid Metlock for its purchase of July 17.

Prepare the necessary journal entries for Metlock Computers. (If no entry is required, select "No Entry" for the account titles and enter O for

the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before

credit entries. Record journal entries in the order presented in the problem.)

Date

July 1

Account Titles and Explanation

Accounts Receivable

July 10

Sales Revenue

(To record sales revenue.)

Sales Returns and Allowances

Refund Liability

(To record allowance for sales returns.)

Cash

July 17

Sales Discounts

Accounts Receivable

Accounts Receivable

Sales Revenue

July 30

Cash

Accounts Payable

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ABC had Accounts Receivable of P150,000 at December 1, 2023. The following transactions occurred during December of 2023: December 5-A customer paid P90,000 worth of receivables. December 10-Sold P350,000 worth of goods to XYZ for P500,000 receiving 60% of the bill in cash and the rest to be received at a later time. The terms of the sale is 2/10, n/30. December 15 - XYZ returned P35,000 worth of goods which were billed for P50,000. December 20-XYZ paid the remaining balance. How much was debited/credited to Sales Return and Allowances on December 15? (positive if debited and negative if credited)arrow_forwardOn March 2, Blossom Company sold $960,000 of merchandise on account to Pina Company, terms 3/10, n/30. The cost of the merchandise sold was $562,000. On March 6, Pina Company returned $96,000 of the merchandise purchased on March 2. The cost of the returned merchandise was $59,000. On March 12, Blossom Company received the balance due from Pina Company. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter 0 for the amounts) Account Titles and Explanation Debit Creditarrow_forwardplease provide workingarrow_forward

- - (a) On March 3, Kitseiman Appliances sells $667,200 of its receivables to Blossom Inc. Blossom assesses a finance charge of 3% of the amount of receivables sold. Prepare the entry on Kitselman Appliances' books to record the sale of the receivables. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Mar. 3 Date Account Titles May 10 (b) On May 10, Fillmore Company sold merchandise for $13,000 and accepted the customer's America Bank MasterCard. America Bank charges a 2% service charge for credit card sales. Prepare the entry on Fillmore Company's books to record the sale of merchandise. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Account Titles Credit Debit Creditarrow_forwardBolton sold a customer service contract with a price of $37,000 to Sammy's Wholesale Company. Bolton offered terms of 1/10, n/30 and uses the gross method. Required: Hide Prepare the journal entry assuming the payment is made after 10 days (after the discount period). Account and Explanation Debit Credit Record collection of accounts receivablearrow_forwardRecord these transactions in general journal ledger: Dec 1: Purchased equipment costing $15,608 by taking out a 4-month installment note with First Bank. Dec 4: Accepted a sales return from Eastern for an item having an original gross sales price of $6,000. The original sale to Eastern occurred in November with terms 2/15, n/30. Dec 5: Specifically wrote off the receivable balance owed by Baker as uncollectible. Dec 7: Returned defective inventory with a gross cost of $4,000 back to Hunt Corp. Dec 14: Wilson returned an item originally purchased on Dec 12 with a gross sales price of $7,000. Dec 14: Returned inventory with a gross cost of $2,000 back to Nelson Industries. Dec 18: Bought office supplies on account for $9,000 from Staples Inc. (open a new Accounts Payable in the subsidiary ledger--Vendor # 210-30). Invoice # is OM1218. Staples Inc.’s terms are n/30 Dec 19: Received the December utilities bill for the amount of $15,000. The bill will be paid in January of next year.…arrow_forward

- Presented below is information from Culver Computers Incorporated. July 1 Sold $14,100 of computers to Larkspur Company with terms 3/15, n/60. Culver uses the gross method to record cash discounts. 10 Culver received payment from Larkspur for the full amount owed from the July 1 transaction. 17 Sold $108,100 in computers and peripherals to The Clark Store with terms of 3/10, n/30. 30 The Clark Store paid Culver for its purchase of July 17. Prepare the necessary journal entries for Culver Computers. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.)arrow_forwardA company purchased $8, 200 of merchandise on June 15th with terms of 3/10, n/45. on June 20, it returned $410 of that merchandise. on June 24th it paid the balance owed for the merchandise taking any discount it was entitled to. The cash paid ok june 24th is a) 8, 200 b) 7, 790 c) 7,556 d) 7,597 e) 7, 954arrow_forwardPlease answer the question correctly. Thank you.arrow_forward

- Company X sold merchandise for $50,000 with terms 3/30, n/90 on January 1. On January 29, Company X received half the payment in cash. On March 1, they received the remaining half. Prepare the journal entries to record the sale and the receipt of cash under (1) the gross method and (2) the net method. What effect does using the gross method vs. the net method have on the company’s current ratio after the sale? After the receipt of cash?arrow_forwarddon't give answer in image formatarrow_forward4. On January 1st, 2018, Blue Co. made a $10,000 sale for 1,000 water bottles on account with terms: of 2/15, n/30. If the company uses the net method, which of the following will be included in the Journal entry to record customer payment for all 1,000 water bottles on January 28th, 2018? a) credit Accounts Receivable $10,000 b) credit Sales Discounts Forfelted $200 c) debit Sales Discount $200 d) debit Cash $9,800arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education