FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

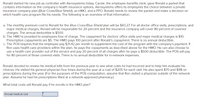

Transcribed Image Text:Ronald started his new job as controller with Aerosystems today. Carole, the employee benefits clerk, gave Ronald a packet that

contains information on the company's health insurance options. Aerosystems offers its employees the choice between a private

insurance company plan (Blue Cross/Blue Shield), an HMO, and a PPO. Ronald needs to review the packet and make a decision on

which health care program fits his needs. The following is an overview of that information.

a. The monthly premium cost to Ronald for the Blue Cross/Blue Shield plan will be $43.27. For all doctor office visits, prescriptions, and

major medical charges, Ronald will be responsible for 20 percent and the insurance company will cover 80 percent of covered

charges. The annual deductible is $500.

b. The HMO is provided to employees free of charge. The copayment for doctors' office visits and major medical charges is $10.

Prescription copayments are $5. The HMO pays 100 percent after Ronald's copayment. There is no annual deductible.

c. The POS requires that the employee pay $31.42 per month to supplement the cost of the program with the company's payment. If

Ron uses health care providers within the plan, he pays the copayments as described above for the HMO. He can also choose to

use a health care provider out of the service and pay 20 percent of all charges after he pays a $500 deductible. The POS will pay

for 80 percent of those covered visits. There is no annual deductible for in-network expenses.

Ronald decided to review his medical bills from the previous year to see what costs he had incurred and to help him evaluate his

choices. He visited his general physician four times during the year at a cost of $205 for each visit. He also spent $70 and $98 on

prescriptions during the year. (For the purposes of the POS computation, assume that Ron visited a physician outside of the network

plan. Assume he had his prescriptions filled at a network-approved pharmacy.)

What total costs will Ronald pay if he enrolls in the HMO plan?

Annual medical cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kemiah has the following insurance information from her employer: Premium: $200/month Deductible: $150 Tier 1: $10 Tier 2: $20 Tier 3: $40 She has never filled a prescription before, and brought her script for phentermine 37.5 mg to the pharmacy for processing. The pharmacy technician at the window informs Kemiah that this drug is not covered, and has a cash price of $37.22. Assuming she has paid the premium for her insurance to be active, what will she have ended up paying for the drug that month, all costs included? O a. $37.22 Ob. $200 O c. $150 O d. $237.22arrow_forwardVaibhavarrow_forwardPersonally Established Retirement Accounts These days, almost anyone can open personal, tax-sheltered retirement accounts whether or not they're enrolled in a plan at work. Terms and provisions vary among plans, so it pays to do some homework before deciding which is best for your circumstances and goals. To help you focus on the aspects of different plans, answer the following questions. Madeline is a sole proprietor. She wants to create a retirement plan that requires the least amount of setup and maintenance effort. What type of plan is Madeline most likely going to open? SEP-IRA О Кеogh Chun is a small-business owner. She wants to create a profit-sharing or money-purchase retirement plan. What type of plan is Chun most likely going to open? SEP-IRA О Кеogh Alison is 58 years old and opened a traditional IRA when she was 53. Alison earns less than $100,000 per year. Her contribution for this year is $7,000. This contribution is made entirely with: pretax dollars. O after-tax…arrow_forward

- Wanda gets her health insurance covered in an employee benefits package. Her employer pays 45% of her annual premium for basic health insurance, and 35% for dental and vision insurance. Iif the health insurance premium is $11.540, and the vision and dental are together $1.230 annually. What is the total amount Wanda pays for insurance each year? Select one O a $8,362 Ob. 57,146.50 c. $8.300,50 d. $7,200arrow_forwardIsis quit her job at A Corp. While at A Corp., Isis was enrolled in their group health insurance plan. Now, Isis works for C Corp., which also has a group insurance plan. According to the Health Insurance Portability and Accountability Act, C Corp. must ______. a. pay A Corp. so that Isis can maintain her health insurance through A Corp b. wait to enroll Isis in C Corp.'s plan until she has been employed with the company for 1 year c. reimburse Isis for any out-of-pocket expenses she incurred while unemployed d. allow her to participate in the company group health insurance planarrow_forwardRonald started his new job as a controller with Aerosystems today. Carole, the employee benefits clerk, gave Ronald a packet that contained information on the company’s health insurance options. Aerosystems offers its employees the choice between a private insurance company plan (Blue Cross or Blue Shield), an HMO, and a PPO. Ronald needs to review the packet and make a decision on which health care program best fits his needs. The following is an overview of that information. The monthly premium cost for Ronald for the Blue Cross or Blue Shield plan will be $48.32. For all doctor's office visits, prescriptions, and major medical charges, Ronald will be responsible for 20 percent and the insurance company will cover 80 percent of the covered charges. The annual deductible is $500. The HMO is provided to employees free of charge. The copayment for doctors’ office visits and major medical charges is $25. Prescription copayments are $30. The HMO pays 100 percent after Ronald’s…arrow_forward

- Dengararrow_forwardThe Affordable Care Act (ACA) requires large employers to provide a minimum level of health insurance coverage to employees or face significant tax penalties. According to the ACA, a large employer is a company who, at any point during the year, employs at least: 40 people 50 people. 100 people. 25 people.arrow_forwardPlease help me. Thankyou.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education