FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

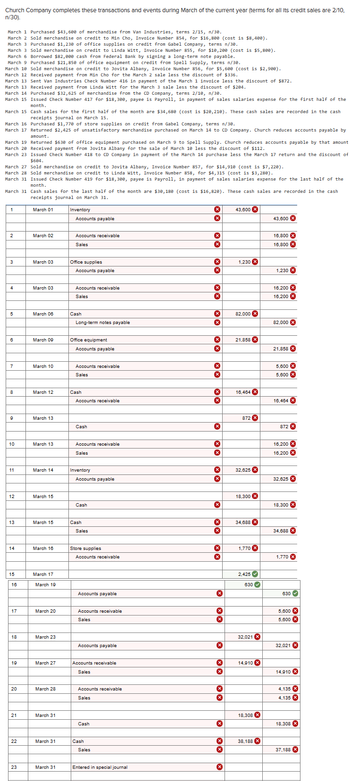

Transcribed Image Text:Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 2/10,

n/30).

March 1 Purchased $43,600 of merchandise from Van Industries, terms 2/15, n/30.

March 2 Sold merchandise on credit to Min Cho, Invoice Number 854, for $16,800 (cost is $8,400).

March 3 Purchased $1,230 of office supplies on credit from Gabel Company, terms n/30.

March 3 Sold merchandise on credit to Linda Witt, Invoice Number 855, for $10,200 (cost is $5,800).

March 6 Borrowed $82,000 cash from Federal Bank by signing a long-term note payable.

March 9 Purchased $21,850 of office equipment on credit from Spell Supply, terms n/30.

March 10 Sold merchandise on credit to Jovita Albany, Invoice Number 856, for $5,600 (cost is $2,900).

March 12 Received payment from Min Cho for the March 2 sale less the discount of $336.

March 13 Sent Van Industries Check Number 416 in payment of the March 1 invoice less the discount of $872.

March 13 Received payment from Linda Witt for the March 3 sale less the discount of $204.

March 14 Purchased $32,625 of merchandise from the CD Company, terms 2/10, n/30.

March 15 Issued Check Number 417 for $18,300, payee is Payroll, in payment of sales salaries expense for the first half of the

month.

March 15 Cash sales for the first half of the month are $34,680 (cost is $20,210). These cash sales are recorded in the cash

receipts journal on March 15.

March 16 Purchased $1,770 of store supplies on credit from Gabel Company, terms n/30.

March 17 Returned $2,425 of unsatisfactory merchandise purchased on March 14 to CD Company. Church reduces accounts payable by

amount.

March 19 Returned $630 of office equipment purchased on March 9 to Spell Supply. Church reduces accounts payable by that amount

March 20 Received payment from Jovita Albany for the sale of March 10 less the discount of $112.

March 23 Issued Check Number 418 to CD Company in payment of the March 14 purchase less the March 17 return and the discount of

$604.

March 27 Sold merchandise on credit to Jovita Albany, Invoice Number 857, for $14,910 (cost is $7,220).

March 28 Sold merchandise on credit to Linda Witt, Invoice Number 858, for $4,315 (cost is $3,280).

March 31 Issued Check Number 419 for $18,300, payee is Payroll, in payment of sales salaries expense for the last half of the

month.

March 31 Cash sales for the last half of the month are $30,180 (cost is $16,820). These cash sales are recorded in the cash

receipts journal on March 31.

