Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

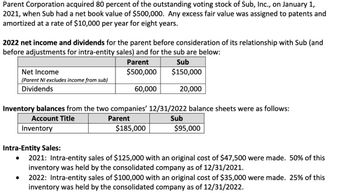

Transcribed Image Text:Parent Corporation acquired 80 percent of the outstanding voting stock of Sub, Inc., on January 1,

2021, when Sub had a net book value of $500,000. Any excess fair value was assigned to patents and

amortized at a rate of $10,000 per year for eight years.

2022 net income and dividends for the parent before consideration of its relationship with Sub (and

before adjustments for intra-entity sales) and for the sub are below:

Net Income

Parent

$500,000

Sub

$150,000

(Parent NI excludes income from sub)

Dividends

60,000

20,000

Inventory balances from the two companies' 12/31/2022 balance sheets were as follows:

Account Title

Inventory

Parent

$185,000

Sub

$95,000

Intra-Entity Sales:

•

2021: Intra-entity sales of $125,000 with an original cost of $47,500 were made. 50% of this

inventory was held by the consolidated company as of 12/31/2021.

2022: Intra-entity sales of $100,000 with an original cost of $35,000 were made. 25% of this

inventory was held by the consolidated company as of 12/31/2022.

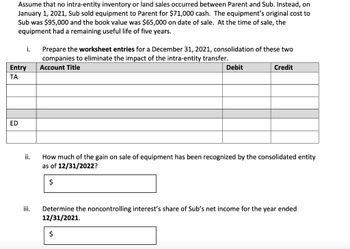

Transcribed Image Text:Assume that no intra-entity inventory or land sales occurred between Parent and Sub. Instead, on

January 1, 2021, Sub sold equipment to Parent for $71,000 cash. The equipment's original cost to

Sub was $95,000 and the book value was $65,000 on date of sale. At the time of sale, the

equipment had a remaining useful life of five years.

i.

Entry

TA

Prepare the worksheet entries for a December 31, 2021, consolidation of these two

companies to eliminate the impact of the intra-entity transfer.

Account Title

Debit

Credit

ED

ii.

How much of the gain on sale of equipment has been recognized by the consolidated entity

as of 12/31/2022?

$

iii. Determine the noncontrolling interest's share of Sub's net income for the year ended

12/31/2021.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Intor Company acquired 20% of the ordinary shares of Intee Company on January 1, 2019. At this date, all the identifiable assets and liabilities of Intee were recorded at fair value. An analysis of the acquisition showed that P200,000 of goodwill was acquired. Intee Company recorded a profit of P1,000,000 for 2020 and paid dividend of P700,000 during the same year. The following transactions have occurred between the two entities. • In December 2020, Intee sold inventory to Intor for P1,500,000. This inventory had previously cost Intee P1,000,000 and remains unsold by Intor on December 31. 2020. • In November 2020, Intor sold inventory to Intee at a before tax profit of P300.000. Half of this was sold by Intee before December 31, 2020. • In December 2019, Intee sold inventory to Intor for P1,800,000. This inventory had cost Intee P1,200,000. At December 31. 2019, this inventory remained unsold by Intor. However, it was all sold by Intor in 2020. Ignoring income tax, Intor company…arrow_forwardIntor Company acquired 20% of the ordinary shares of Intee Company on January 1, 2019. At this date, all the identifiable assets and liabilities of Intee were recorded at fair value. An analysis of the acquisition showed that P200,000 of goodwill was acquired. Intee Company recorded a profit of P1,000,000 for 2020 and paid dividend of P700,000 during the same year. The following transactions have occurred between the two entities. • In December 2020, Intee sold inventory to Intor for P1,500,000. This inventory had previously cost Intee P1,000,000 and remains unsold by Intor on December 31, 2020. • In November 2020, Intor sold inventory to Intee at a before tax profit of P300,000. Half of this was sold by Intee before December 31, 2020. • In December 2019, Intee sold inventory to Intor for P1,800,000. This inventory had cost Intee P1,200,000. At December 31, 2019, this inventory remained unsold by Intor. However, it was all sold by Intor in 2020. Ignoring income tax, Intor company shall…arrow_forwardOn 1 July 2021, King Ltd acquired all the share capital of Queen Ltd for $1,800,000, and on that date Queen Ltd.'s equity were as follows: Share capital $1,200,000; Revaluation surplus $500,000 and Retained earnings $200,000. All the assets and liabilities of Queen Ltd. were recorded at fair value on 1 July 2021. During the financial year 2022, the following intragroup transactions occurred between King Ltd and Queen Ltd: Queen Ltd sold land to King Ltd for $400,000, which was $100,000 above cost. The land was still hold by King Ltd. King Ltd sold an equipment to Queen Ltd for $400,000. The carrying amount of equipment to King Ltd of $320,000. Both entities depreciate equipment at a rate of 10% p.a. on cost. Queen Ltd sold inventories costing $160,000 to King Ltd for $180,000. 1/4th of the inventories were still on hand with King Ltd. King Ltd received $15,000 of service revenue from Queen Ltd. Queen Ltd paid dividend of $30,000 and interest on loan of $8,000 to King Ltd. The tax rate…arrow_forward

