FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

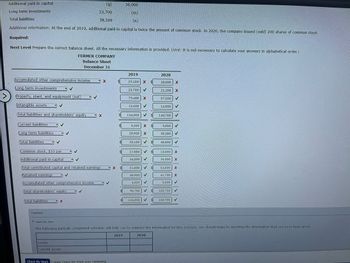

Please answer what’s in red only.

Transcribed Image Text:38,000

Additional paid-in capital

Long-term investments

(m)

Total liabilities

(n)

Additional information: At the end of 2019, additional paid-in capital is twice the amount of common stock. In 2020, the company issued (sold) 200 shares of common stock.

Required:

Next Level Prepare the correct balance sheet. All the necessary information is provided. (Hint: It is not necessary to calculate your answers in alphabetical order.)

FERMER COMPANY

Balance Sheet

December 31

Accumulated other comprehensive income

Long-term investments

Property, plant, and equipment (net)

Intangible assets

Total liabilities and shareholders' equity

Current liabilities

Long-term liabilities

Total liabilities

✓

Total liabilities

✓

Feedback

Total shareholders' equity

✓

Common stock, $10 par

Additional paid-in capital

Total contributed capital and retained earnings

Retained earnings ✓

Accumulated other comprehensive income

X

Assets

Current assets

✓

✓

✓

(g)

23,700

38,100

X

X

✓

X

Check My Work 2 more Check My Work uses remaining.

$

2019

19,100 X

23,700 ✔

79,400 X

12,600 ✔

2019

134,800 ✔

9,200 X

28,900 X

38,100 ✔

17,000 $

34,000

51,000

40,900 ✔

4,800

96,700

134,800 ✔

2020

20,000 X

21,200 X

87,500

12,000 ✓

2020

140,700

9,800

30,200

40,000

18,000 X

36,000 X

54,000 X

41,700 X

5,000 ✓

100,700

V Check My Work

The following partially completed schedule will help you to organize the information for this exercise. You should begin by inserting the information that you have been given.

140,700

✓

✓

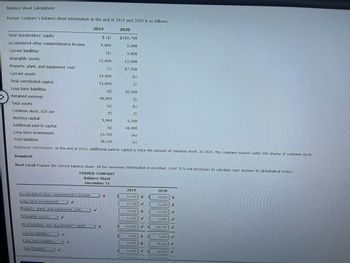

Transcribed Image Text:Balance Sheet Calculations

Fermer Company's balance sheet information at the end of 2019 and 2020 is as follows:

Total shareholders' equity

Accumulated other comprehensive income

Current liabilities

Intangible assets

Property, plant, and equipment (net)

Current assets

Total contributed capital

Long-term liabilities

Retained earnings

Total assets

Accumulated other comprehensive income

Long-term investments

Property, plant, and equipment (net)

Intangible assets

✓

Total liabilities and shareholders' equity

(h)

(i)

30,200

(i)

(k)

Common stock, $10 par

(1)

Working capital

9,200

Additional paid-in capital

38,000

Long-term investments

(m)

Total liabilities

(n)

Additional information: At the end of 2019, additional paid-in capital is twice the amount of common stock. In 2020, the company issued (sold) 200 shares of common stock.

Required:

Next Level Prepare the correct balance sheet. All the necessary information is provided. (Hint: It is not necessary to calculate your answers in alphabetical order.)

FERMER COMPANY

Balance Sheet

December 31

Current liabilities

Long-term liabilities

otal liabilities

✓

2019

✓

$ (a)

4,800

(b)

12,600

(c)

19,000

51,000

(d)

40,900

(e)

(f)

9,900

(9)

23,700

38,100

✓

X

2020

$100,700

5,000

9,800

12,000

87,500

X

2019

19,100 X

23,700 ✓

79,400 X

12,600 ✓

$ 134,800 ✓

$

9,200 X

28,900 X

38,100 ✓

$

2020

20,000 X

21,200 X

87,500

12,000

140,700 ✓

9,800 ✓

30,200

40,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In the image you can look at the question . Is asking me to choose the correct answer below and fill in the answer box to complete your choice . How can I solve this type of question ?arrow_forwardRequired information [The following information applies to the questions displayed below.] Consider the following narrative describing the process of filling a customer's order at a Starbucks branch: Identify the start and end events and the activities in the following narrative, and then draw the business process model using BPMN: the Starbucks customer entered the drive-through lane and stopped to review the menu. He then ordered a Venti coffee of the day and a blueberry muffin from the barista. The barista recorded the order in the cash register. While the customer drove to the window, the barista filled a Venti cup with coffee, put a lid on it, and retrieved the muffin from the pastry case and placed it in a bag. The barista handed the bag with the muffin and the hot coffee to the customer. The customer has an option to pay with cash, credit card, or Starbucks gift card. The customer paid with a gift card. The barista recorded the payment and returned the card along with the…arrow_forwardAnswer the following questions by writing down the correct letter next to the relevant number:arrow_forward

- How do you make a two-dimensional columnar chart in excel?arrow_forwardPlease provide the introductory part and answer for question D.arrow_forwardwhen viewing a detail level report, such as Open Invoices Report, what happens when you double click on the amount shown on any particular transaction?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education