Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Ort corporation has provided the following solve this question

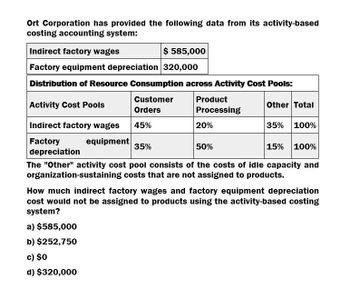

Transcribed Image Text:Ort Corporation has provided the following data from its activity-based

costing accounting system:

Indirect factory wages

$ 585,000

Factory equipment depreciation 320,000

Distribution of Resource Consumption across Activity Cost Pools:

Activity Cost Pools

Customer

Orders

Indirect factory wages

45%

Factory

depreciation

equipment

35%

Product

Other Total

Processing

20%

35% 100%

50%

15% 100%

The "Other" activity cost pool consists of the costs of idle capacity and

organization-sustaining costs that are not assigned to products.

How much indirect factory wages and factory equipment depreciation

cost would not be assigned to products using the activity-based costing

system?

a) $585,000

b) $252,750

c) $0

d) $320,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardThe cost behavior patterns below are lettered A through H. The vertical axes of the graphs represent total dollars of expense, and the horizontal axes represent production in units, machine hours, or direct labor hours. In each case, the zero point is at the intersection of the two axes. Each graph may be used no more than once. Required: Select the graph that matches the lettered cost described here. a. Depreciation of equipmentthe amount of depreciation charged is computed based on the number of machine hours that the equipment was operated. b. Electricity billflat fixed charge, plus a variable cost after a certain number of kilowatt hours are used. c. City water billcomputed as follows: d. Depreciation of equipmentthe amount is computed by the straight-line method. e. Rent on a factory building donated by the citythe agreement calls for a fixed fee payment, unless 200,000 labor hours are worked, in which case no rent need be paid. f. Salaries of repair workersone repair worker is needed for every 1,000 machine hours or less (i.e., 0 to 1,000 hours requires one repair worker, 1,001 to 2,000 hours requires two repair workers, etc.).arrow_forwardThe following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forward

- Need help with this question solution general accountingarrow_forwardA company has provided the following data from its activity-based costing accounting system: Indirect factory wages Factory equipment depreciation S 27,000 $ 204,000 Distribution of Resource Consumption across Activity Cost Pools: Activity Cost Pools Indirect factory wages Factory equipment depreciation Product Processing 48% 25% Customer Orders Other 38 128 Total 100% 100% 63% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. Required: a. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool. b. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products. Complete this question by entering your answers in the tabs below. Required A Required B Determine the total amnount of indirect factory wages and factory equipment…arrow_forwardGeneral accountingarrow_forward

- A company has provided the following data from its activity-based costing accounting system: Indirect factory wages $552,000 Factory equipment depreciation $332,000 Distribution of Resource Consumption across Activity Cost Pools: 14 Activity Cost Pools Customer Product Orders Processing Other Total Indirect factory wages 55% 35% 10% 100% Factory equipment depreciation 30% 50% 20% 100% The "Other" activity cost pool consists of the costs of idle capacity and organization- sustaining costs, How much indirect factory wages and factory equipment depreciation cost would NOT be assigned to products using the activity-based costing system? Multiple Choice $552,000 $332.000 $121,600 $0arrow_forwardhelparrow_forwardTCM Company uses activity-based costing to determine products costs for external financial reports. The company has provided the following data concerning its activity-based costing system: Activity cost pools (and activity measures) Depreciation (allocated based on machine-hours) Batch setup (allocated based on # of set ups) General Factory (allocated based on direct labor hours) Estimated Overhead costs $67,500 273,700 204,000 Expected Activity (Allocation base) Product y Product x Activity Cost pool Depreciation Batch setup General factory The activity rate for the general factory activity cost pool is? Total 5000 m hours 4000 1000 7000 set ups 3000 4000 8000 dl hours 1000 7000arrow_forward

- Eccles Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system: Costs: Wages and salaries $ 286,000 Depreciation 270,000 Utilities 231,000 Total $ 787,000 Distribution of resource consumption: Activity Cost Pools Total Assembly Setting Up Other Wages and salaries 45% 30% 25% 100% Depreciation 35% 20% 45% 100% Utilities 10% 65% 25% 100% How much cost, in total, would be allocated in the first-stage allocation to the Assembly activity cost pool?arrow_forwardBeckley Corporation has provided the following data from its activity-based costing accounting system: Indirect factory wages Factory equipment depreciation $ 35,000 $ 212,000 Distribution of Resource Consumption across Activity Cost Pools: Activity Cost Pools Indirect factory wages Factory equipment depreciation Customer Orders 45% 64% Product Processing 44% 25% Other 11% Total 100% 11% 100% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. Required: a. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool. b. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products. Complete this question by entering your answers in the tabs below. Required A Required B Determine the total amount of indirect factory wages and…arrow_forwardDoede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts-equipment depreciation and supervisory expense-to three activity cost pools-Machining. Order Filing, and Other-based on resource consumption, Data to perform these allocations appear below: Overhead costs: Equipment depreciation Supervisory expense $ 30,000 $ 14,800 Distribution of Resource Consumption Across Activity Cost Pools: Equipment depreciation Supervisory expense Activity: Product W1 Product Me Total Machining Order Filling 0.50 0.50 In the second stage, Machining costs are assigned to products using machine-hours (Ms) and Order Filing costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Product W1 Product Me Total Activity Cost Pools MHS (Machining) 5,530 17,000 22,530 0.40 0.30 Show Transcribed Text 5,530 17,000 22,530 Orders (Order Filling)…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College