PAYROLL ACCT.,2019 ED.(LL)-TEXT

19th Edition

ISBN: 9781337619783

Author: BIEG

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

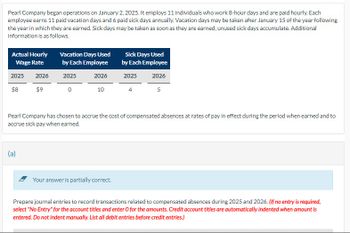

Transcribed Image Text:Pearl Company began operations on January 2, 2025. It employs 11 individuals who work 8-hour days and are paid hourly. Each

employee earns 11 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the year following

the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional

information is as follows.

Actual Hourly

Wage Rate

Vacation Days Used

by Each Employee

Sick Days Used

by Each Employee

2025 2026

2025

2026

2025

2026

$8

$9

0

10

4

5

Pearl Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to

accrue sick pay when earned.

(a)

Your answer is partially correct.

Prepare journal entries to record transactions related to compensated absences during 2025 and 2026. (If no entry is required,

select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is

entered. Do not indent manually. List all debit entries before credit entries.)

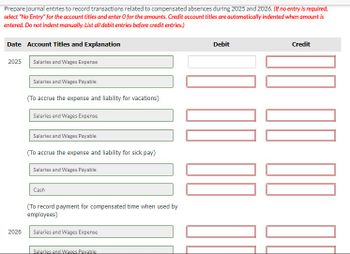

Transcribed Image Text:Prepare journal entries to record transactions related to compensated absences during 2025 and 2026. (If no entry is required,

select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is

entered. Do not indent manually. List all debit entries before credit entries.)

Date Account Titles and Explanation

Debit

Credit

2025

Salaries and Wages Expense

2026

Salaries and Wages Payable

(To accrue the expense and liability for vacations)

Salaries and Wages Expense

Salaries and Wages Payable

(To accrue the expense and liability for sick pay)

Salaries and Wages Payable

Cash

(To record payment for compensated time when used by

employees)

Salaries and Wages Expense

Salaries and Wages Pavable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Accounting for bonus and vacation pay Cathy Muench a factory worker, earns 1,000 each week. In addition, she will receive a 4,000 bonus at year-end and a four-week paid vacation. Prepare the entry to record the weekly payroll and the costs and liabilities related to the bonus and the vacation pay, assuming that Muench is the only employee.arrow_forwardBarbara Ripa receives 695 for a regular 40-hour week and time and one-half for overtime. For a workweek of 45 hours, compute: a. The regular earnings________ b. The overtime earnings________ c. The total earnings________arrow_forwardA weekly payroll summary made from labor time records shows the following data for Pima Company: Overtime is payable at one-and-a-half times the regular rate of pay and is distributed to all jobs worked on during the period. a. Determine the net pay of each employee. The income taxes withheld for each employee amount to 15% of the gross wages. b. Prepare journal entries for the following: 1. Recording the payroll. 2. Paying the payroll. 3. Distributing the payroll. (Assume that the overtime premium will be charged to all jobs worked on during the period.) 4. The employers payroll taxes. (Assume that none of the employees has achieved the maximum wage bases for FICA and unemployment taxes.)arrow_forward

- Sheffield Company began operations on January 2, 2019. It employs 10 individuals who work 8-hour days and are paid hourly. Each employee earns 10 paid vacation days and 8 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $6 $7 0 9 6 7 Sheffield Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. (a) Correct answer icon Your answer is correct Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account…arrow_forwardSheffield Company began operations on January 2, 2019. It employs 10 individuals who work 8-hour days and are paid hourly. Each employee earns 10 paid vacation days and 8 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $6 $7 0 9 6 7 Sheffield Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. (a) Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit…arrow_forwardMarin Company began operations on January 2, 2019. It employs 11 individuals who work 8-hour days and are paid hourly. Each employee earns 9 paid vacation days and 7 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $11 $12 0 8 5 6 Marin Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. prepare journal entries to record transactions related to compensated absences during 2019 and 2020. Compute the amounts of any liability for compensated absences that should be reported on the balance sheet at December 31, 2019 and…arrow_forward

- Wise Company began operations on January 2, 2019. It employs 9 individuals who work 8-hour days and are paid hourly. Each employee earns 11 paid vacation days and 8 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $ 11 $ 12 0 10 6 7 Wise Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. Part A: Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. 2019 (to accrue the exp & liability for vacation) (to accrue the exp & liability for sick pay) (to record pymt for…arrow_forwardWaterway Company began operations on January 2, 2025. It employs 10 individuals who work 8-hour days and are paid hourly. Each employee earns 12 paid vacation days and 7 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual Hourly Vacation Days Used Wage Rate by Each Employee Sick Days Used by Each Employee 2025 2026 2025 2026 2025 2026 $12 $13 0 10 5 6 Waterway Company has chosen not to accrue paid sick leave until used, and has chosen to accrue vacation time at expected future rates of pay without discounting. The company used the following projected rates to accrue vacation time. Year in Which Vacation Time Was Earned 2025 2026 Projected Future Pay Rates Used to Accrue Vacation Pay $12.45 13.45 (a) Prepare journal entries to record transactions related to compensated absences during 2025…arrow_forwardSheffield Company began operations on January 2, 2019. It employs 11 individuals who work 8-hour days and are paid hourly. Each employee earns 13 paid vacation days and 8 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $13 $14 0 11 5 6 Sheffield Company has chosen not to accrue paid sick leave until used, and has chosen to accrue vacation time at expected future rates of pay without discounting. The company used the following projected rates to accrue vacation time. Year in Which VacationTime Was Earned Projected Future Pay RatesUsed to Accrue Vacation Pay 2019 $13.65 2020 14.73…arrow_forward

- Ayayai Company began operations on January 2, 2019. It employs 9 individuals who work 8-hour days and are paid hourly. Each employee earns 9 paid vacation days and 7 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $6 $7 0 8 5 6 Ayayai Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically…arrow_forwardAyayai Company began operations on January 2, 2019. It employs 9 individuals who work 8-hour days and are paid hourly. Each employee earns 9 paid vacation days and 7 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $6 $7 0 8 5 6 Ayayai Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically…arrow_forwardCullumber Company began operations on January 2, 2019. It employs 10 individuals who work 8-hour days and are paid hourly. Each employee earns 9 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $11 $12 0 8 4 5 Cullumber Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning