FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

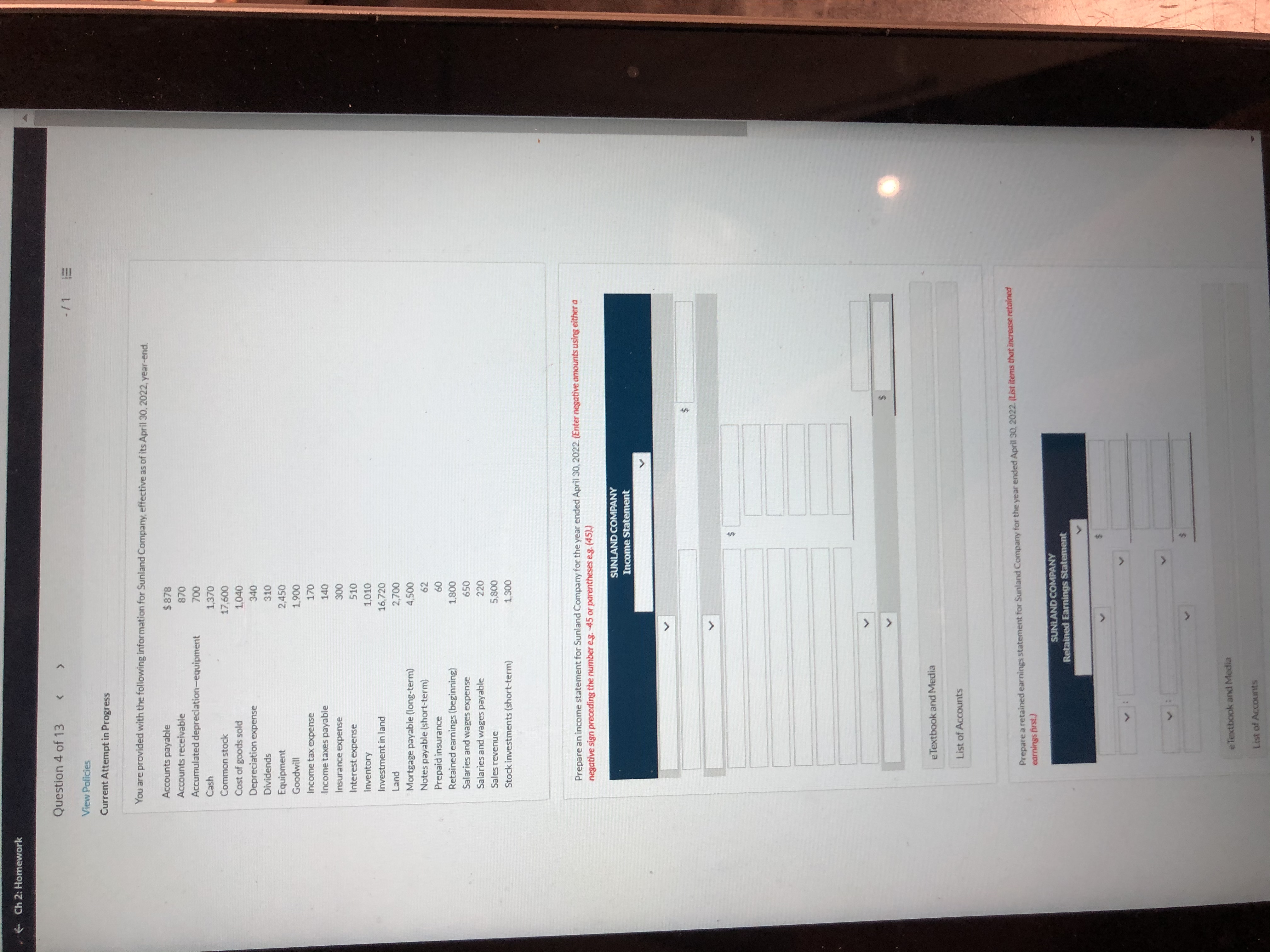

Transcribed Image Text:## Financial Data and Task Overview for Sunland Company

### Overview

This section provides financial data for Sunland Company as of April 30, 2022, including details necessary for preparing income and retained earnings statements.

