FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

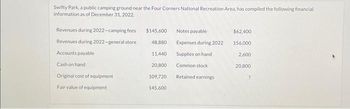

Question

Transcribed Image Text:Swifty Park, a public camping ground near the Four Corners National Recreation Area, has compiled the following financial

information as of December 31, 2022

Revenues during 2022-camping fees $145,600

Revenues during 2022-general store

48,880

Accounts payable

11,440

Cash on hand

20,800

Original cost of equipment.

109,720

Fair value of equipment

145,600

Notes payable

Expenses during 2022

Supplies on hand

Common stock

Retained earnings

$62,400

156,000

2,600

20,800

?

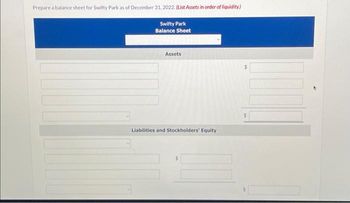

Transcribed Image Text:Prepare a balance sheet for Swifty Park as of December 31, 2022. (List Assets in order of liquidity.)

Swifty Park

Balance Sheet

Assets

Liabilities and Stockholders' Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What findings can you give about these FINANCIAL PROJECTIONS below. (Feasibilty Study)arrow_forwardA. Prepare CORIS RA Statement of Cash Flow for the year ended December 31, 2020 using the direct method B. Prepare CORIS RA Statement of Financial Performance for the year ended December 31, 2020arrow_forwardSelected information from Peridot Corporation's accounting records and financial statements for 2021 is as follows ($ in millions): Cash paid to acquire machinery Reacquired Peridot common stock $40 51 Proceeds from sale of land 97 Gain from the sale of land 46 Investment revenue received 75 Cash paid to acquire office equipment 82 In its statement of cash flows, Peridot should report net cash outflows from investing activities of: Multiple Choice 3 million. $25 million. $110 million. $105 million.arrow_forward

- The cash balance of Lalana Company is 434000OMR at the beginning of the year. The cash flows during the year are given as follows; Operating cash inflow:38490 Financing cash outflow: 22430 Investing inflow: 95800 Which of the following is the cash balance at the end of the year. Select one: a. 468890 b. 465760 C. 554520 d. 545860arrow_forwardTimmins Company of Emporia, Kansas, spreads herbicides and applies liquid fertilizer for local farmers. On May 31, 2022, the company's Cash account per its general ledger showed a balance of $6,738.90. The bank statement from Emporia State Bank on that date showed the following balance. EMPORIA STATE BANK Checks and Debits Deposits and Credits Daily Balance XXX XXX 5-31 6,968.00 A comparison of the details on the bank statement with the details in the Cash account revealed the following facts. 1. The statement included a debit memo of $40.00 for the printing of additional company checks. Cash sales of $883.15 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit slip were incorrectly made for $933.15. The bank credited Timmins Company for the correct amount. 2. 3. Outstanding checks at May 31 totaled $276.25, and deposits in transit were $1,880.15. On May 18, the company issued check No. 1181 for $685.00 to H. Moses, on account. The check, which cleared…arrow_forwardSydMel Ltd Statement of financial position As of 30 June 2020. 2020 2019 Assets Cash at Bank 18000 - Account Receivable 34000 28000 Inventories 112000 96000 Land 40000 80000 Buildings 120000 120000 Accumulated depreciation-Buildings (10000) (6000) Equipment 72000 60000 Accumulated depreciation-Equipment (30000) (18000) Total assets 356000 360500 Liabilities Account Payables 52000 48000 Bank Overdraft - 20000 Equity Share Capital 214000 200000 Retained Earnings 90000 92500 Total liabilities and equity 356000 360500 SydMel Ltd Statement of profit and loss and other comprehensive income For the year ended 30 June 2020. 2020 income $ $ Sales revenue - 445500 Less: expenses Cost of sales 288000 Employee expenses 78000 Interest expenses 5000 Loss on…arrow_forward

