FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

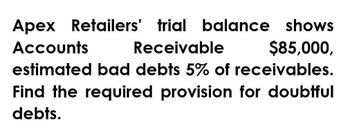

Financial accounting: find the required provision for doubtful debt (6 points)

Transcribed Image Text:Apex Retailers' trial balance shows

$85,000,

Accounts

Receivable

estimated bad debts 5% of receivables.

Find the required provision for doubtful

debts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Find the required provision for doubtful debtsarrow_forwardOne company has estimated that $3150 of its accounts receiable will be uncollectible. If allownace for doubtful accounts already has a credit balance of $1102, and the percentage of receivables method is used, it sadjustment to recrod for the period will require a debit to what for what amount?arrow_forwardWhat amount should it debit bad debt expense?arrow_forward

- The following information concerns Complex, Inc.: Accounts receivable, 12/31/X7 $56,000 Credit sales during X7 $189,000 Allowance for doubtful accounts, 12/31/X7 $1,500 credit Bad debt expense is determined using the percentage of sales method. The company believes that 4% of sales will never be collected. What would be the balance in allowance for doubtful accounts after the adjusting entry? Select one: O a. $9,060 O b. $7,560 O c. $1,500 O d. $6,060 Oe. $2,240arrow_forwardPina Colada Corp. uses the percentage of receivables method for recording bad debts expense. The accounts receivable balance is $270000 and credit sales are $2710000. Management estimates that 3% of accounts receivable will be uncollectible. What adjusting entry will Pina Colada Corp. make if the Allowance for Doubtful Accounts has a credit balance of $2700 before adjustment?arrow_forwardNichols Company uses the percentage of receivables method for recording bad debts expense. The accounts receivable balance is $250,000 and credit sales are $1,000,000. Management estimates that 4% of accounts receivable and 1% of credit sales will be uncollectible. What adjusting entry will Nichols Company make if the Allowance for Doubtful Accounts has a credit balance of $2,500 before adjustment? Group of answer choices DR Bad Debt Expense and CR Allowance for Doubtful Accounts $10,000 DR Bad Debt Expense and CR Allowance for Doubtful Accounts for $7,500 DR Bad Debt Expense and CR Accounts Receivable for $7,500 DR Bad Debt Expense and CR Allowance for Doubtful Accounts for $7,000arrow_forward

- Gabby Renovation has a total accounts receivable of $600,000. Its analysis indicates that $30,000 of accounts receivable will be uncollectible. The Allowance for Doubtful Accounts has a credit balance of $8,000. What is the adjusting entry to the Allowance for Doubtful Accounts? O a Debit of $30,000 Credit of $22,000 Credit of $30,000arrow_forwardBlossom Company uses the percentage of receivables method for recording bad debts expense. The accounts receivable balance is $310000 and credit sales are $3110000. Management estimates that 4% of accounts receivable will be uncollectible. What adjusting entry will Blossom Company make if the Allowance for Doubtful Accounts has a credit balance of $3100 before adjustment?arrow_forwarda) The trial balance before adjustment of Jason Donohoe Company reports the following balances: Accounts receivable Allowance for doubtful accounts Sales (all on credit) Sales returns and allowances Dr. $300,000 80,000 Date Instructions (a) Prepare the entry for estimated bad debts assuming the balance sheet approach is used, and doubtful accounts are estimated to be 6% of gross accounts receivable. DR/CR Cr. (b) Prepare the entry for estimated bad debts assuming that income statement approach is used at 1% of net sales. $ 5,000 1,700,000 (c) Assume that all the information above is the same, except that the Allowance for Doubtful Accounts has a debit balance of $5,000 instead of a credit balance. How will this difference affect the journal entry in part (a)? Account Debit Creditarrow_forward

- Wolfe, Inc. had credit sales for the period of $146,000. The balance in Allowance for Doubtful Accounts is a debit of $663. If Wolfe estimates that 5% of credit sales will be uncollectible, what is the required journal entry to record estimated uncollectible accounts? O A. Debit Bad Debt Expense, $7,300; credit Allowance for Uncollectible Accounts, $7,300. O B. No entry is required. O C. Debit Bad Debt Expense, $6.637; credit Allowance for Uncollectible Accounts, $6.637. O D. Debit Bad Debt Expense, $7,963; credit Allowance for Uncollectible Accounts, S7,963.arrow_forwardPlease help mearrow_forwardUsing the aging approach, management estimates that10%of the$10,000of Accounts Receivable will be uncollectible. The Allowance for Doubtful Accounts has a$100unadjusted debit balance. After the bad debt adjusting entry is recorded, Bad Debt Expense on the income statement will be the Allowance for Doubtful Accounts on the balance sheet. Multiple Choice$100less than$100more than the same amount as$9,900more thanarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education