FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

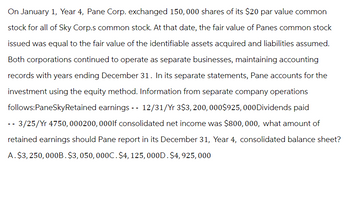

Transcribed Image Text:On January 1, Year 4, Pane Corp. exchanged 150,000 shares of its $20 par value common

stock for all of Sky Corp.s common stock. At that date, the fair value of Panes common stock

issued was equal to the fair value of the identifiable assets acquired and liabilities assumed.

Both corporations continued to operate as separate businesses, maintaining accounting

records with years ending December 31. In its separate statements, Pane accounts for the

investment using the equity method. Information from separate company operations

follows:PaneSkyRetained earnings -- 12/31/Yr 3$3, 200, 000$925,000 Dividends paid

-- 3/25/Yr 4750, 000200, 000lf consolidated net income was $800,000, what amount of

retained earnings should Pane report in its December 31, Year 4, consolidated balance sheet?

A. $3,250,000B. $3,050,000C. $4, 125, 000D. $4, 925,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rim Ltd purchased assets of 8,00,000 from Ant Ltd. It issued equity shares of 100 each full paid up in satisfaction of their claim. Make Journal entries to record these transactions.arrow_forwardAdams Moving and Storage, a family-owned corporation, declared a property dividend of 2,000 shares of GE common stock that Adams had purchased in February for $94,000 as an investment. GE’s shares had a market value of $45 per share on the declaration date. Prepare the journal entries to record the property dividend on the declaration and payment dates. Record adjustment of stock to fair value. Record the journal entry on the declaration date. Record the journal entry on the payment date.arrow_forwardOn January 1, Barnyard Corporation acquired common stock of Fresh Hay Corporation. At the time of acquisition, the book value and the fair value of Fresh Hay Corporation's net assets were $1 billion. During the year, Fresh Hay Corporation reported net income of $480 million and declared dividends of $160 million. The fair value of the shares increased by 10 percent during the year. How much income would Barnyard Corporation report for the year related to its investment under the assumption that it:A. Paid $150 million for 15 percent of the common stock and uses the fair value method to account for its investment in Fresh Hay Corporation. (Pay attention to the "fair value method" mention, some who attempted to answer this question got it wrong because they missed that). B. Paid $300 million for 30 percent of the common stock and uses the equity method to account for its investment in Fresh Hay Corporation. Please show all your steps so we can follow what we might be doing wrong.arrow_forward

- When it purchased Sutton, Inc. on January 1, 20X1, Pavin Corporation issued 500,000 shares of its $5 par voting common stock. On that date the fair value of those shares totaled $4,200,000. Related to the acquisition, Pavin had payments to the attorneys and accountants of $200,000, and stock issuance fees of $100,000. Immediately prior to the purchase, the equity sections of the two firms appeared as follows: Pavin Sutton Common stock $ 4,000,000 $ 700,000 Paid-in capital in excess of par 7,500,000 900,000 Retained earnings 5,500,000 500,000 Total $17,000,000 $2,100,000 Immediately after the purchase, the consolidated balance sheet should report retained earnings of: a. $6,000,000 b. $5,800,000 c. $5,500,000 d. $5,300,000arrow_forwardOn January 2, year 1, an entity purchased a 30% interest in Tod Co. for 250,000. On this date, Tod’s stockholders’ equity was 500,000. The carrying amounts of Tod’s identifiable net assets approximated their fair values, except for land whose fair value exceeded its carrying amount by 200,000. Tod reported net income of 100,000 for year 1, and paid no dividends. The entity accounts for this investment using the equity method. In its December 31, year 1 balance sheet, what amount should the entity report as investment in subsidiary?arrow_forwardOn November 1 of Year 1, Drucker Co. acquired the following investments in equity securities measured at FV-NI. Kelly Corporation 400 shares of common stock (no-par) at $60 per share Keefe Corporation 240 shares preferred stock ($10 par) at $20 per share On December 31, the company's year-end, the quoted market prices were as follows: Kelly Corporation common stock, $52, and Keefe Corporation preferred stock, $24. Following are the data for the following year (Year 2). Mar. 02: Dividends per share, declared and paid: Kelly Corp., $1, and Keefe Corp., $0.50. Oct. 01: Sold 80 shares of Keefe Corporation preferred stock at $25 per share. Dec. 31: Fair values: Kelly common, $46 per share, Keefe preferred, $26 per share. Year 1 Year 2 d. Prepare the entries required in Year 2 to record dividend revenue, the sale of stock, and the fair value adjustment. Assume that the Fair Value Adjustment account needs to be adjusted for the investment portfolio on December 31, Year 2. Date Mar. 2, Year 2…arrow_forward