### Financial Information

- **Accounts Payable:** $878

- **Accounts Receivable:** $870

- **Accumulated Depreciation—Equipment:** $1,200

- **Cash:** $1,370

- **Common Stock:** $17,600

- **Cost of Goods Sold:** $10,040

- **Depreciation Expense:** $340

- **Dividends:** $1,040

- **Equipment:** $2,450

- **Goodwill:** $1,900

- **Income Tax Expense:** $170

- **Income Taxes Payable:** $140

- **Insurance Expense:** $500

- **Interest Expense:** $310

- **Inventory:** $1,010

- **Investment in Land:** $1,620

- **Land:** $2,700

- **Mortgage Payable (Long-term):** $4,500

- **Notes Payable (Short-term):** $290

- **Prepaid Insurance:** $420

- **Retained Earnings (Beginning):** $1,800

- **Salaries and Wages Expense:** $2,360

- **Salaries and Wages Payable:** $280

- **Sales Revenue:** $5,280

- **Stock Investments (Short-term):** $1,300

### Instructions for Income Statement Preparation

Prepare an income statement for Sunland Company for the year ended April 30, 2022. Enter negative amounts using either a negative sign or parentheses (e.g., -45 or (45)).

#### Income Statement Components

- **Revenue**

- **Expenses** (includes cost of goods sold, depreciation, taxes, insurance, interest, and salaries)

- **Net Income/Loss**

### Instructions for Retained Earnings Statement Preparation

Prepare a retained earnings statement for Sunland Company for the year ended April 30, 2022. List items that increase retained earnings first.

