FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

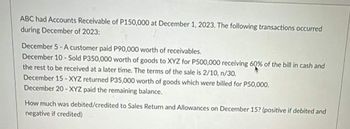

Transcribed Image Text:ABC had Accounts Receivable of P150,000 at December 1, 2023. The following transactions occurred

during December of 2023:

December 5-A customer paid P90,000 worth of receivables.

December 10-Sold P350,000 worth of goods to XYZ for P500,000 receiving 60% of the bill in cash and

the rest to be received at a later time. The terms of the sale is 2/10, n/30.

December 15 - XYZ returned P35,000 worth of goods which were billed for P50,000.

December 20-XYZ paid the remaining balance.

How much was debited/credited to Sales Return and Allowances on December 15? (positive if debited and

negative if credited)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The trial balance of Novak Ltd. at December 31, 2020, follows: Debits Credits Cash $295,000 Sales revenue $10,299,000 FV-NI investments (at fair value) 323,000 Cost of goods sold 6,400,000 Bond investment at amortized cost 429,000 FV—OCI investments (fair value $445,000) 378,000 Notes payable (due in six months) 99,000 Accounts payable 805,000 Selling expenses 2,460,000 Investment income or loss* 11,000 Land 320,000 Buildings 2,940,000 Dividends payable 56,000 Income tax payable 106,000 Accounts receivable 705,000 Accumulated depreciation—buildings 232,000 Allowance for doubtful accounts 37,000 Administrative expenses 930,000 Interest expense 251,000 Inventory 767,000 Gain on disposal of land…arrow_forwardEvergreen Company sells lawn and garden products to wholesalers. The company's fiscal year-end is December 31. During 2021, the following transactions related to receivables occurred: Feb. 28 Sold merchandise to Lennox, Inc., for $20,000 and accepted a 6%, 7-month note. 6% is an appropriate rate for this type of note. Mar. 31 Sold merchandise to Maddox Co. that had a fair value of $15,040, and accepted a noninterest-bearing note for which $16,000 payment is due on March 31, 2022. Apr. 3 Sold merchandise to Carr Co. for $14,000 with terms 2/10, n/30. Evergreen uses the gross method to account for cash discounts. 11 Collected the entire amount due from Carr Co. 17 A customer returned merchandise costing $4,800. Evergreen reduced the customer’s receivable balance by $6,600, the sales price of the merchandise. Sales returns are recorded by the company as they occur. 30 Transferred receivables of $66,000 to a factor without recourse. The…arrow_forwardJangles Corporation received a $20,000 invoice dated March 3. The Cash discount terms were 3/10, n/30. On March 10, Jangles sent a $12,000 partial payment. What credit should Jangles receive for this partial payment?arrow_forward

- GRAPEFRUIT Co. Uses the NET method to record sales made on credit. On June 10, 2023, it made sales of ₱100,00 with terms 2/10, n/30 to FIG Farms, Inc. On June 19, 2023, GRAPEFRUIT received payment for 1/2 the amount due from FIG Farms. GRAPEFRUIT’s fiscal year end is on June 30, 2023. What amount will be reported in the statement of financial position for the accounts receivable from FIG Farms, Inc? A. ₱49, 000 B. ₱50, 000 C. ₱48, 000 D. ₱51, 000arrow_forwardDescribed below are certain transactions of Pharoah Company for 2021: On May 10, the company purchased goods from Fox Company for $74,900, terms 2/10, n/30. Purchases and accounts payable are recorded at net amounts. The invoice was paid on May 18. 1. On June 1, the company purchased equipment for $96,000 from Rao Company, paying $31,200 in cash and giving a one- year, 9% note for the balance. 2. On September 30, the company discounted at 11% its $220,000, one-year zero-interest-bearing note at Virginia State Bank, receiving $198,000. 3.arrow_forwardA company makes a credit sale of $1,000 on June 13 according to the payment terms 5/10, n/30. On June 16, there is a return of $100. The buyer makes the payment for the remaining amount by utilizing the discount. What should be the amount to be paid? O A) $855 B) $900 C) $950 D) $810 E) $600arrow_forward

- Grouper Company sells goods to Danone Inc. by accepting a note receivable on January 2, 2020. The goods have a sales price of $550,100 (cost of $510,000). The terms are net 30. If Danone pays within 5 days, however, it receives a cash discount of $10,100. Past history indicates that the cash discount will be taken. On January 28, 2020, Danone makes payment to Grouper for the full sales price. (a)Prepare the journal entry(ies) to record the sale and related cost of goods sold for Grouper Company on January 2, 2020, and the payment on January 28, 2020. Assume that Grouper Company records the January 2, 2020, transaction using the net method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) (b)Prepare the journal entry(ies) to record the sale and related cost of goods sold for Grouper Company on January 2, 2020, and the payment on January 28,…arrow_forwardRiverbed Company sells goods to Danone Inc. by accepting a note receivable on January 2, 2020. The goods have a sales price of $630,700 (cost of $500,000). The terms are net 30. If Danone pays within 5 days, however, it receives a cash discount of $10,700. Past history indicates that the cash discount will be taken. On January 28, 2020, Danone makes payment to Riverbed for the full sales price. (a)Prepare the journal entry(ies) to record the sale and related cost of goods sold for Riverbed Company on January 2, 2020, and the payment on January 28, 2020. Assume that Riverbed Company records the January 2, 2020, transaction using the net method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Choose date Jan 2 or Jan 28…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education