1

March 01

Inventory

Accounts payable

2

March 02

Accounts receivable

Sales

3

March 03

Office supplies

Accounts payable

4

March 03

Accounts receivable

Sales

5

March 06

Cash

Long-term notes payable

6

March 09

Office equipment

Accounts payable

Accounts receivable

7

March 10

Sales

8

March 12

Cash

Accounts receivable

9

March 13

Cash

10

March 13

Accounts receivable

Sales

11

March 14

Inventory

Accounts payable

12

March 15

Cash

13

March 15

Cash

Sales

× ☑

43,600

43,600

16,800x

16,800

1,230

1,230

16,200 x

16,200

82,000

82,000

×

21,858

21,858

× ☑

× ×

5,600

5,600

16,464

16,464

872

872

16,200 x

16,200

32,625

32,625

18,300

18,300

34,688

34,688

14

March 16

Store supplies

1,770

Accounts receivable

1,770

15

March 17

16

March 19

Accounts payable

March 20

Accounts receivable

Sales

2,425

630

630

5,600

5,600x

18

March 23

32,021 x

Accounts payable

32,021

19

March 27

Accounts receivable

Sales

20

March 28

Accounts receivable

Sales

21

March 31

Cash

22

March 31

Cash

Sales

23

March 31

Entered in special journal

☑

× ×

☑

14,910

14,910 x

4,135

4,135x

18,308

18,308 x

38,188

37,188

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During the months of January and February, Solitare Corporation sold goods to two customers. The sequence of events was as follows: January 6 Sold goods for $260 to Wizard Incorporated with terms 2/30, n/60. The goods cost Solitare $78. January 6 Sold goods to Spyder Corporation for $104 with terms 2/10, n/30. The goods cost Solitare $68. January 14 Collected cash for the amount due from Wizard Incorporated. February 28 Collected cash for the amount due from Spyder Corporation. Required: Compute the Net Sales Solitare would report over the two months. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Net Sales 132 H 11 **** 1 +arrow_forwardThe following information was drawn from the Year 1 accounting records of Ozark Merchandisers: Inventory that had cost $21,200 was sold for $39,900 under terms 2/20, net/30. Customers returned merchandise to Ozark five days after the purchase. The merchandise had been sold for a price of $1,520. The merchandise had cost Ozark $920. All customers paid their accounts within the discount period. Selling and administrative expenses amounted to $4,200. Interest expense paid amounted to $360. Land that had cost $8,000 was sold for $9,250 cash. Requireda. Determine the amount of net sales. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) b. Prepare a multistep income statement. (Round your intermediate calculations and final answer to the nearest whole dollar amount. Amounts to be deducted and losses should be indicated with a minus sign.) c. Where would the interest expense be shown on the statement of cash flows? Operating activities…arrow_forwardPresented below is information from Metlock Computers Incorporated. July 1 10 Sold $19,600 of computers to Robertson Company with terms 3/15, n/60. Metlock uses the gross method to record cash discounts. Metlock estimates allowances of $1,274 will be honored on these sales. (Metlock records these estimates at point of sale.) Metlock received payment from Robertson for the full amount owed from the July transactions. 17 Sold $196,000 in computers and peripherals to The Clark Store with terms of 2/10, n/30. 30 The Clark Store paid Metlock for its purchase of July 17. Prepare the necessary journal entries for Metlock Computers. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Date July 1 Account Titles and Explanation Accounts…arrow_forward