#### Retained Earnings Statement Components

- **Beginning Retained Earnings**

- **Net Income from Income Statement**

- **Dividends**

- **Ending Retained Earnings**

### Tools Provided

- Editable income and retained earnings statement templates

- eTextbook and Media

-

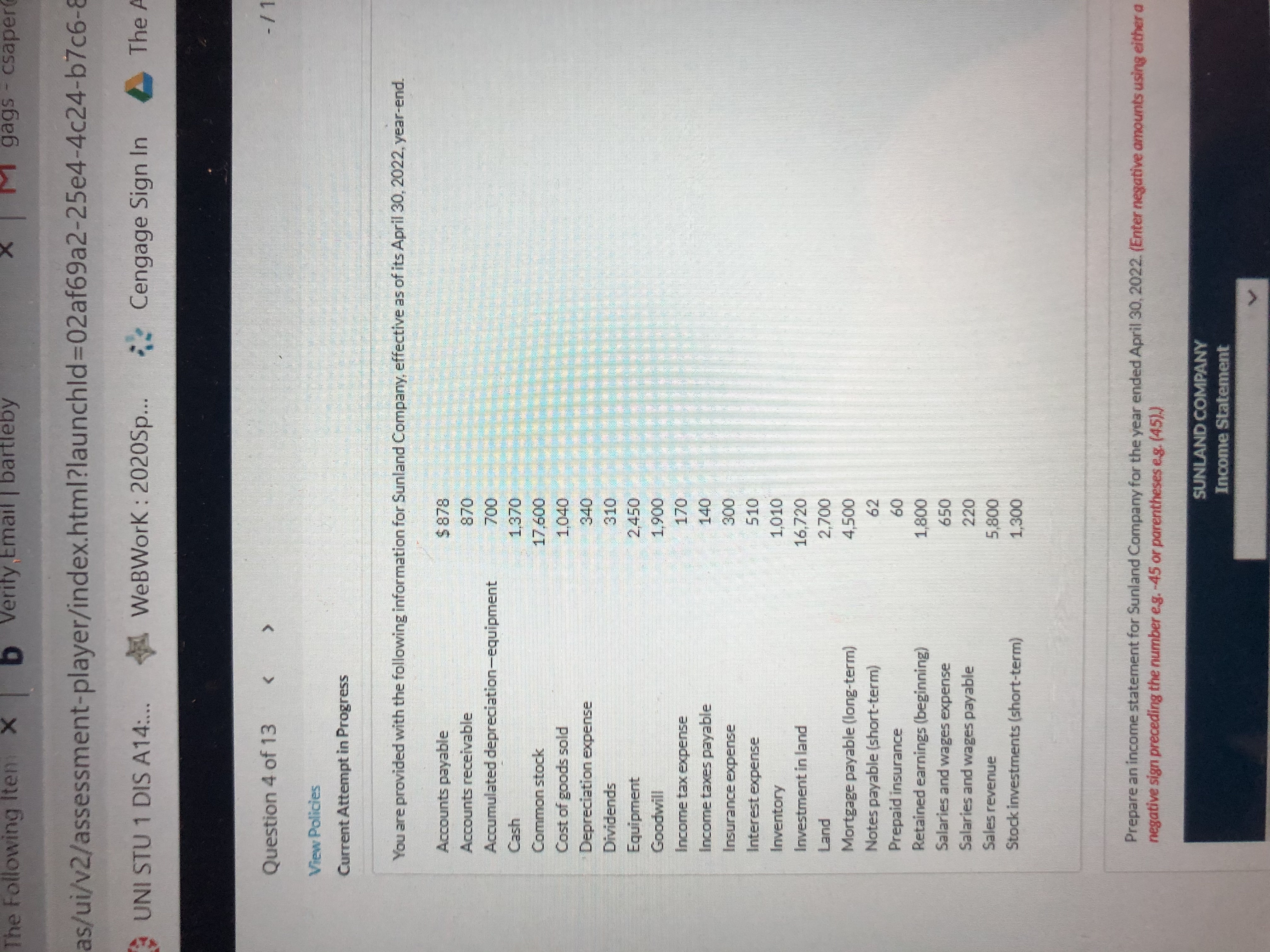

Transcribed Image Text:### Sunland Company Financial Information

**As of April 30, 2022**

#### Balance Sheet Information:

- **Liabilities:**

- Accounts payable: $878

- Income taxes payable: $140

- Mortgage payable (long-term): $4,500

- Notes payable (short-term): $62

- Salaries and wages payable: $220

- **Assets:**

- Accounts receivable: $870

- Accumulated depreciation—equipment: $700

- Cash: $1,370

- Inventory: $1,010

- Investment in land: $16,720

- Land: $2,700

- Prepaid insurance: $60

- Stock investments (short-term): $1,300

- **Equity:**

- Common stock: $17,600

- Retained earnings (beginning): $1,800

#### Income Statement Information:

- **Revenue and Gains:**

- Sales revenue: $5,800

- **Expenses and Losses:**

- Cost of goods sold: $1,040

- Depreciation expense: $340

- Dividends: $310

- Equipment: $2,950

- Goodwill: $1,900

- Income tax expense: $170

- Insurance expense: $300

- Interest expense: $510

- Salaries and wages expense: $650

### Instruction for Preparing the Income Statement:

Prepare an income statement for Sunland Company for the year ended April 30, 2022. When entering negative amounts, use either a negative sign (e.g., -45) or parentheses (e.g., (45)).

