FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

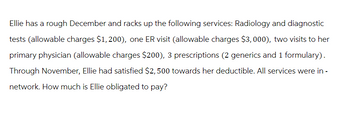

Transcribed Image Text:Ellie has a rough December and racks up the following services: Radiology and diagnostic

tests (allowable charges $1, 200), one ER visit (allowable charges $3,000), two visits to her

primary physician (allowable charges $200), 3 prescriptions (2 generics and 1 formulary).

Through November, Ellie had satisfied $2,500 towards her deductible. All services were in -

network. How much is Ellie obligated to pay?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Ms. Daphnee Rosagas needs 5,500 on August 19, 1991 for her children's school expenses. She plans to repay the money on December 6, 1991. What size of loan should she request from the Employees Credit Cooperative if the interest in advance is 6 3/8% (Simple Discount)arrow_forward3. On December 30, Nancy Sheridan hired an employee, Tom Shanahan, to help her with the medical billing. His first weekly pay period ends January 7 and he will be paid on January 14. He earns $17.25 per hour. During the 40-hour weekly pay period, Tom worked 48 hours. His Federal income tax is $122. Social Security tax is 6.2% and Medicare tax is 1.45%. a. Compute Tom's pay as of January 7. Regular earnings Date Overtime earnings Gross pay (Wages Expense) b. Record the General Journal entry for Tom's January 7 pay. Date Description Social Federal income tax Security payable tax payable Description Debit Medicare tax payable c. The FUTA rate for Sheridan is 0.6% and the SUTA rate is 5.4%. Record the General Journal entry for the January 14 employer's share payroll taxes. Debit Credit Net pay (Wages payable) Creditarrow_forwardCheck my work Ariana's health Insurance policy includes a deductible of $1,050 and a coinsurance provision requiring her to pay 20 percent of all bils. Her total bill is $8,700. What is Ariana's total cost? (Do not round intermediate calculations.) Imsured's cotarrow_forward

- John Klos was in the hospital for 15 days, the total bill was $152,000. Then John spent an additional 10 days in rehab which cost $200 a day. John earns $2,700 a month John missed 1 month of work (23 days) John has health insurance from work with a $500 deductible and $1,500 coinsurance cap John has 1 month of sick days (23 days) No, long-tern heath care or disability income insurance How much of this person’s direct medical expenses was paid by the insurance company? What did they have to pay for the rehab? How much income was lost?arrow_forwardAli is a member of a family that consists of him, his father, his mother and his older brother. Each member of the family has his own mobile phone. Each mobile phone is on a post-paid plan, for which a monthly bill is received at the end of each month. The electricity, on the other hand, is provided to the entire house in general, with one bill is received at the end of each month. The father has recently received the electricity bill for the month. and wishes to do some analysis of electricity consumption. Assuming that the value of the electricity bill is calculated based on a constant monthly subscription fee. In the above information, the cost of electricity to Ali is: a. A direct fixed cost O b. A direct, variable cost OC. An indirect fixed cost d. An indirect, variable cost e. An indirect mixed cost O O O Oarrow_forwardJenna bought a new car for $39,000. She paid a 10% down payment and financed the remaining balance for 48 months with an APR of 4.5%. Determine the monthly payment that Jenna pays. Round your answer to the nearest cent, if necessary.arrow_forward

- Jill Walsh purchases a bedroom set for a cash price of $3,920. The down payment is $392, and the monthly installment payment is $176 for 24 months. Find (a) the amount financed, (b) the finance charge, and (c) the deferred payment price.arrow_forwardAli is a member of a family that consists of him, his father, his mother and his older brother. Each member of the family has his own mobile phone. Each mobile phone is on a post-paid plan, for which a monthly bill is received at the end of each month. The electricity, on the other hand, is provided to the entire house in general, with one bill is received at the end of each month. The father has recently received the electricity bill for the month. and wishes to do some analysis of electricity consumption. Assuming that the value of the electricity bill is calculated based on a constant monthly subscription fee. In the above information, the cost of electricity to Ali is: O a. A direct fixed cost O b. An indirect, variable cost C. O c. An indirect fixed cost O d. Adirect, variable cost O e. An indirect mixed costarrow_forwardDeja owns a photo printing business and wants to purchase a new state-of-the-art photo printer that she found online for $9,275, plus sales tax of 5.5%. The supply company is offering cash terms of 2/15, n/30, with a 1.5% service charge on late payments, or 90 days same as cash financing if Deja is approved for a company line of credit. If she is unable to pay within 90 days under the second option, she would have to pay 22.9% annual simple interest for the first 90 days, plus 2% simple interest per month on the unpaid balance after 90 days. Deja has an excellent credit rating but is unsure of what to do. a) If Deja took the cash option and was able to pay off the printer within the 15-day discount period, how much would she save? How much would she owe? b) If Deja takes the 90 days same as cash option and purchases the printer on December 30 to get a current-year tax deduction, using exact time, what is her deadline for paying no interest in a non-leap year? In a leap year?arrow_forward

- Ali is a member of a family that consists of him, his father, his mother and his older brother. Each member of the family has his own mobile phone. Each mobile phone is on a post-paid plan, for which a monthly bill is received at the end of each month. The electricity, on the other hand, is provided to the entire house in general, with one bill is received at the end of each month. The father has recently received the electricity bill for the month. and wishes to do some analysis of electricity consumption. Assuming that the value of the electricity bill is calculated based on a constant monthly subscription fee. In the above information, the cost of electricity to Ali is An indirect, variable cost a O A direct, variable cost .b O A direct fixed cost .c O An indirect fixed cost .d O An indirect mixed cost .e O hp 10 ho & 7 V 8 9. T Y P. G H. J K. ...arrow_forwardLydia borrows $2000 from a credit card company at 23% annually for two years. Determine Lydia’s monthly payments.arrow_forwardJanet borrows $3500 from a credit card company at 22.5% annually for 3 years. Determine Janet’s monthly payment. Show your work.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education