FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

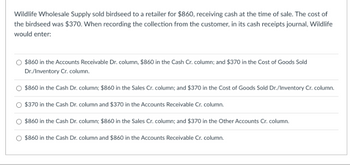

Transcribed Image Text:Wildlife Wholesale Supply sold birdseed to a retailer for $860, receiving cash at the time of sale. The cost of

the birdseed was $370. When recording the collection from the customer, in its cash receipts journal, Wildlife

would enter:

$860 in the Accounts Receivable Dr. column, $860 in the Cash Cr. column; and $370 in the Cost of Goods Sold

Dr./Inventory Cr. column.

$860 in the Cash Dr. column; $860 in the Sales Cr. column; and $370 in the Cost of Goods Sold Dr./Inventory Cr. column.

$370 in the Cash Dr. column and $370 in the Accounts Receivable Cr. column.

$860 in the Cash Dr. column; $860 in the Sales Cr. column; and $370 in the Other Accounts Cr. column.

$860 in the Cash Dr. column and $860 in the Accounts Receivable Cr. column.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nevada Company provided services with a list price of $48,500 to Small Enterprises with terms 2/15, n/45. Nevada records sales at gross. Required: Question Content Area 1. Prepare the entry to record this sale in Nevada's journal 2. Prepare the entry for Nevada's journal to record receipt of cash in payment for the sale within the discount period. If an amount box does not require an entry, leave it blank. 3.Prepare the entry for Nevada's journal to record receipt of cash in payment for the sale after the discount period.arrow_forwardThe following transactions were selected from the records of Evergreen Company: July 12 Sold merchandise to Wally Butler, who paid the $1,400 purchase with cash. The goods cost Evergreen Company $840. July 15 Sold merchandise to Claudio's Chair Company at a selling price of $5,300 on terms 3/10, n/30. The goods cost Evergreen Company $3,710. July 16 Sold merchandise to Otto's Ottomans at a selling price of $3,150 on terms 3/10, n/30. The goods cost Evergreen Company $1,980. July 23 Received cash from Claudio's Chair Company for the amount due from July 15. July 31 Received cash from Otto's Ottomans for the amount due from July 16. Required: Prepare journal entries to record the transactions, assuming Evergreen Company records discounts using the net method in a perpetual inventory system. Forfeited discounts are recorded as Other Revenue. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Round your answers to the nearest…arrow_forwardFollowing are the merchandising transactions of Dollar Store. November 1 Dollar Store purchases merchandise for $1,300 on terms of 2/5, n/30, FOB shipping point, invoice dated November 1. November 5 Dollar Store pays cash for the November 1 purchase. November 7 Dollar Store discovers and returns $150 of defective merchandise purchased on November 1, and paid for on November 5, for a cash refund. November 10 Dollar Store pays $65 cash for transportation costs for the November 1 purchase. November 13 Dollar Store sells merchandise for $1,404 with terms n/30. The cost of the merchandise is $702. November 16 Merchandise is returned to the Dollar Store from the November 13 transaction.. The returned items are priced at $290 and cost $145; the items were not damaged and were returned to inventory. Journalize the above merchandising transactions for the Dollar Store assuming it uses a perpetual inventory system and the gross method. View transaction list Journal entry worksheetarrow_forward

- Finer Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Journalize the following transactions that should be recorded in the sales journal. May 2 Sold merchandise costing $300 to B. Facer for $450 cash, invoice no. 5703. 5 Purchased $2,400 of merchandise on credit from Marchant Corp. 7 Sold merchandise costing $800 to J. Dryer for $1,250, terms 2/10, n/30, invoice no. 5704. 8 Borrowed $9,000 cash by signing a note payable to the bank. 12 Sold merchandise costing $200 to R. Lamb for $340, terms n/30, invoice no. 5705. 16 Received $1,225 cash from J. Dryer to pay for the purchase of May 7. 19 Sold used store equipment (noninventory) for $900 cash to Golf, Inc. 25 Sold merchandise costing $500 to T. Taylor for $750, terms n/30, invoice no. 5706. SALES JOURNAL Date Account Debited Invoice Number Accounts Receivable Dr. Cost of Goods Sold Dr. Sales Cr. Inventory Cr.arrow_forwardOn June 3, Marigold Company sold to Chester Company merchandise having a sale price of $3,800 with terms of 4/10, n/60, f.o.b. shipping point. An invoice totalling $91, terms n/30, was received by Chester on June 8 from John Booth Transport Service for the freight cost. On June 12, the company received a check for the balance due from Chester Company. (a) Prepare journal entries on the Marigold Company books to record all the events noted above under each of the following bases. (1) (2) No. Your answer is partially correct. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) (1) (2) Sales and receivables are entered at gross selling price. Sales and receivables are entered at net of cash discounts. Date June 3 June 3 June 12 June 3…arrow_forwardThe following transactions were selected from the records of Evergreen Company:July 12 Sold merchandise to Wally Butler, who paid the $1,000 purchase with cash. Thegoods cost Evergreen Company $600.15 Sold merchandise to Claudio’s Chair Company at a selling price of $5,000 onterms 3/10, n/30. The goods cost Evergreen Company $3,500.20 Sold merchandise to Otto’s Ottomans at a selling price of $3,000 on terms 3/10,n/30. The goods cost Evergreen Company $1,900.23 Collected payment from Claudio’s Chair Company from the July 15 sale.Aug. 25 Collected payment from Otto’s Ottomans from the July 20 sale.Required:Assuming that Sales Discounts are reported as contra-revenue, compute Net Sales for the twomonths ended August 31.arrow_forward

- on june 3, concord comoany sold to chester merchandise having a sale price of $5,500 with terms 2/10,n/60,F.O.B. shipping point. An invoice totalling $99, terms n/30, was received by chester on june 8 from john booth transportservice for the freight cost. on june 12, the company received a check for the balance due from chester company. prepare journal entries on the concord company books to record all the events noted above under each of the following basis. (1) sales and receivable are entered at gross selling price. (2). sales and receivable are entered at net cash discounts.arrow_forwardThe following are selected transactions of Molina Company. Molina sells in large quantities to other companies and also sells its product in a small retail outlet. March 1 6 Sold merchandise on account to Dodson Company for $5,000, terms 2/10, n/30. Dodson Company returned merchandise with a sales price of $500 to Molina. Molina collected the amount due from Dodson Company from the March 1 sale. 15 Molina sold merchandise for $400 in its retail outlet. The customer used his Molina credit card. 31 Molina added 1.5% monthly interest to the customer's credit card balance. Prepare journal entries for the transactions above. (Ignore cost of goods sold entries and explanations.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation March 1 く Accounts Receivable Sales Revenue March 3 く Sales Returns and Allowances Accounts Receivable Debit Creditarrow_forwardjituarrow_forward

- Caesar Company uses a sales journal, purchases journal, cash receipts journal, cash payments journal, and general journal. Journalize the following transactions that should be recorded in the sales journal. June 5 Purchased $1,800 of merchandise on credit from Roman Corp. 9 Sold merchandise costing $495 to R. Allen for $825, terms n/10, Invoice No. 2080. 12 Sold merchandise costing $390 to J. Meyer for $650 cash, Invoice No. 2081. pay for the purchase of June 9. 19 Received $825 cash from R. Allen to 27 Sold merchandise costing $525 to B. Kraft for $750, terms n/10, Invoice No. 2082. Date Account Debited SALES JOURNAL Invoice Number Accounts Receivable Dr. Sales Cr. Cost of Goods Sold Dr. Inventory Cr.arrow_forwardFlounder Company purchased merchandise on account from a supplier for $32,100, terms 2/10, n/30. Flounder Company returned $8,600 of the merchandise and received full credit. a. If Flounder Company pays the invoice within the discount period, what is the amount of cash required for the payment? EE 6-2 p. 288 SHOW ME HOW b. What account is credited by Flounder Company to record the return?arrow_forwardsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education