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. Jan. 2 Issued Ck. No. 6981 to JSS Management Company for monthly rent, $758. 2 J. Hammond, the owner, invested an additional $3,518 in the business. 4 Bought merchandise on account from Valencia and Company, invoice no. A691, $2,932; terms 2/10, n/30; dated January 2. 4 Received check from Vega Appliance for $972.16 in payment of $992 invoice less discount. 4 Sold merchandise on account to L. Paul, invoice no. 6483, $864. 6 Received check from Petty, Inc., $653.66, in payment of $667 invoice less discount. 7 Issued Ck. No. 6982, $594.86, to Fischer and Son, in payment of invoice no. C1272 for $607 less discount. 7 Bought supplies on account from Doyle Office Supply, invoice no. 1906B, $108; terms net 30 days. 7 Sold merchandise on account to Ellison and Clay,…arrow_forwardThe following are selected transactions of Molina Company. Molina sells in large quantities to other companies and also sells its product in a small retail outlet. March 1 6 Sold merchandise on account to Dodson Company for $5,000, terms 2/10, n/30. Dodson Company returned merchandise with a sales price of $500 to Molina. Molina collected the amount due from Dodson Company from the March 1 sale. 15 Molina sold merchandise for $400 in its retail outlet. The customer used his Molina credit card. 31 Molina added 1.5% monthly interest to the customer's credit card balance. Prepare journal entries for the transactions above. (Ignore cost of goods sold entries and explanations.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation March 1 く Accounts Receivable Sales Revenue March 3 く Sales Returns and Allowances Accounts Receivable Debit Creditarrow_forwardDuring the month of June, Ace Incorporated purchased goods from two suppliers. The sequence of events was as follows: June 3 Purchased goods for $7,700 from Diamond Incorporated with terms 2/10, n/30. June 5 Returned goods costing $2,900 to Diamond Incorporated for credit on account. June 6 Purchased goods from Club Corporation for $2,800 with terms 2/10, n/30. June 11 Paid the balance owed to Diamond Incorporated. June 22 Paid Club Corporation in full. Required: Prepare journal entries to record the transactions, assuming Ace records discounts using the gross method in a perpetual inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list No 1 2 3 4 5 Date June 03 June 05 June 06 June 11 June 22 View journal entry worksheet Inventory Accounts Payable Accounts Payable Inventory Inventory Accounts Payable Accounts Payable Cash Accounts Payable Cash General Journal Debit 7,700 2,900 2,800 7,546…arrow_forward

- ABC Company is a merchandising firm. On June 3, the company sells, on account, merchandise for $2,200, credit terms 2/10, n/30. The cost of merchandise sold is $1,200. On June 8, ABC Company collects the amount due from June 3 sale. Which of the following is correct regarding the journal entry to record the transaction on June 8:arrow_forwardPresented below are selected transactions of Pina Colada Company. Pina Colada sells in large quantities to other companies and also sells its product in a small retail outlet. March 1 Sold merchandise on account to Dodson Company for $13,600, terms 6/10, n/30. 3- Dodson Company returned merchandise worth $1,200 to Pina Colada. Pina Colada collected the amount due from Dodson Company from the March 1 sale. Pina Colada sold merchandise for $3,000 in its retail outlet. The customer used his Pina Colada credit card. Pina Colada added 1.0% monthly interest to the customer's credit card balance. 9 15 31 Prepare journal entries for the transactions above. (Ignore cost of goods sold entries and explanations.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit 111arrow_forwardSydney returns $1,300 of the $29,000 of goods to Troy, who receives them the same day and restores them to its inventory. The returned goods had cost Troy $871. Note: Enter debits before credits. Date General Journal Debit Credit May 12arrow_forward

- During the month of June, Ace Incorporated purchased goods from two suppliers. The sequence ofevents was as follows:June 3 Purchased goods for $4,100 from Diamond Inc. with terms 2/10, n/30.5 Returned goods costing $1,100 to Diamond Inc. for full credit.6 Purchased goods from Club Corp. for $1,000 with terms 2/10, n/30.11 Paid the balance owed to Diamond Inc.22 Paid Club Corp. in full.Required:Assume that Ace uses a perpetual inventory system and that the company had no inventory on handat the beginning of the month. Calculate the cost of inventory as of June 30.arrow_forwardThe following transactions occurred over the months of September to December at Nicole's Getaway Spa (NGS). September Sold spa merchandise to Ashley Welch Beauty for $1,850 on account; the cost of these goods to NGS was $920. October Sold merchandise to Kelly Fast Nail Gallery for $478 on account; the cost of these goods to NGS was $210. November Sold merchandise to Raea Gooding Wellness for $320 on account; the cost of these goods to NGS was $200. December Received $1,230 from Ashley Welch Beauty for payment on its account. Required: 1. Prepare journal entries for each of the transactions. Assume a perpetual inventory system. 2. Estimate the Allowance for Doubtful Accounts required at December 31, assuming the only receivables outstanding at December 31 arise from the transactions listed above. NGS uses the aging of accounts receivable method with the following uncollectible rates: one month, 3%; two months, 5%, three months, 20%; more than three months, 30%. 3. The Allowance for…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education