- Wooden Reed Inc. (WRI) issued 30,000 voting common shares to acquire all of the assets and liabilities of Creative Instrument Ltd. (CIL). On the acquisition date, WRI's shares were trading at $21.83 per share. After the transaction, CIL owned 20% of WRI's outstanding shares. Below are the statements of financial position of both companies immediately before the transaction, along with the fair values of CIL's assets and liabilities: WRI CIL Cash Accounts receivable Inventory Property, plant, equipment (net) Current liabilities Long-term debt Common shares Retained earnings $754,900 ■ $919,900 $265,000 O $100,000 S carrying value 75,000 CA 180,000 220,000 880,000 $ 1,355,000 $ 75,000 235,000 100,000 945,000 $ 1,355,000 If the consolidated statement of financial position was created immediately after the acquisition, the consolidated 2. common share account will be: A TTİNEN carrying value $ 35,000 TRT- 67,500 10 125,000 S climi 1 temagam de - SAM A TRILOŽ B 350,000 $ 577,500 $ 25,000…arrow_forwardOn January 1, 2007, Jondy Ltd acquires 5% of the voting shares of Montag Inc. for 785,000. The investment is classified as available for sale. The Montag shares do not trade in an active market. Jondy Ltd has a December 31 year-end. During the year ending Deccember 31, 2007, Montag has net income of 700,000 and pays dividends of 500,000. During the year ending December 31, 2008, Montag has net income of nil but continues to pay dividend of 500,000. Provide journal entries to record the preceding information on the books of Jondy Ltd.arrow_forwardSpartan Corporation redeemed 25 percent of its shares for $1,800 on July 1 of this year, in a transaction that qualified as an exchange under IRC §302(a). Spartan’s accumulated E&P at the beginning of the year was $1,800. Its current E&P is $16,300. Spartan made dividend distributions of $2,700 on June 1 and $6,000 on August 31. Determine the beginning balance in Spartan’s accumulated E&P at the beginning of the next year. See Revenue Rules 74-338 and 74-339 for help in making this calculation. (Round your intermediate calculations to the nearest whole dollar amount.)arrow_forward

- On December 31, 2021, the end of its first year of operations, Ivanhoe Associates owned the following securities that are held as long- term investments. Common Stock C Co. D Co. E Co. (a) July Aug. Sept. 1 Oct. 1 Nov. 1 Dec. Shares 15 980 On this date, the total fair value of the securities was equal to its cost. The securities are not held for influence or control over the investees. In 2022, the following transactions occurred. 31 5,420 1,297 1 Received $2.00 per share semiannual cash dividend on D Co. common stock. 1 Received $0.50 per share cash dividend on C Co. common stock. Sold 1,050 shares of D Co. common stock for cash at $10 per share. Sold 300 shares of C Co. common stock for cash at $50 per share. Received $1 per share cash dividend on E Co. common stock. Received $0.50 per share cash dividend on C Co. common stock Received $2.20 per share semiannual cash dividend on D Co. common stock Cost $44,100 39,566 25,940 At December 31, the fair values per share of the common…arrow_forwardABC and XYZ (the parties) entered into an agreement to establish a separate vehicle (DEF) and share joint control over the separate vehicle. The assets and liabilities of DEF are considered as assets and liabilities of DEF and not the assets and liabilities of ABC and XYZ. Upon formation of DEF, DEF issued 70% of its shares equally to ABC and XYZ and the remaining 30% are issued to other investors. Summary transactions for the first two years of operations of DEF are as follows: 2022 2023 Proceeds from issuance of shares P110,000,000 Revenues 12,000,000 16,000,000 Various costs and operating expenses 8,000,000 11,000,000 Dividends declared (to be paid in 2024) 4,000,000 1. How much is the carrying amount of the investment in DEF to be presented in the books of ABC as of December 31, 2022? 2. How much is the investment income for 2022? 3. How much is the carrying amount of the investment in DEF to be presented in the books of ABC as of December 31, 2023? 4. How much is the investment…arrow_forwardOn January 1, 2023, Pyxis Company issued share appreciation rights to its president exercisable for one year beginning January 1, 2025 provided that the president is still in the employ of the company at that date of exercise. Each right provides for a cash payment equal to the excess of the entity’s share price over P50. The equivalent number of shares for share appreciation rights will be based on the level of sales at the date of exercise. The number of equivalent shares is 20,000 if the level of sales is P4,000,000 to P6,000,000 and 30,000 shares if the level of sales is over P6,000,000. The actual sales achieved totaled P5,000,000 in 2023 and P7,000,000 in 2024. The share prices are P70 in 2023 and P65 in 2024. What is the compensation expense for 2023? ANSWER: 200,000 What is the compensation expense for 2024? ANSWER: 150,000 Show full solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education