FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Mayfair Co. allows select customers to make purchases on credit. Its other customers can use either of two credit cards: Zisa or Access. Zisa deducts a 5.5% service charge for sales on its credit card. Access deducts a 4.5% service charge for sales on its card. Mayfair completes the following transactions in June.

| June | 4 | Sold $600 of merchandise on credit (that had cost $240) to Natara Morris. | ||

| 5 | Sold $7,100 of merchandise (that had cost $2,840) to customers who used their Zisa cards. | |||

| 6 | Sold $6,152 of merchandise (that had cost $2,461) to customers who used their Access cards. | |||

| 8 | Sold $4,300 of merchandise (that had cost $1,720) to customers who used their Access cards. | |||

| 13 | Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $739 balance in McKee’s account stemmed from a credit sale in October of last year. | |||

| 18 | Received Morris’s check in full payment for the purchase of June 4. |

Required:

Prepare journal entries to record the preceding transactions and events. (The company uses the perpetual inventory system.) (If no entry is required for a transaction/event, select "No

-

1Sold $600 of merchandise on credit to Natara Morris.

-

2Record cost of goods sold, $240

-

3Sold $7,100 of merchandise to customers who used their Zisa cards.

-

4Record cost of goods sold, $2,840.

-

5Sold $6,152 of merchandise to customers who used their Access cards.

-

6Record cost of goods sold, $2,461.

-

7Sold $4,300 of merchandise to customers who used their Access cards.

-

8Record cost of goods sold, $1,720.

-

9Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $739 balance in McKee’s account stemmed from a credit sale in October of last year.

-

10Received Morris's check in full payment for the purchase of June 4.

Transcribed Image Text:1

2

4

5

6

7

8

9

10

>

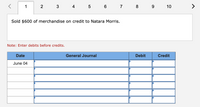

Sold $600 of merchandise on credit to Natara Morris.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

June 04

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 17. Merchandise with a sales price of P500 is sold on account with term 2/10, n/30. The journal entry to record the sale would include a a. debit to Cash for P500 b. Debit to Sales Discounts for P10 C. Credit to Sales for P500 d. Debit to Accounts Receivable for P490 18. Merchandise subject to terms 1/10, n/30, FOB shipping point, is sold account to a customer for P15,000. The seller paid transportation costs et P1,000 and issued a credit memorandum for P5,000 prior to payment. What i the amount of the cash discount allowable? a. P160 b. P150 c. P140 d. P100 19. The entry to record the return of merchandise from a customer would include a a. debit to Sales b. credit to Sales c. debit to Sales Returns and Allowances d. credit to Sales returns and Allowances 20. A sales invoice included the following information: merchandise price, P4,000; transportation, P300; terms 1/10, n/eom, FOB shipping point. Assuming tha credit for merchandise returned of P600 is granted prior to payment, trhat…arrow_forwardOn 15 December 2020; Saadah Company purchased goods at the amount of 42500 OMR and paid 12500, the balance is on account. Which of the following is the correct journal entry for this transaction? Select one: O A. Date Accounts Debit Credit (RO) (RO) Goods 42500 30000 15.12.2020 Payable Cash 12500 О в. Debit Credit (RO) (RO) Date Accounts Payable 30000 15.12.2020 Cash 12500 Goods 42500 Date Accounts Debit Credit (RO) (RO) Payable 30000 15.12.2020 Cash 12500 Goods 42500 D. Date Accounts Debit Credit (RO) (RO) Goods 42500 30000 15.12.2020 Cash Payable 12500arrow_forwardBUS 038 : Business Computatns10. You purchase goods on an invoice dated July 27 with terms of 3/10 EOM. Determine (a) the last day of the discount period, and (b) the last day of the credit period.arrow_forward

- Prepare the Journal Entries for the following purchase transactions: I. Purchase of merchandise for cash:a. Merchandise is purchased for cash, P35,000b. Merchandise listed at P50,000, subject to a trade discount of 10%, is purchased for cash. II. Purchase of merchandise on account:a. Merchandise purchased on account, credit terms 2/10, n/30, P40,000.b. Merchandise purchased on account, credit terms 3/10, n/30, P28,000.c. Payment is made on invoice (a) within the discount period.d, Payment is made on invoice (b) beyond the discount period.arrow_forward78.arrow_forwardOn October 4, 2o08, Terry Corporation had credit sales transactions of P2,800 from merchandise having cost P1,900. The entries to record the day's credit transactions include a * debit of P2,800 to Merchandise Inventory. O credit of P2,800 to Sales. O debit of P1,900 to Merchandise Inventory. O credit of P1,900 to Cost of Goods Sold.arrow_forward

- What does it mean "listed at" example Merchandise purchased on May 4, "listed at" $520, is returned for credit.arrow_forwardE9.3arrow_forwardA sales invoice included the following information: merchandise price, P4,200; transportation, P320; terms 1/10, n/EOM, FOB shipping point. Assuming that a credit for merchandise returned of P600 is granted prior to payment, that the transportation is prepaid by the seller, and the invoice is paid within the discount period, what is the amount of cash received by the seller? O A. P3,878 B. P3,880.80 O C. P3,558 O D. P3,884 20arrow_forward

- Merchandise subject to terms 2/10, n/30, FOB shipping point, is sold on account to a customer for $22,100. What is the amount of sales discount allowable?arrow_forwardAssume the following information: merchandise is sold on account to customer for P120,000, FOB Shipping Point, 2/10, n/30. The seller paid transportation cost of P6,000. What is the amount of remittance due within the discount period?arrow_forwardThe journal entry to record the receipt of a payment from customer within the discount period on a sale of $2325 with terms of 3/10, n/30 will include a credit to O a. Sales discounts for $70 O b. Accounts receivable for $2325 O c. Sales Revenue for $2325 O d. Cash for $2255arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education