This exercise aids in understanding how to compile financial statements using given data for a company at the end of its fiscal year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Forecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Medtronic PLC Consolidated Statement of Income $ millions, For Fiscal Year Ended April 26, 2019 Net sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expense 979 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 83 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 7,734 Other nonoperating income, net (157) Interest expense 1,444 Income before income taxes 6,447 Income tax provision 547 Net income 5,900 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $5,881…arrow_forwardI have obtained Target Corporation’s annual report for its 2018 fiscal year (year ended February 2, 2019). What was Target’s accounting equation for 2018?arrow_forwardDo parts a to d Accounting for Income Taxes Yoda Company is in the process of accounting for its income taxes for the year ended December 31, 2020. The following information came from Yoda's accounting and taxation records: Accounting income before income taxes for 2020 $ 98,967 Depreciation expense for property, plant, and equipment for 2020 $ 222,227 Capital cost allowance to be claimed on Yoda's 2020 income tax return $ 244,450 Book value of property, plant, and equipment at December 31, 2019 $ 1,399,268 Undepreciated capital cost of property, plant, and equipment at December 31, 2019 $ 1,203,370 Assume that there were no additions or disposals of property, plant, and equipment during 2020. In 2020, Yoda began offering a 1-year warranty on all merchandise sold. Following are details pertaining to this warranty: Warranty expense for 2020 for accounting purposes $ 38,860…arrow_forward

- Use the Ulta annual report to calculate profit margin, total debt ratio, and cash ratio for the year ending in 2021.arrow_forwardhttps://www.republictt.com/pdfs/annual-reports/RFHL-Annual-Report-2022.pdf Financial Reporting Analysis: Use Republic Bank Limited Annual Report 2022 to answer the Questions. a) Evaluate the company’s latest annual financial statements (balance sheet, income statement, and cash flow statement) and comment on the company's financial performance and position. In your response, use the requirements of IAS 1 as a guide. b) Identify and discuss key accounting principles and standards applied in the company’s financial reporting process indicating their reasons for choosing these and how they were applied. Comment briefly on the appropriateness of the choices made given the company’s industry, location and type (e.g. MNC, regional conglomerate, etc.) c) Critically analyze any significant accounting policies and estimates disclosed in the notes to the financial statements. In your answer, indicate whether the company complied with the accounting standards and conventions.arrow_forwardUse the following information for Ingersoll, Incorporated. Assume the tax rate is 24 percent. 2020 2021 Sales Depreciation $ 17,573 $16,536 1,781 1,856 Cost of goods sold 4,579 4,827 Other expenses 1,006 884 Interest 855 986 Cash 6,247 6,826 Accounts receivable 8,160 9,787 Short-term notes payable 1,290 1,267 Long-term debt 20,680 24,936 Net fixed assets 51,152 54,633 Accounts payable 4,576 5,004 Inventory 14,487 15,408 1,550 1,738 Dividends Prepare a balance sheet for this company for 2020 and 2021 (Do not round intermediate calculations) Current assets Assets INGERSOLL, INCORPORATED Balance Sheet as of December 31 2020 2021 Total assets $ 86,654 Liabilities & Equity Current liabilities Total liabilities & owners' equity $ 6,271arrow_forward

- Using functions , complete the “Aggregated Data” worksheet using the “Statementof Income” worksheet.arrow_forwardReview the Republic Financial Holdings Limited 2022 annual report. What recommendations can be made for the preparation of the financial statements ?arrow_forwardF. Based on Baker’s account balances, the amount of Net Income that would be shown on Baker’s Income Statement for December 2017 would be:arrow_forward

- Swifty Park, a public camping ground near the Four Corners National Recreation Area, has compiled the following financial information as of December 31, 2022 Revenues during 2022-camping fees $145,600 Revenues during 2022-general store 48,880 Accounts payable 11,440 Cash on hand 20,800 Original cost of equipment. 109,720 Fair value of equipment 145,600 Notes payable Expenses during 2022 Supplies on hand Common stock Retained earnings $62,400 156,000 2,600 20,800 ?arrow_forwardPlease helparrow_forwardForecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Medtronic PLC Consolidated Statement of Income $ millions, For Fiscal Year Ended April 26, 2019 Net sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expense 979 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 83 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 7,734 Other nonoperating income, net (157) Interest expense 1,444 Income before income taxes 6,447 Income tax provision 547 Net income 5,900 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $5,881…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education