FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

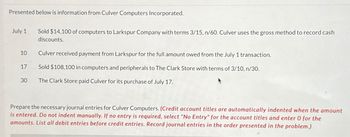

Transcribed Image Text:Presented below is information from Culver Computers Incorporated.

July 1

Sold $14,100 of computers to Larkspur Company with terms 3/15, n/60. Culver uses the gross method to record cash

discounts.

10

Culver received payment from Larkspur for the full amount owed from the July 1 transaction.

17

Sold $108,100 in computers and peripherals to The Clark Store with terms of 3/10, n/30.

30

The Clark Store paid Culver for its purchase of July 17.

Prepare the necessary journal entries for Culver Computers. (Credit account titles are automatically indented when the amount

is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the

amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- [The following information applies to the questions displayed below.] Littleton Books has the following transactions during May. May 2 Purchases books on account from Readers Wholesale for $2,708, terms 2/10, n/38. May 3 Pays cash for freight costs of $140 on books purchased from Readers. May 5 Returns books with a cost of $250 to Readers because part of the order is incorrect. May 10 Pays the full amount due to Readers. May 30 Sells all books purchased on May 2 (less those returned on May 5) for $3,400 on account. Required: 1. Record the transactions of Littleton Books, assuming the company uses a perpetual inventory system. (If no entry is requi transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 1 2 3 4 5 6 Record purchase of books on account from Readers Wholesale for $2,700, terms 2/10, n/30. Note: Enter debits before credits. Date May 02 General Journal Debit Creditarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardPresented below are selected transactions of Pina Colada Company. Pina Colada sells in large quantities to other companies and also sells its product in a small retail outlet. March 1 Sold merchandise on account to Dodson Company for $13,600, terms 6/10, n/30. 3- Dodson Company returned merchandise worth $1,200 to Pina Colada. Pina Colada collected the amount due from Dodson Company from the March 1 sale. Pina Colada sold merchandise for $3,000 in its retail outlet. The customer used his Pina Colada credit card. Pina Colada added 1.0% monthly interest to the customer's credit card balance. 9 15 31 Prepare journal entries for the transactions above. (Ignore cost of goods sold entries and explanations.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit 111arrow_forward

- please provide workingarrow_forwardFlounder Company purchased merchandise on account from a supplier for $32,100, terms 2/10, n/30. Flounder Company returned $8,600 of the merchandise and received full credit. a. If Flounder Company pays the invoice within the discount period, what is the amount of cash required for the payment? EE 6-2 p. 288 SHOW ME HOW b. What account is credited by Flounder Company to record the return?arrow_forwardFollowing are the merchandising transactions of Dollar Store. November 1 Dollar Store purchases merchandise for $2,800 on terms of 2/5, n/30, FOB shipping point, invoice dated November 1. November 5 Dollar Store pays cash for the November 1 purchase. November 7 Dollar Store discovers and returns $100 of defective merchandise purchased on November 1, and paid for on November 5, for a cash refund. November 10 Dollar Store pays $140 cash for transportation costs for the November 1 purchase. November 13 Dollar Store sells merchandise for $3,024 with terms n/30. The cost of the merchandise is $1,512. November 16 Merchandise is returned to the Dollar Store from the November 13 transaction. The returned items are priced at $205 and cost $103; the items were not damaged and were returned to inventory. Journalize the above merchandising transactions for the Dollar Store assuming it uses a perpetual inventory system and the gross method.arrow_forward

- Oswego Clay Pipe Company sold $46,000 of pipe to Southeast Water District 45 on April 12 of the current year with terms 1/10,n/30. Oswego uses the gross method of accounting for sales discounts. What entry would Oswego make on April 18, assuming the customer made the correct payment on that date? Account Title Debit Credit Cash Sales 45,540 460 Accounts receivable 46,000 Account Title Debit Credit Cash 46,000 Accounts receivable Sales 45,540 460 Account Title Debit Credit Cash 45,540 Sales discounts 460 Accounts receivable 46,000 Account Title Debit Credit Cash 46,000 Sales discounts 460 Accounts receivable 46,000 Sales discounts forfeited 460arrow_forwardChoose the correct answer: 12. On November 10 of the current year, Al-Kamil Co. sold carpet to a customer for OR 8,000 with credit terms 2/10, n/30. Al-Kamil uses the gross method of accounting for cash discounts. What is the correct entry for Al-Kamil on November 10? Select one: a. Accounts receivable 8,000 Sales 8,000 b. Accounts receivable 8,000 cash discounts 160 Sales 7,840 c. Accounts receivable 7,840 cash discounts 160 Sales 8,000 d. Accounts receivable 7,840 Sales…arrow_forwardThe following transactions were selected from among those completed by Bennett Retallers in November and December: November 20 November 25 Sold 20 items of merchandise to Customer 8 at an invoice price of $6,400 (total); terms 2/10, n/30. Sold two items of merchandise to Customer C, who charged the $700 (total) sales price on her Visa credit card. Visa charges Bennett Retailers a 1 percent credit card fee. Sold 10 identical items of merchandise to Customer D at an invoice price of $9,600 (total); terms 2/10, n/38. Customer D returned one of the items purchased on the 28th; the item was defective and credit was given to the customer. December 6 Customer D paid the account balance in full. December 20 Customer 8 paid in full for the invoice of November 20. November 28 November 29 Required: Assume that Sales Returns and Allowances, Sales Discounts, and Credit Card Discounts are treated as contra-revenues; compute net sales for the two months ended December 31. Note: Do not round your…arrow_forward

- On January 15, Tundra Co. sold merchandise to customers for cash of $45,000 (cost $30,600). Merchandise costing $11,400 was sold to customers for $17,000 on January 17; terms 2/10, n/30. Sales totalling $321,500 (cost $216,000) were recorded on January 20 to customers using MasterCard; assume the credit card charges a 2% fee. On January 25, sales of $78,600 (cost $52,700) were made to debit card customers. The bank charges Tundra a flat fee of 0.5% on all debit card transactions. Required: Prepare journal entries for each of the transactions described (assume a perpetual inventory system). View transaction list Journal entry worksheet Record the sale of merchandise on terms 2/10, n/30.arrow_forwardJuly 1 Sold $21,600 of computers to Robertson Company with terms 3/15, n/60. Windsor uses the gross method to record cash discounts. Windsor estimates allowances of $1,404 will be honored on these sales. 10 Windsor received payment from Robertson for the full amount owed from the July transactions. 17 Sold $216,000 in computers and peripherals to The Clark Store with terms of 2/10, n/30. 30 The Clark Store paid Windsor for its purchase of July 17. Prepare the necessary journal entries for Windsor Computers. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation (To record sales revenue.) (To record allowance for sales returns.) Debit Creditarrow_forwardOn June 14, Year 1, Sure-Fit Shoe Store sold $13,000 of merchandise that cost $8,700 and accepted credit cards as payment. Sure-Fit electronically transmitted the credit card forms to the credit card company which charges a 4% fee to handle such transactions. On June 18, Year 1, Sure-Fit received the proceeds from the credit card company. Required: a. How will the entry to record the sale of the merchandise on June 14, Year 1, affect the company's financial statements? b. How will the entry to record the credit card proceeds on June 18, Year 1, affect the company's financial statements? Complete this question by entering your answers in the tabs below. Required A Required B How will the entry to record the sale of the merchandise on June 14, Year 1, affect the company's financial statements? Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Assets Balance Sheet Liabilities Stockholders' Equity Revenue Income…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education