- 9.Hong Kong Clothiers reported revenue of $5,150,000 for its year ended December 31, 2021. Accounts receivable at December 31, 2020 and 2021, were $321,400 and $354,300, respectively. Using the direct method for reporting cash flows from operating activities, Hong Kong Clothiers would report cash collected from customers of: Group of answer choices $5,117,100 $5,150,000 $5,192,900 $5,182,900arrow_forwardUpton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers. Upton's balance sheet as of December 31, 2019, is shown here (millions of dollars): Cash Receivables Inventories 5 Total current assets. Net fixed assets million % $3.5 26.0 58.0 $87.5 35.0 Accounts payable Notes payable Line of credit Accruals Total current liabilities. Mortgage loan Common stock Retained earnings Total assets $122.5 Total liabilities and equity Sales for 2019 were $375 million and net income for the year was $11.25 million, so the firm's profit margin was 3.0%. Upton paid dividends of $4.5 million to common stockholders, so its payout ratio was 40%. Its tax rate was 25%, and it operated at full capacity. Assume that all assets/sales ratios, (spontaneous liabilities)/sales ratios, the profit margin, and the payout ratio remain constant in 2020. Do…arrow_forwardThis fourth, and final, project for the semester will involve the following items to turn in: 1) A statement of cash flows from information I will provide you. You can turn in the information in excel, best choice, word or hand written and scanned. All files need to be uploaded to this assignment.arrow_forward

- The following information on selected cash transactions for 2021 has been provided by Ehrlich Company: Proceeds from sale of land $300,000 Proceeds from long-term borrowings 600,000 Purchases of plant assets 216,000 Purchases of inventories 1,020,000 Proceeds from sale of Ehrlich common stock 360,000 What is the cash provided (used) by investing activities for the year ended December 31, 2021, as a result of the above information? Group of answer choices $84,000 $684,000 $315,000 $1,044,000arrow_forwardSelected financial data for Surf City and Paradise Falls are as follows: ($ in millions) Surf City Surf City Paradise Falls Paradise Falls 2021 2020 2021 2020 Total assets $16,103 $14,862 $32,816 $34,061 Total liabilities 9,780 8,165 13,398 14,158 Total stockholders’ equity 6,323 6,697 19,418 19,903 Sales revenue $6,473 14,586 Interest expense 309 402 Tax expense 41 Net income 562 2,318 1-a. Calculate the debt to equity ratio for Surf City and Paradise Falls for the most recent year. (Do not round intermediate calculations. Round ratios answers to 2 decimal places. Enter your answer in millions. (i.e., $5,500,000 should be entered as 5.5)) Debt to Equity Ratio Surf City = Paradise Falls = 2-a. Calculate the return on assets for Surf City and Paradise Falls. (Do not round intermediate calculations. Round ratios answers to 2 decimal places. Enter your answer in…arrow_forwardBalance Sheet for Bearcat Hathaway, 2022 2021 2022 Cash Accounts Receivable Inventory Current Assets Accum.Depreciation Net Fixed Assets Gross Fixed Assets $16,251,665 $20,567,330 Less $7,460,897 $10,117,819 Total Assets O 11.58% O 44.90% O 8.37% $5,268,485 $10,268,485 O 4.35% $2,574,230 $2,314,672 O 6.02% $529,062 $696,685 $8,371,777 $13,279,842 Total Liabilities and Equity What is the common size value for 2022 Notes Payable? $8,790,768 $10,449,511 $17,162,545 $23,729,353 Current Liabilities 2021 Accounts Payable Notes Payable $1,033,110 $1,987,233 2022 $1,673,992 $2,438,271 $2,707,102 $4,425,504 Long Term Debt $9,242,830 $11,468,302 Total Liabilities $11,949,932 $15,893,806 Common Stock ($0.50 par) $1,300,000 $1,600,000 Capital Surplus $1,148,120 $1,800,969 Retained $2,764,493 $4,434,578 Earnings $17,162,545 $23,729,353arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education