FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

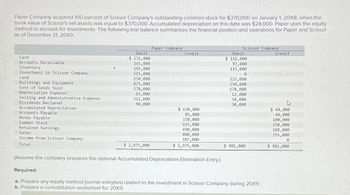

Transcribed Image Text:Paper Company acquired 100 percent of Scissor Company's outstanding common stock for $370,000 on January 1, 20X8, when the

book value of Scissor's net assets was equal to $370,000. Accumulated depreciation on this date was $24,000. Paper uses the equity

method to account for investments. The following trial balance summarizes the financial position and operations for Paper and Scissor

as of December 31, 20X9:

Cash

Accounts Receivable

Inventory

Investment in Scissor Company

Land

Buildings and Equipment

Cost of Goods Sold

Depreciation Expense

Selling and Administrative Expense

Dividends Declared

Accumulated Depreciation

Accounts Payable

Bonds Payable

Common Stock

Retained Earnings

Sales

Income from Scissor Company

Total

Debit

$ 232,000

165,000

193,000

515,000

250,000

875,000

278,000

65,000

312,000

90,000

$ 2,975,000

Paper Company

Credit

$ 630,000

85,000

150,000

625,000

498,000

880,000

107,000

$ 2,975,000

Scissor Company

Debit

$ 116,000

97,000

115,000

1-0

125,000

250,000

178,000

12,000

58,000

30,000

$ 981,000

(Assume the company prepares the optional Accumulated Depreciation Elimination Entry.)

Required:

a. Prepare any equity method journal entry(ies) related to the investment in Scissor Company during 20X9.

b. Prepare a consolidation worksheet for 20X9.

Credit

h

$ 48,000

40,000

100,000

250,000

188,000

355,000

0

$ 981,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gaw Company purchased 15% of the common stock of Trace Corporation for $150,000 on 1/1/X1. At the time, Trace's equity included $500,000 of capital stock and $500,000 retained earnings. Gaw selected the fair-value method to account for this investment. On 12/31/X1, Trace's stock had a $1,200,000 total market value. Trace reported net income of $200,000 for year X1 and paid dividends of $60,000 on October 1, X1. How much income should Gaw recognize from its Trace investment in year X1?arrow_forwardTorres Investments acquired $233,600 of Murphy Corp., 6% bonds at their face amount on October 1, Year 1. The bonds pay interest on October 1 and April 1. On April 1, Year 2, Torres sold $111,200 of Murphy Corp. bonds at 105. Journalize the entries to record the following (refer to the Chart of Accounts for exact wording of account titles): a. The initial acquisition of the Murphy Corp. bonds on October 1, Year 1. b. The adjusting entry for three months of accrued interest earned on the Murphy Corp. bonds on December 31, Year 1. c. The receipt of semiannual interest on April 1, Year 2. d. The sale of $111,200 of Murphy Corp. bonds on April 1, Year 2, at 105.arrow_forwardAshvinarrow_forward

- Peanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $317,700 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $353,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, follow: Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings and Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total Peanut Company Debit $ 171,000 170,000 220,000 360,000 206,000 717,000 191,000 48,000 210,000 96,000 $ 2,389,000 Credit $ 435,000 60,000 187,000 480,000 360,100 794,000 72,900 $ 2,389,000 Debit Snoopy Company $ 90,000 69,000 89,000 89,000 192,000 105,000 8,000 48,000 34,000 $724,000 Credit $ 16,000 45,000 68,000 181,000 172,000 242,000 0 $724,000 Required: a. Prepare any…arrow_forwardksk.09arrow_forwardanswerarrow_forward

- On 3 January 20X4, Windsor Company purchased 10% of the shares of Brampton for $608,000 cash. Windsor will use the equity method. On this date, Brampton has $1,980,000 of assets, $1,584,000 of liabilities, and $396,000 of equity. Book values reflect fair values except for $895,000 of equipment, which has a five-year life and a fair value of $1,118,750. In 20X4, Brampton pays $35,400 of total dividends and reports earnings of $118,000. Required: 1. Calculate goodwill on acquisition, and the annual extra depreciation on investee equipment at fair value. 2. Prepare 20X4 journal entries for Windsor Company. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 3. At the end of 20X4, what is the balance in the investment account?arrow_forwardPlug Products owns 80 percent of the stock of Spark Filter Company, which it acquired at underlying book value on August 30, 20X6. At that date, the fair value of the noncontrolling interest was equal to 20 percent of the book value of Spark Filter. Summarized trial balance data for the two companies as of December 31, 20X8, are as follows: Cash and Accounts Receivable Inventory Buildings and Equipment (net) Investment in Spark Filter Company Cost of Goods Sold Depreciation Expense Current Liabilities Common Stock Retained Earnings Sales Income from Spark Filter Company Total No A B C Entry 1 2 3 Plug Products Credit $ 154,000 232,000 285,000 On January 1, 20X8, Plug's inventory contained filters purchased for $63,000 from Spark Filter, which had produced the filters for $43,000. In 20X8, Spark Filter spent $103,000 to produce additional filters, which it sold to Plug for $150,907. By December 31, 20X8, Plug had sold all filters that had been on hand January 1, 20X8, but continued to…arrow_forwardAlpesharrow_forward

- When it purchased Sutton, Inc. on January 1, 20X1, Pavin Corporation issued 500,000 shares of its $5 par voting common stock. On that date the fair value of those shares totaled $4,200,000. Related to the acquisition, Pavin had payments to the attorneys and accountants of $200,000, and stock issuance fees of $100,000. Immediately prior to the purchase, the equity sections of the two firms appeared as follows: Pavin Sutton Common stock $ 4,000,000 $ 700,000 Paid-in capital in excess of par 7,500,000 900,000 Retained earnings 5,500,000 500,000 Total $17,000,000 $2,100,000 Immediately after the purchase, the consolidated balance sheet should report retained earnings of: a. $6,000,000 b. $5,800,000 c. $5,500,000 d. $5,300,000arrow_forwardPutt Company issues 500 shares of $100 preferred stock to Drive Corporation in exchange for land on December 31. This land was carried on Drive’s books for $40,000. Required: 1. Prepare the journal entry to record the acquisition of the land for each of the following independent situations: a. The preferred stock is currently selling for $110 per share. No appraisal is available on the land. b. The land is appraised at $65,000. There have been no recent sales of the preferred stock. c. The preferred stock is currently selling for $125 per share. The land is appraised at $64,000.arrow_forwardHELP MEarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education