Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

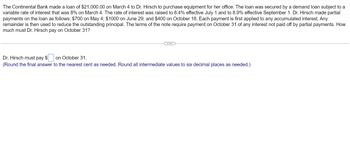

Transcribed Image Text:The Continental Bank made a loan of $21,000.00 on March 4 to Dr. Hirsch to purchase equipment for her office. The loan was secured by a demand loan subject to a

variable rate of interest that was 8% on March 4. The rate of interest was raised to 8.4% effective July 1 and to 8.9% effective September 1. Dr. Hirsch made partial

payments on the loan as follows: $700 on May 4; $1000 on June 29; and $400 on October 18. Each payment is first applied to any accumulated interest. Any

remainder is then used to reduce the outstanding principal. The terms of the note require payment on October 31 of any interest not paid off by partial payments. How

much must Dr. Hirsch pay on October 31?

Dr. Hirsch must pay $ on October 31.

(Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- University at student supplies needs funds to obtain books before the start of the semester. The store manager signed a promissory note with a face value of 28,080. Find the ordinary interest rate if the interest charges over 180 days are 780.arrow_forwardA credit card bill for $562 was due on September 14. Purchases of $286 were made on September 19, and $18 was charged on September 28. A payment of $350 was made on September 25. The annual interest on the average daily balance is 21.5%. Find the finance charge due (in dollars) on the October 14 bill. (Use 365 for the number of days in a year. Round your answer to the nearest cent.)arrow_forwardRosewood Company made a loan of $7,000 to one of the company's employees on April 1, Year 1. The one-year note carried a 6% rate of interest. What is the amount of interest revenue that Rosewood would report in Year 1 and Year 2, respectively? Multiple Choice O O $420 in Year 1 and $0 in Year 2 $0 in Year 1 and $420 in Year 2 $105 in Year 1 and $315 in Year 2 $315 in Year 1 and $105 in Year 2arrow_forward

- Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank in the amount of $670,000. The terms of the loan are 3.8% annual interest rate and payable in 8 months. Interest is due in equal payments each month. A. Compute the interest expense due each month. If required, round final answer to two decimal places. B. Show the journal entry to recognize the interest payment on October 20, and the entry for payment of the short-term note and final interest payment on May 20. If required, round final answers to two decimal places. If an amount box does not require an entry, leave it blank. Oct. 20 May 20arrow_forwardOn March 8, Manuel borrowed $720.00 from his uncle at 4.3% per annum calculated on the daily balance. He gave his uncle six cheques for $110.00 dated the 8th of each of the next six months starting April 8 and a cheque dated October 8 for the remaining balance to cover payment of interest and repayment of principal. Construct a complete repayment schedule for the loan including totals for Amount Paid, Interest Paid, and Principal Repaid. Complete the repayment schedule below. (Round to the nearest cent as needed.) Balance Before Payment Amount Paid Balance After Payment Payment Number O Mar. 8 Interest Paid Principal Repaid $720.00 1 Apr. 8 $720.00 $110.00 2 May 8 $110.00 3 June 8 $110.00 4 July 8 $110.00 5 Aug. 8 $110.00 6 Sept. 8 $110.00 7 Oct. 8 $0.00 Totals:arrow_forward11). rosewood company made a loan of $12,600 to one of the company's employees on april 1, year 1. the one-year note carried a 6% rate of interest. what is the amount of interest revenue that rosewood would report in year 1 and year 2 respectively?arrow_forward

- Rosewood Company made a loan of $12,200 to one of the company's employees on April 1, Year 1. The one-year note carried a 6% rate of interest. What is the amount of interest revenue that Rosewood would report in Year 1 and Year 2, respectively? Multiple Choice $0 in Year 1 and $732 in Year 2 $732 in Year 1 and $0 in Year 2 $183 in Year 1 and $549 in Year 2 $549 in Year 1 and $183 in Year 2arrow_forwardThe Continental Bank made a loan of $ 24 comma 000.00 on March 10 to Dr. Hirsch to purchase equipment for her office. The loan was secured by a demand loan subject to a variable rate of interest that was 5% on March 10. The rate of interest was raised to 5.25% effective July 1 and to 5.75% effective September 1. Dr. Hirsch made partial payments on the loan as follows: $1000 on May 24; $700 on June 28; and $300 on October 22. Each payment is first applied to any accumulated interest. Any remainder is then used to reduce the outstanding principal. The terms of the note require payment on October 31 of any interest not paid off by partial payments. How much must Dr. Hirsch pay on October 31 ? Question content area bottom Part 1 Dr. Hirsch must pay $ enter your response here on October 31. (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardThe Tomac Swim Club arranged short-term financing of $13,000.00 on July 19 with the Bank of Commerce and secured the loan with a demand note. The club repaid the loan by payments of $6100 on September 13, $3200 on November 25, and the balance on December 30. Interest, calculated on the daily balance and charged to the club's current account on the last day of each month, was at 6% per annum on July 19. The rate was changed to 6.5% effective September 1 and to 5.5% effective December 1. How much interest was paid on the loan? The total interest paid was S (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education