- P Co. acquired 80% of the 300,000 $1 equity shares of S Co. on 1 April 2021 when the retained earnings of S were $150,000. Consideration comprised X1 by cash, and X2 payable on 31 March 2022. The book values of S's net assets at acquisition date were equal to their fair values except a loan which had a book value of $400,000 and a fair value of $500,000. P measures non-controlling interest at fair value, based on share price. The market value of S's shares on 1 April 2021 was $1.5. P has a cost on capital of 10%. Required: 1/Provide relevant X1, X2 so that the goodwill at the acquisition date is positive. 2/Calculate the goodwill arising on acquisition.arrow_forwardOn January 1, 2019, Blackpink Company acquired 40% of the ordinary shares of an associate. On such date, assets and liabilities of the investee were recorded at fair value and the acquisition showed that goodwill of P1,000,000 was acquired. The investee reported net income of P8,000,000 for 2019. What amount of Share in Profit of Associate should be reported by Blackpink Company for 2019?arrow_forwardOn January 1, 2021, Arneyow Company acquired 10% of the outstanding voting shares of Pee Yu Pi Incorporated for P900,000. These shares were designated as equity investments at fair value through other comprehensive income. On January 1, 2022, Arneyow gained the ability to exercise significant influence over financial and operating policies of Pee Yu Pi by acquiring additional 20% of the outstanding shares for P2,760,000. The two purchases were made at prices proportionate to the value assigned to Pee Yu Pi's net assets, which is equal to their carrying amounts. For the years ended December 31, 2021 and 2022, Pee Yu Pi reported the following: 2021 2022 Dividends paid P2,000,000 P3,000,000 Profit for the year P 6,000,000 P 6,500,000 The fair values of the investments on December 31, 2021 and 2022 were P1,380,000 and P5,160,000, respectively. The carrying value of the investment in associate at the end of 2022 is?arrow_forward

- Placid Lake Corporation acquired 80 percent of the outstanding voting stock of Scenic, Incorporated, on January 1, 2023, when Scenic had a net book value of $510,000. Any excess fair value was assigned to intangible assets and amortized at a rate of $4,000 per year. Placid Lake's 2024 net income before consideration of its relationship with Scenic (and before adjustments for intra-entity sales) was $410,000. Scenic reported net income of $220,000. Placid Lake declared $100,000 in dividends during this period; Scenic paid $51,000. At the end of 2024, selected figures from the two companies' balance sheets were as follows: Items Placid Lake Scenic Inventory $ 250,000 $ 101,000 Land 710,000 310,000 Equipment (net) 510,000 410,000 During 2023, intra-entity sales of $130,000 (original cost of $64,000) were made. Only 20 percent of this inventory was still held within the consolidated entity at the end of 2023. In 2024, $200,000 in intra-entity sales were made with an original…arrow_forwardAllison Corporation acquired all of the outstanding voting stock of Mathias, Incorporated, on January 1, 2023, in exchange for $6,203,000 in cash. Allison intends to maintain Mathias as a wholly owned subsidiary. Both companies have December 31 fiscal year-ends. At the acquisition date, Mathias’s stockholders’ equity was $2,080,000 including retained earnings of $1,580,000. At the acquisition date, Allison prepared the following fair-value allocation schedule for its newly acquired subsidiary: Consideration transferred $ 6,203,000Mathias stockholders' equity 2,080,000Excess fair over book value $ 4,123,000to unpatented technology (8-year remaining life) $ 928,000 to patents (10-year remaining life) 2,660,000 to increase long-term debt (undervalued, 5-year remaining life) (180,000) 3,408,000Goodwill $ 715,000Postacquisition, Allison employs the equity method to account for its investment in Mathias. During the two years following the…arrow_forwardOn January 1, 2023, Andrei Company acquired 40% of the ordinary shares of an associate. On such date, assets and liabilities of the investee were recorded at fair value and the acquisition showed that goodwill of P1,000,000 was acquired. The investee reported net income of P8,000,000 for 2023. In December 2023, the investee sold inventory costing P3,000,000 to Andrei Company for P5,000,000. The inventory remained unsold by Andrei Company on December 31, 2023. On January 1, 2023, the investee sold an equipment to Andrei Company with carrying amount of P2,500,000 for P4,000,000. The remaining life of the equipment is 5 years. What amount of investment income should be reported by Andrei Company for 2023?arrow_forward

- Goodwill arisingarrow_forwardPlacid Lake Corporation acquired 90 percent of the outstanding voting stock of Scenic, Inc., on January 1, 2020, when Scenic had a net book value of $610,000. Any excess fair value was assigned to intangible assets and amortized at a rate of $4,000 per year. Placid Lake's 2021 net income before consideration of its relationship with Scenic (and before adjustments for intra-entity sales) was $510,000. Scenic reported net income of $320,000. Placid Lake declared $200,000 in dividends during this period; Scenic paid $61,000. At the end of 2021, selected figures from the two companies' balance sheets were as follows: Placid Lake Scenic Inventory $ 350,000 $ 111,000 Land 810,000 410,000 Equipment (net) 610,000 510,000 During 2020, intra-entity sales of $180,000 (original cost of $84,000) were made. Only 30 percent of this inventory was still held within the consolidated entity at the end of 2020. In 2021, $300,000 in intra-entity sales were made…arrow_forwardParent Corporation acquired 90 percent of the outstanding voting stock of Subsidiary, Inc., on January 1, 2020, when Subsidiary had a net book value of $610,000. Any excess fair value was assigned to intangible assets and amortized at a rate of $4,000 per year. Parent's 2021 net income before consideration of its relationship with Subsidiary (and before adjustments for intra-entity sales) was $510,000. Subsidiary reported net income of $320,000. Parent declared $200,000 in dividends during this period; Subsidiary paid $61,000. At the end of 2021, selected figures from the two companies' balance sheets were as follows: Parent Subsidiary $350,000 $111,000 810,000 410,000 Equipment (net) 610,000 510,000 Inventory Land In 2020, Subsidiary sold land costing $51,000 to Parent for $92,000. On the 2021 consolidated balance sheet, what value should be reported for land? Complete this question by entering your answers in the tabs below. Required On the 2021 consolidated balance sheet, what value…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning