FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

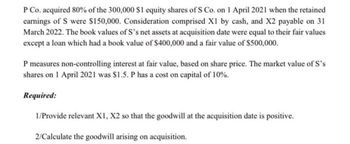

Transcribed Image Text:P Co. acquired 80% of the 300,000 $1 equity shares of S Co. on 1 April 2021 when the retained

earnings of S were $150,000. Consideration comprised X1 by cash, and X2 payable on 31

March 2022. The book values of S's net assets at acquisition date were equal to their fair values

except a loan which had a book value of $400,000 and a fair value of $500,000.

P measures non-controlling interest at fair value, based on share price. The market value of S's

shares on 1 April 2021 was $1.5. P has a cost on capital of 10%.

Required:

1/Provide relevant X1, X2 so that the goodwill at the acquisition date is positive.

2/Calculate the goodwill arising on acquisition.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On 1 July 2019, Silver Ltd, a reporting entity, acquired all of the issued shares of Brumby Ltd. As part of the settlement, Silver Ltd agreed to pay $1,700,000 on 1 July 2019 and $1,284,000 payable on 1 July 2020. The appropriate discount rate was 7% per annum. Silver Ltd also issued 475,000 shares of Silver Ltd to the shareholders of Brumby Ltd. At acquisition date, the fair value of the ordinary shares of Silver Ltd were $2.50 and the fair value of the ordinary shares of Brumby Ltd were $3.00. Brumby Ltd's shareholders' equity on 1 July 2019 consisted of the following: Issued capital $1,900,000 Retained earnings $650,000 Total shareholders' equity $ 2,550,000 At 1 July 2019, all of Brumby Ltd's net assets were recorded at fair value, except the following items: Carrying Amount Fair Value Machinery $1,120,000 $1,400,000 Brumby Ltd purchased the plant for $1,500,000. On 1 July 2019, the plant had an estimated remaining useful life of 7 years with zero residual value. Brumby Ltd is…arrow_forwardOn June 30, 2021, Plaster, Inc., paid $988,000 for 80 percent of Stucco Company's outstanding stock. Plaster assessed the acquisition-date fair value of the 20 percent noncontrolling interest at $247,000. At acquisition date, Stucco reported the following book values for its assets and liabilities: Cash Accounts receivable Inventory Land Buildings Equipment Accounts payable (Parentheses indicate credit balances.) On June 30, Plaster allocated the excess acquisition-date fair value over book value to Stucco's assets as follows: $ 64,500 136,900 Equipment (3-year remaining life) Database (10-year remaining life) Cash Accounts receivable (net) Inventory Land Buildings (net) Equipment (net) Database 219, 200 70,400 189,400 324,300 (37,700) At the end of 2021, the following comparative (2020 and 2021) balance sheets and consolidated income statement were available: Plaster, Inc. December 31, 2020 Total assets Accounts payable Long-term liabilities Common stock Noncontrolling interest…arrow_forwardOn 1/1/2020, X Company acquired 100% of Y Company's Net assets for $150,000 cash. The Book value of Y's Net assets was equal to the fair value of Y Company's net assets at the date of acquisition except for Land (included in fixed assets) its market value was less than the book value by $1,000, the balance sheet data at 1/1/2020, are as follows: item X co Y co cash 404,000 150,000 Fixed assets 100,000 66,000 Liabilities 144,000 72,000 Common stock 120,000 60,000 Retained earning 240,000 84,000 required: if the acquisition are merger record the journal entries and prepare x balance sheet after the mergerarrow_forward

- Carnes Co. decided to use the partial equity method to account for its investment in Domino Corp. An unamortized trademark associated with the acquisition was $30,000, and Carnes decided to amortize the trademark over ten years. For 2021, Carnes' Equity in Subsidiary Earnings was $78,000. Required: What balance would have been in the Equity in Subsidiary Earnings account if Carnes had used the equity method?arrow_forwardOn July 19, 2021, SUNOB acquired 60% of the outstanding shares of YSAE. The business combination resulted to a gain on bargain purchase of P200,000. The consideration paid was exactly the fair value for the 60% outstanding stocks, and the fair value of the non-controlling interest is not given. Fair value of the net assets of YSAE amounted to P1,000,000 on that date. How much is the gain on acquisition attributable to SUNOB? Zero 600,000 200,000 120,000arrow_forwardCompute the goodwil (gain on bargain purchase)arrow_forward

- On July 1, 2021, PASSETS acquired all the net assets of SIABS at its underlying book value, which resulted to neither a gain nor a goodwill. Considerations transferred included cash paid, bonds issued, and stocks issued. Apart from the transaction to acquire the net assets of and to transfer the consideration to the acquiree, PASSETS also has the following transactions: PASSETS paid P150,000 to SEC to register the newly issued shares PASSETS incurred the obligation to pay P50,000 for printing of the stock certificates of the new shares issued. PASSETS paid Mr. Louis McRasigan P100,000 cash for his professional services in administering the business combination A total of P1,000,000 for general and administrative expenses were incurred by the company, half of which was attributable to the business combination and treated as an unpaid indirect cost. Among the four related transactions above, how much will decrease assets of the acquirer? 200,000 250,000 1,300,000 800,000arrow_forwardS acquired 100 percent of F for P275,000. At the date of acquisition, F had the following book and market values: (see image below) What is the amount of the “Investment in F” account on S’s financial records at the acquisition date? What amount of pre-acquisition earnings is eliminated in the acquisition date worksheet elimination? Please answer in good accounting form. Thank you!arrow_forwardAcquirer Company purchased the net asset of Acquiree Company (excluding cash) by paying P250,000 cash, issuing shares with a fair value of P1,810,000 and issuing a bond debenture with a fair value of P380,000 on January 2, 2022. The financial statements of Acquirer and Acquiree as of this date were as follows (see image below).The book value reflected the fair value of the assets and liabilities except that the inventory of Acquirer had a fair value of 1,500,000 and the inventory and equipment of Acquiree had fair values of P750,000 and P1,400,000 respectively. Acquirer also incurred the following costs: Finder’s fee – P10,000; Accountant’s fee – P15,000; Legal fees – P7,500; Printing of stock certificates – P5,000; and Audit and accountant’s fee related to stock issuance – P20,000. Acquirer only paid 50% of the said acquisition related costs. Answer the following: a. How much is the Consolidated Equity? b. How much is the Goodwill/Gain on Bargain Purchase? c. How much is the…arrow_forward

- Dimensionsarrow_forwardOn January 1, 2023, Flounder Corporation, a public company following IFRS, acquired 17,400 of the 58,000 outstanding common shares of Noah Corp. for $27 per share. Noah's statement of financial position reported the following information at the date of the acquisition: Assets not subject to depreciation $287,800 Assets subject to depreciation 863,600 Liabilities 148,600 Additional information: 1. On the acquisition date, the fair value is the same as the carrying amount for the assets that are not subject to depreciation and for the liabilities. 2. 3. 4. On the acquisition date, the fair value of the assets that are subject to depreciation is $957,600. These assets had a remaining useful life of eight years at that time. Noah reported 2023 net income of $94,000 and paid dividends of $4,500 in December 2023. Noah's shares are not actively traded on the stock exchange, but Flounder has determined that they have a fair value of $25 per share on December 31, 2023. (a) Prepare the journal…arrow_forwardIf CARDO Co purchases the net assets of SYANO Co by issuing 5,000 shares of their P20 par valueshares with a fair value of P40 per share, incurs a mortgage loan for P90,000, pays P150,000 cash andpaying direct, indirect and stock issue costs of P75,000, P50,000 and P40,000 respective. REQUIREMENTS:A. GoodwillB. Consolidated Total Assets at the date of acquisitionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education