FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

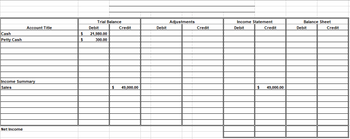

- Prepare a worksheet for Brown’s Plumbing and Heating.

- Write the heading for the worksheet for the fiscal period ending December 31, 20xx.

- Record the

trial balance using the accounts and their balances from the Ledger tab. Some are done for you. - Calculate and record the Supplies adjustment. There is $5,600.00 in supplies on hand at the end of the fiscal year.

- Calculate and record the Insurance adjustment. There is $900.00 of insurance coverage left at the end of the fiscal year.

- Prove the Adjustments columns.

- Extend all

balance sheet account balances. - Extend all income statement account balances.

- Calculate and record the net income or loss.

- Total and rule the Income Statement and Balance Sheet columns.

Transcribed Image Text:ACCOUNT Cash

DATE

Dec.

ACCOUNT Petty Cash

DATE

31

Dec. 31

DATE

ACCOUNT Accounts Receivable

Dec. 31

ACCOUNT Supplies

DATE

Dec.

ACCOUNT Insurance

DATE

=

Dec. 4

ITEM

ITEM

DATE

Dec. 1

ITEM

ITEM

ACCOUNT Accounts Payable

ITEM

DATE

Dec. 31

ACCOUNT Ray Brown, Capital

ITEM

ITEM

POST

REF

DEBIT

2 $35,640.00

2

POST

REF

2 $ 300.00

POST

REF

DEBIT

DEBIT

2$ 6,250.00

POST

REF. DEBIT

POST

REF. DEBIT

$ 12,100.00

1$ 3,500.00

POST.

REF.

POST.

REF. DEBIT

1

ill

DENT

ACCOUNT NO

CREDIT DEBIT CREDIT

$35,640.00

$13,660.00 $21.980.00

CREDIT

ACCOUNT NO.

BALANCE

CREDIT DEBIT CREDIT

$ 300.00

BALANCE

ACCOUNT NO. 130

BALANCE

CREDIT

ACCOUNT NO. 140

$ 6.250.00

DEBIT CREDIT

CREDIT DEBIT CREDIT

|$ 12,100.00

ACCOUNT NO.

BALANCE

BALANCE

CREDIT

$10,000.00

DEBR

$3,600.00

ACCOUNT NO. 210

BALANCE

110

CREDIT

CREDIT DEBIT CREDE

$ 1,100.00

$1,100.00

DEBIT

150

120

ACCOUNT NO. 310

BALANCE

CREDIT

$10,000.00

ACCOUNT Ray Brown, Drawing

DATE

Dec.

ACCOUNT Income Summary

DATE

ACCOUNT Sales

DATE

Dec. 31

ITEM

DATE

Dec. 9

ITEM

ACCOUNT Advertising Expense

ITEM

ITEM

POST

REF. DEBIT

1$ 7,000.00

POST

REF. DEBIT

POST

REF. DEBIT

2

POST.

REF.

DEBIT

1$ 2,530.00

ACCOUNT NO.

CREDIT

CREDIT

ACCOUNT NO.

CREDIT

BALANCE

$49,000.00

DEBIT

$ 7,000.00

CREDIT

BALANCE

DEBIT

ACCOUNT NO. 410

DEBIT

ACCOUNT NO.

CREDIT

BALANCE

320

CREDIT

DEBIT

$ 2,530.00

BALANCE

CREDIT

$49,000.00

510

CREDIT

ACCOUNT Insurance Expense

DATE

ACCOUNT Miscellaneous Expense

DATE

I

Dec.

DATE

ACCOUNT Supplies Expense

9

DATE

ITEM

Dec.

ACCOUNT Utilities Expense

ITEM

9

ITEM

ITEM

POST

REF.

POST

REF DEBIT

DEBIT

1$ 780.00

POST.

REF. DEBIT

POST

REF

DEBIT

$ 5.560.00

1$

ACCOUNT NO.

CREDIT

CREDIT

BALANCE

ACCOUNT NO. 530

CREDIT

DEBIT CREDIT

CREDIT

BALANCE

ACCOUNT NO.

520

DEBIT CREDIT

$ 780.00

BALANCE

540

DEBIT CREDIT

ACCOUNT NO. 550

BALANCE

DEBIT

$ 5,560.00

CREDIT

Transcribed Image Text:Cash

Petty Cash

Account Title

Income Summary

Sales

Net Income

$

$

Trial Balance

Debit

21.980.00

300.00

$

Credit

49,000.00

Debit

Adjustments

Credit

Income Statement

Debit

Credit

$ 49,000.00

Balance Sheet

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Use the appropriate formula located on Illustration 10-1 on page 209 to solve the problem. At the end of every 3 months, Teresa deposits $1500 into an account that pays 6% compounded quarterly for 4 years. A) When this certificate matures, how much will Teresa have accumulated B) How much interest did Teresa earn? Show the use of the appropriate formulas for each part by indicating the evaluation of the formula with the information and provide the answer. Be sure to label the parts using the provided letters and organize your work neatly.arrow_forwardMiguel purchased a hot tub costing $5,070 by taking out an installment loan. He made a down payment of $1,300 and financed the balance for 24 months. If the payments are $171.77 each month, use the APR formula to find the APR. Round to the nearest hundredth of a percent. % Need Help? Read It Watch It Master Itarrow_forwardChris opena a chiropractie office in Houston on January 1, 2018. In 2018, Chris drives a total of 4,200 miles from his office to elients' homes to do chiropraetie adjustments. In addition, he driven a total of 3,000 miles for commuting between his home and his ofice in 2018. He elects to use the standard mileage method. Oa January 1, 2018, Chris purchases an annual subscription to a chiropractic journal for $200 and a l-year medical reference service for $500. Calculate Chris's deduction for the above items for the 2018 tax year.arrow_forward

- Miguel purchased a hot tub costing $5,030 by taking out an installment loan. He made a down payment of $1,300 and financed the balance for 24 months. If the payments are $175.77 each month, use the APR formula to find the APR. Round to the nearest hundredth of a percent.arrow_forwardKemiah has the following insurance information from her employer: Premium: $200/month Deductible: $150 Tier 1: $10 Tier 2: $20 Tier 3: $40 She has never filled a prescription before, and brought her script for phentermine 37.5 mg to the pharmacy for processing. The pharmacy technician at the window informs Kemiah that this drug is not covered, and has a cash price of $37.22. Assuming she has paid the premium for her insurance to be active, what will she have ended up paying for the drug that month, all costs included? O a. $37.22 Ob. $200 O c. $150 O d. $237.22arrow_forwardI'm working on a project in accounting..I'm trying to figure out which expenses are considered medical... The Bryds had the following medical expenses for 2019: Medical insurance premiums....4500 Doctor bill for Sam incurred in 2018 and not paid until 2019...7600 Operation for Sam...8500 Prescription medicines for Sam....900 Hospital expenses for Sam....3500 Reimbursement from insurance company received in 2019.....3600 Also what is considered gifts to charity? What falls under that umbrella?arrow_forward

- Paul's Pool Service provides pool cleaning, chemical application, and pool repairs for residential customers. Clients are billed weekly for services provided and usually pay 50 percent of their fees in the month the service is provided. In the month following service, Paul collects 40 percent of service fees. The final 10 percent is collected in the second month following service. Paul purchases his supplies on credit and pays 50 percent in the month of purchase and the remaining 50 percent in the month following purchase. Of the supplies Paul purchases, 85 percent is used in the month of purchase, and the remainder is used in the month following purchase. The following information is available for the months of June, July, and August, which are Paul's busiest months: ⚫ June 1 cash balance $16,000. ⚫ June 1 supplies on hand $4,400. ⚫ June 1 accounts receivable $9,100. • June 1 accounts payable $4,300. • Estimated sales for June, July, and August are $27,300, $41,000, and $43,900,…arrow_forwardMai earned a gross weekly income of $464.00 the first week of January. Using a 6.2% FICA Social Security rate and a 1.45% FICA Medicare rate, calculate Mai's FICA tax for this week.arrow_forwardA patient's total surgery charges are $1,278. The patient must pay the annual deductible of $1,000, and the policy states a 80-20 coinsurance. What does the patient owe?arrow_forward

- Paul’s Pool Service provides pool cleaning, chemical application, and pool repairs for residential customers. Clients are billed weekly for services provided and usually pay 50 percent of their fees in the month the service is provided. In the month following service, Paul collects 40 percent of service fees. The final 10 percent is collected in the second month following service. Paul purchases his supplies on credit and pays 50 percent in the month of purchase and the remaining 50 percent in the month following purchase. Of the supplies Paul purchases, 85 percent is used in the month of purchase, and the remainder is used in the month following purchase. The following information is available for the months of June, July, and August, which are Paul’s busiest months: June 1 cash balance $16,000. June 1 supplies on hand $4,400. June 1 accounts receivable $9,100. June 1 accounts payable $4,300. Estimated sales for June, July, and August are $27,300, $41,000, and $43,900, respectively.…arrow_forwardPlease help me do a general journal entry for this scenario: Scott Blout takes a year end distribution form the Business of $5,000.arrow_forwardRonald started his new job as a controller with Aerosystems today. Carole, the employee benefits clerk, gave Ronald a packet that contained information on the company’s health insurance options. Aerosystems offers its employees the choice between a private insurance company plan (Blue Cross or Blue Shield), an HMO, and a PPO. Ronald needs to review the packet and make a decision on which health care program best fits his needs. The following is an overview of that information. The monthly premium cost for Ronald for the Blue Cross or Blue Shield plan will be $48.32. For all doctor's office visits, prescriptions, and major medical charges, Ronald will be responsible for 20 percent and the insurance company will cover 80 percent of the covered charges. The annual deductible is $500. The HMO is provided to employees free of charge. The copayment for doctors’ office visits and major medical charges is $25. Prescription copayments are $30. The HMO pays 100 percent after Ronald’s…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education