PAYROLL ACCT.,2019 ED.(LL)-TEXT

19th Edition

ISBN: 9781337619783

Author: BIEG

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Solve this accounting question problem

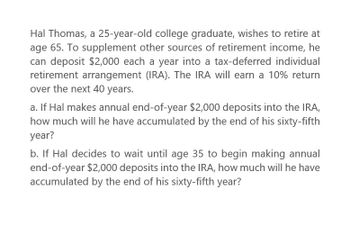

Transcribed Image Text:Hal Thomas, a 25-year-old college graduate, wishes to retire at

age 65. To supplement other sources of retirement income, he

can deposit $2,000 each a year into a tax-deferred individual

retirement arrangement (IRA). The IRA will earn a 10% return

over the next 40 years.

a. If Hal makes annual end-of-year $2,000 deposits into the IRA,

how much will he have accumulated by the end of his sixty-fifth

year?

b. If Hal decides to wait until age 35 to begin making annual

end-of-year $2,000 deposits into the IRA, how much will he have

accumulated by the end of his sixty-fifth year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Minnie owns a qualified annuity that cost 78,000. The annuity is to pay Minnie 650 per month for life after she reaches age 65. Minnie turns 65 on September 28, 2019, and receives her first payment on November 1, 2019. a. How much gross income does Minnie have from the annuity payments she receives in 2019? b. Shortly after receiving her payment on October 1, 2034, Minnie is killed in an automobile accident. How does the executor of Minnies estate account for the annuity on her return for the year 2034? c. Assume that the accident does not occur until November 1, 2043. How does the executor of Minnies estate account for the annuity on her 2043 return?arrow_forwardEZ Leifer plans to retire at the age of 65 and believes he will live to be 90. EZ wants to receive an annual retirement payment of $50,000 at the beginning of each year. He seta a retirement account that is estimated to earn 6 percent annually. a. How much money will EZ have in the account when he reached 65 years old? b. EZ is currently 29 years of age. How much must he invest in this account at the end of each year for the next 36 years to have the required amount in his account at age 65?arrow_forwardEZ Leifer plans to retire at the age of 65 and believes he will live to be90. EZ wants to receive an annual retirement payment of $50,000 at thebeginning of each year. He sets up a retirement account that is estimated toearn 6 percent annually.a. How much money must EZ have in the account when he reaches 65 yearsold?b. EZ is currently 29 years of age. How much must he invest in this accountat the end of each year for the next 36 years to have the required amount inhis account at age 65?arrow_forward

- Daryl wishes to save money to provide for his retirement. He is now 30 years old and will be retiring at age 64. Beginning one month from now, he will begin depositing a fixed amount into a retirement savings account that will earn 12% compounded monthly. Then one year after making his final deposit, he will withdraw $100,000 annually for 25 years. In addition, and after he passes away (assuming he lives 25 years after retirement) he wishes to leave in the fund a sum worth $1,000,000 to his nephew who is under his charge. The fund will continue to earn 12% compounded monthly. How much should the monthly deposits be for his retirement plan?arrow_forwardAndrea, a self-employed individual, wishes to accumulate a retirement fund of $400,000. How much should she deposit each month into her retirement account, which pays interest at a rate of 5.5%/year compounded monthly, to reach her goal upon retirement 35 yr from now? (Round your answer to the nearest cent.)arrow_forwardCharles wants to retire in 18 years. At that time he wants to be able to withdraw $22,000 at the end of each year for 18 years. Assume that money can be deposited at 6% per year compounded annually. What exact amount will Charles need to deposit today to have enough to cover his retirement? Show the use of the appropriate formula by indicating the use of the information into the formula.arrow_forward

- Carla Lopez deposits $2,500 a year into her retirement account. If these funds have an average earnings of 5 percent over the 40 hears until her retirement, what will be the value of her retirement account?arrow_forwardIrene plans to retire on December 31st, 2019. She has been preparing to retire by making annual deposits, starting on December 31st, 1979, of $2450 into an account that pays an effective rate of interest of 9.1%. She has continued this practice every year through December 31st, 2000. Her goal is to have $1.5 million saved up at the time of her retirement. How large should her annual deposits be (from December 31st, 2001 until December 31st, 2019) so that she can reach her goal? Payment = $68573.5arrow_forwardMagnus wishes to have $1,500,00 when he retires in 44 years. What are the monthly payments he must deposit into an account that earns 2.5%?arrow_forward

- Gary decides to set up a retirement fund by depositing $300 at the end of each week for 29 years. How much will he have after 29 years, if the interest rate is 2.11%, compounded semiannually?arrow_forwardSandra Jones intends to retire in 20 years at the age of 65. As yet, she has not provided for retirement income, and she wants to set up a periodic savings plan to do this. She has the opportunity to make equal annual payments into a savings account that pays 4 percent interest per year. How large must her payments be to ensure that after retirement, she will be able to draw $30,000 per year from this account until she is 80? \arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning