FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

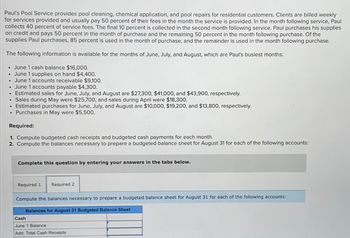

Transcribed Image Text:Paul's Pool Service provides pool cleaning, chemical application, and pool repairs for residential customers. Clients are billed weekly

for services provided and usually pay 50 percent of their fees in the month the service is provided. In the month following service, Paul

collects 40 percent of service fees. The final 10 percent is collected in the second month following service. Paul purchases his supplies

on credit and pays 50 percent in the month of purchase and the remaining 50 percent in the month following purchase. Of the

supplies Paul purchases, 85 percent is used in the month of purchase, and the remainder is used in the month following purchase.

The following information is available for the months of June, July, and August, which are Paul's busiest months:

⚫ June 1 cash balance $16,000.

⚫ June 1 supplies on hand $4,400.

⚫ June 1 accounts receivable $9,100.

•

June 1 accounts payable $4,300.

• Estimated sales for June, July, and August are $27,300, $41,000, and $43,900, respectively.

Sales during May were $25,700, and sales during April were $18,300.

. Estimated purchases for June, July, and August are $10,000, $19,200, and $13,800, respectively.

.

Purchases in May were $5,500.

Required:

1. Compute budgeted cash receipts and budgeted cash payments for each month.

2. Compute the balances necessary to prepare a budgeted balance sheet for August 31 for each of the following accounts:

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Compute the balances necessary to prepare a budgeted balance sheet for August 31 for each of the following accounts:

Cash

Balances for August 31 Budgeted Balance Sheet

June 1 Balance

Add: Total Cash Receipts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Brandon, the Manager, who earns a salary of $52,000 per year or $1,000 per week, Clarissa, the Sales Coordinator, who is paid $20 per hour, and David, the Shipper, who is paid $.20 per package shipped. Alan pays his employees every week and, this past week, Brandon worked all five scheduled days, Clarissa worked fifty (50) hours, and David shipped 4,500 packages. Record/journalize the employees' payroll entry (pay attention to what's asked for) by function (Management Salary Expense, Sales Wage Expense, & Shipping Wage Expense) now for the paychecks that will be issued this coming Friday, which will be the first time the employees are paid this calendar year. All the employees want 20% of their earnings withheld for Federal Income Tax purposes. The tax rates are: 6.2% FICA Social Security State Unemployment 5.4% Medicare 1.45% Federal Unemployment 0.6% Book the taxes you withhold as one entry for all three employees, not separate entries for each employee.arrow_forwardBetsy's Gift Baskets sells gift baskets, on average, for $125; each gift basket costs, on average, $60. Betsy pays salaries each month of $1,300 and her store rent is $1,000 per month. She also pays sales commissions of 5% of the sales price. In May, 140 gift baskets were sold. Required: a. Prepare a traditional income statement for the month of May. b. Prepare a contributioarrow_forwardJason Rogers works full-time for UPS and runs a lawn-mowing service part-time after work during the warm months of April through October. Jason has three men working with him, each of whom is paid $6.00 per lawn mowing. Jason has 27 residential customers who contract with him for once-weekly lawn mowing during the months of May through September, and twice-per-month mowings during April and October. On average, Jason charges $48 per lawn mowed. Recently, LStar Property Management Services asked Jason to mow the lawn at each of its 30 rental houses every two weeks during the months of May through September. LStar has offered to pay $30 per lawn mowing, and would forego the lawn edging that normally takes Jason’s team about half of its regular mowing time. If Jason accepts the job, he can assign a two-man team to mow the rental house yards, and will have to buy an additional power lawn mower for about $360 used. Fuel to run the additional mower will be about $0.40 per yard. 1. If Jason…arrow_forward

- For large repair jobs, Joe the Plumber requires his customers to put down a 20% deposit one week in advance of the work’s completion. On January 15th, Joe receives $100 from a customer as a deposit for work to be later completed. What is the associated journal entry for this transaction?arrow_forwardMia works in both the jewelry department and the cosmetics department of a retail store. She assists customers in both departments and organizes merchandise in both departments. The store allocates her wages between the two departments based on the time worked in the two departments in each two-week pay period. Mia reports the following hours and activities spent in the two departments in the most recent two weeks. Allocate Mia's $2,400 of wages for two weeks to the two departments. Activities Selling in jewelry department Organizing in Jewelry department Selling in cosmetics department Organizing in Cosmetics department Total Department Hours worked Jewelry Cosmetics Totals Hours 39 18 14 5 76 Percent of Hours worked Numerator Denominator Percent of hours Wages Cost Allocatedarrow_forwardPatricia's Quilt Shoppe sells homemade Amish quilts. Patricia buys the quilts from local Amish artisans for $220 each, and her shop sells them for $370 each. She also pays a sales commission of 4% of sales revenue to her sales staff. Patricia leases her country-style shop for $800 per month and pays $1,600 per month in payroll costs in addition to the sales commissions. Patricia sold 95 quilts in February. Prepare Patricia's traditional income statement and contribution margin income statement for the month. Prepare the traditional income statement for the month. Patricia's Quilt Shoppe Income Statement For the Month Ended February 28 Less: Less: Aarrow_forward

- Romano Services provides room cleaning arrangements for hotels in Ohio. On April 1, Silvia Hotels & Resorts signed an agreement to outsource its room-cleaning functions to Romano. The contract specifies the service fee to be $23,500 per month, and all payments are to be made shortly after the end of each quarter. It also specifies that Romano will receive an additional quarterly bonus of $8,100 if, during that quarter, Silvia receives no more than five complaints from customers about room cleanliness. On April 1, based on historical experience, Romano estimated that there is a 75% chance that it will receive the quarterly bonus. On May 5, Romano learned that, during March, there were two complaints from customers related to room cleanliness. Based on this new information, Romano revised its estimate downward to 40% that it would be entitled to receive the quarterly bonus. On June 30, Silvia notified Romano that, for the quarter ended, there were four complaints associated with…arrow_forwardJane budgets 9% of her net salary for groceries. If she spent $450 on groceries last month, what is her monthly net salary?arrow_forwardJosh is a corporate account manager at a company that sells musical instruments to other businesses. He receives a monthly salary of $1,500 plus commission on any new sales that he makes as part of his daily interactions with his customers. If Josh's sales were $67,000 last month and he earned $3,041, what is his commission rate? Note: Please make sure your final answer(s) are in percentage form and are accurate to 2 decimal places. For example 34.56% Commission rate = 0.00 %arrow_forward

- Avon Corporation sells phone cases to public and private companies. They are located at 123 Locus Rd, Markham, ON. They employ 200 full time employees who work in sales, customer service and office support roles. They have had an annual remuneration of over $1,000,000 for the past several years therefore their EHT rate is 1.95%. Pay period #1 started December 27, 2020. All are paid on a bi-weekly basis. All benefits are processed each pay on an as enjoyed basis. The first pay day for employees is Jan 13, 2021. They have three staff in the Customer Service Department answering questions from clients and the general public. They all work Monday to Friday and do not work statutory holidays but are paid for them. Neema has been with Avon for 3 years and answers calls specifically from clients. She earns $18.25 per hour and works 35 hours per week. She also does not work any overtime. She is paid bi-weekly. Her employer provides the following: · Health and Dental - at a total…arrow_forwardBea owner of an automotive dealership, pays one of the salesman, mike a $1,300 draw per week plus 6% on all commissions sales. Mike sold seven cars over the four week period, totaling $186,900 for the month. mike's commission minus the draw is:arrow_forwardCIA Review, Incorporated, provides review courses twice each year for students studying to take the CIA exam. The cost of textbooks Is Included in the registration fee. Text material requires constant updating and is useful for only one course. To minimize printing costs and ensure availability of books on the first day of class, CIA Review has books printed and delivered to its offices two weeks in advance of the first class. To ensure that enough books are available, CIA Review normally orders 10 percent more than expected enrollment. Usually there is an oversupply and books are thrown away. However, demand occasionally exceeds expectations by more than 10 percent and there are too few books available for student use. CIA Review has been forced to turn away students because of a lack of textbooks. CIA Review expects to enroll approximately 400 students per course. The tuition fee is $2,500 per student. The cost of teachers is $45,000 per course, textbooks cost $180 each, and other…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education