FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

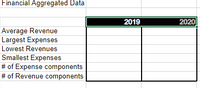

Using functions , complete the “Aggregated Data” worksheet using the “Statement

of Income” worksheet.

Transcribed Image Text:Financial Aggregated Data

2019

2020

Average Revenue

Largest Expenses

Lowest Revenues

Smallest Expenses

# of Expense components

# of Revenue components

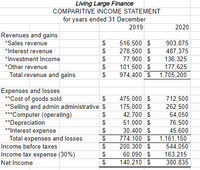

Transcribed Image Text:Living Large Finance

COMPARITIVE INCOME STATEMENT

for years ended 31 December

2019

2020

Revenues and gains

*Sales revenue

$

516,500 $

278,500 $

77,900 $

101,500 $

974,400 $

903,875

487,375

136,325

177,625

*Interest revenue

$

*Investment Income

$

*Other revenue

$

Total revenue and gains

$

1,705,200

Expenses and losses

**Cost of goods sold

**Selling and admin administrative $

***Computer (operating)

**Depreciation

**Interest expense

$

475,000 $

175,000 $

712,500

262,500

64,050

76,500

45,600

1,161,150

544,050

$

42,700 $

51,000 $

30,400 $

774,100 $

$

$

Total expenses and losses

Income before taxes

Income tax expense (30%)

2$

200,300 $

60,090 $

140,210 $

$

163,215

Net Income

$

380,835

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Why are denormalized tables used in data ware-houses?arrow_forwardBriefly explain the relationship between assets, liabilities, and revenue.arrow_forwardanalyze the use of the assets of Facebook please. Please include two ratios, Asset Turnover and Return on Assets. These ratios need to incorporate all assets on the balance sheet.arrow_forward

- Identify the items from the following list that are likely to serve as source documents. Item a. Sales receipt b. Liability accounts c. Balance sheet d. Ledger e. Bank statement f. General journal g. Income statement h. Telephone bill i. Credit card receipt Is this a source document?arrow_forwardWhich type of debit account is balanced in the income statement columns of a worksheet?arrow_forwardList the steps we use to measure external transactions.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education