Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Paul company has two pro..accounting question

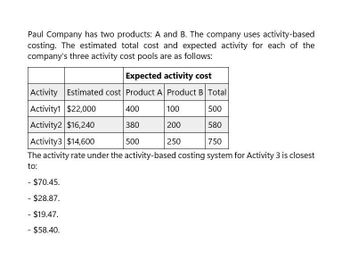

Transcribed Image Text:Paul Company has two products: A and B. The company uses activity-based

costing. The estimated total cost and expected activity for each of the

company's three activity cost pools are as follows:

Expected activity cost

Activity Estimated cost Product A Product B Total

Activity1 $22,000

400

100

500

Activity2 $16,240

380

200

580

Activity3 $14,600

500

250

750

The activity rate under the activity-based costing system for Activity 3 is closest

to:

- $70.45.

- $28.87.

- $19.47.

-$58.40.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Scarborough Company has two products: C and D. The company usesactivity - based costing. The estimated total cost and expected activity foreach of the company's three activity cost pools are as follows:Expected ActivityActivity Cost Pool Estimated Cost Product C Product D TotalActivity 1 S17, 848 S17, 848 100 800Activity 2 S16,350 618 150 768Activity 3 S22, 185 842 120 962How much of Activity 1 is expected to be allocated to Product C? Multiple Choice S22, 310.00S17, 848.00S15, 617.00S2, 231.00arrow_forwardYour Company has two products: A and B. The company uses activity-based costing. The estimated total cost and expected activity for each of the company's three activity cost pools are as follows: Estimated Expected Activity Activity Cost Pool Cost Product A Product B Total Machine related $17,600 700 300 1,000 MH Batch setup $32,600 600 200 800 Setups Other $52,500 900 500 1,400 DLH What is the activity rate under the activity-based costing system for Batch setups? Group of answer choices $54.33 $40.75 $40.75 per Setup $16.30 $16.30 per Setup $54.33 per Setuparrow_forwardJennifer Company has two products: A and B. The company uses activity-based costing. The estimated total cost and expected activity for each of the company's three activity cost pools are as follows: Estimated Expected Activity Overhead Activity Cost Pools Product design Assembling Supporting customers Cost Product A Product B 400 Total $23,500 $18,000 $34,600 100 200 300 500 500 600 700 900 The activity rate under the activity-based costing sysam for Supporting customers is closest to: Multiple Cholce $36.24 $84.56 S115.33 Prev 1 of 10 Next > 2:0 92 F AQI 61 9/9 Type here to search DELLarrow_forward

- Arial Company has two products: A and B. The company uses activity-based costing. The total cost and activity for each of the company's three activity cost pools are as follows: Total Activity Activity Cost Pool Total Cost Product A Product B Total Activity 1 $ 38,000 800 500 1,300 Activity 2 $ 29,040 780 600 1,380 Activity 3 $ 26,600 900 650 1,550 The activity rate under the activity-based costing system for Activity 3 is:arrow_forwardPaul Company has two products: A and B. The company uses activity-based costing. The estimated total cost and expected activity for each of the company's three activity cost pools are as follows: Activity Cost Pool Activity 1 Activity 2 Activity 3 Estimated Cost a. $28.87 O b. $19.47 C. $58.40 O d. $70.45 $22,000 16,240 14,600 Expected Activity Product B Product A 400 380 500 100 200 250 Total 500 580 750 The activity rate under the activity-based costing system for Activity 3 is closest to which of the following?arrow_forwardChrzan, Incorporated, manufactures and sells two products: Product EO and Product NO. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Product E0 Product Ne Total direct labor-hours Activity Cost Pools Labor-related Production orders Order size The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Overhead Cost Multiple Choice $33.94 per MH $54.20 per MH Direct Expected Labor-Hours Production Per Unit 10.1 410 1,550 9.1 $51.98 per MH $21.40 per MH Activity Measures DLHS orders MHs Total Direct Labor- Hours $ 301,890 61,087 585,366 $948,343 The activity rate for the Order Size activity cost pool under activity-based costing is closest to: 4,141 14, 105 18,246 Product E 4,141 850 5,550 Expected Activity Product NO 14, 105 950 5,250 Total 18,246 1,800 10,800arrow_forward

- Balestier Company has two products: A and B. The company uses activity-based costing. The total cost and activity for each of the company's three activity cost pools are as follows: Estimated Expected Activity Activity Cost Pools Overhead Cost Product A Product B Product design $32,600 700 300 Assembling $17,600 600 200 Supporting customers $52,500 400 100 The total overhead cost assigned to Product A under activity-based costing is closest to: Question 12 options: 1) $78,020 2) $102,700 3) $54,380,000 4) $207arrow_forwardThe graphs below represent cost behavior patterns that might occur in acompany's cost structure. The vertical axis represents total cost, and thehorizontal axis represents activity output. Required:For each of the following situations, choose the graph from the group a-1 that best illustrates the cost pattern involved. Also, for each situation,identify the driver that measures activity output. 1. The cost of power when a fixed fee of $500 per month is chargedplus an additional charge of $0.12 per kilowatt-hour used2. Commissions paid to sales representatives. Commissions arepaid at the rate of 5 percent of sales made up to total annual salesof $500,000, and 7 percent of sales above $500,000.3. A part purchased from an outside supplier costs $12 per part for the first 3,000 parts and $10 per part for all parts purchased inexcess of 3,000 units.4. The cost of surgical gloves, which are purchased in incrementsof 100 units (gloves come in boxes of 100 pairs).5. The cost of tuition at a…arrow_forwardElectan Company produces two types of printers. The company uses ABC, and all activity drivers are duration drivers. Electan Company is considering using DBC and has gathered the following data to help with its decision. A. Activities with duration drivers: B. Activities with consumption ratios and costs: C. Products with cycle time and practical capacity: Required: 1. Using cycle time and practical capacity for each product, calculate the total time for all primary activities. Comment on the relationship to ABC. 2. Calculate the overhead rate that DBC uses to assign costs. Comment on the relationship to a unit-based plantwide overhead rate. 3. Use the overhead rate calculated in Requirement 2 to calculate (a) the overhead cost per unit for each product, and (b) the total overhead assigned to each product. How does this compare to the ABC assignments shown in Part B of the Information set? 4. What if the units actually produced were 10,000 for Printer A and 18,000 for Printer B. Using DBC, calculate the cost of unused capacity.arrow_forward

- Frenchys has three cost pools and an associated cost driver to allocate the costs to the product. The cost pools, cost driver, estimated overhead, and estimated activity for the cost pool are: What is the predetermined overhead rate for each activity?arrow_forwardSanford, Inc., has developed value-added standards for four activities: purchasing parts, receiving parts, moving parts, and setting up equipment. The activities, the activity drivers, the standard and actual quantities, and the price standards for 20x1 are as follows: The actual prices paid per unit of each activity driver were equal to the standard prices. Required: 1. Prepare a cost report that lists the value-added, non-value-added, and actual costs for each activity. 2. Which activities are non-value-added? Explain why. Also, explain why value-added activities can have non-value-added costs.arrow_forwardCustoms has three cost pools and an associated cost driver to allocate the costs to the product. The cost pools, cost driver, estimated overhead, and estimated activity for the cost pool are: What is the predetermined overhead rate for each activity?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,